For years, we at Inc42 have tracked the Indian tech startup ecosystem and seen it develop from a child to an grownup. Among the many clearest indicators of evolution and maturity of this ecosystem is the rising variety of startups eyeing a public itemizing now.

For Indian firms, reaching a public itemizing has for lengthy symbolised operational development, transparency, and long-term viability. For startups, it’s a comparatively new however more and more important ceremony of passage, one which not solely alerts coming of age but in addition creates pathways for investor exits and wealth creation.

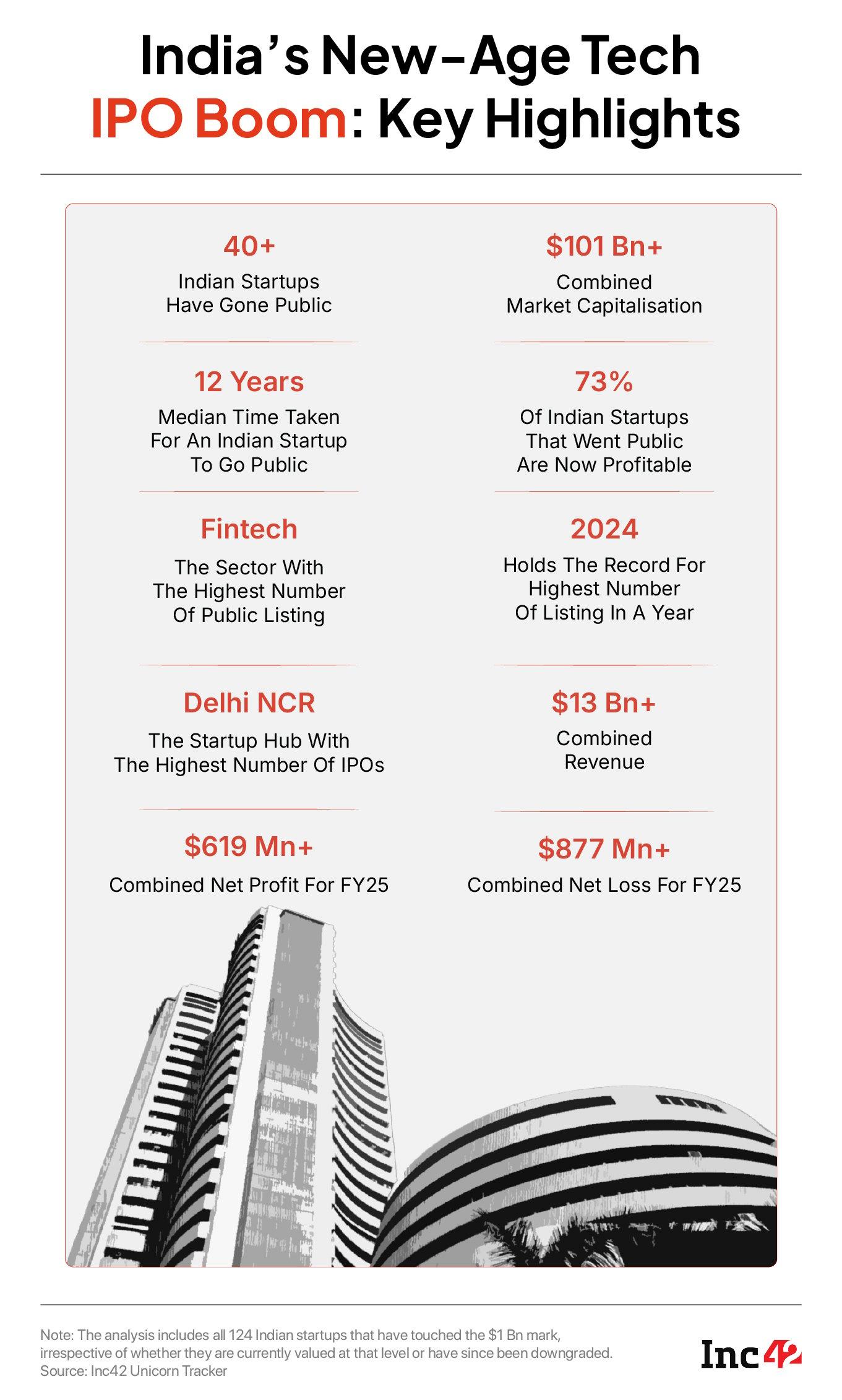

Presently, practically 20 startups, together with Groww, Infra.Market, Lenskart, Meesho, amongst others, are in varied phases of their IPO journey. In the meantime, over 40 Indian new-age tech firms have already crossed the milestone and are actually listed on the bourses.

The depend consists of the likes of Swiggy, Ola Electrical, and Ather Vitality, who made their a lot anticipated market debuts over the previous 12 months. The listing doesn’t embrace Indian firms like MakeMyTrip, Zoomcar and Freshworks, that are listed on Nasdaq within the US.

The height of India’s startup IPO wave got here in 2024, when 13 firms went public amid a buoyant market. In distinction, solely three startups — Ather Vitality, ArisInfra Options and Smartworks — have listed thus far in 2025, with market sentiment dampened by international geopolitical headwinds within the first half of the 12 months.

Nevertheless, an uptick in startup listings is anticipated within the second half as there’s a lengthy queue of new-age tech firms on the brink of drive to Dalal Road.

As of now, the overall market capitalisation of the listed firms stands at over $101 Bn.

![]()

To consolidate all of the details about listed startups, Inc42 has launched the Indian Listed New-Age Tech Firm Tracker. From the motion within the shares of the businesses since their itemizing to the monetary efficiency of those firms, the tracker is your one-stop useful resource to know all the things you want concerning the listed tech firms.

| Organisation Identify | Sector | Listed On | Itemizing Yr | Debut Market Cap (INR Cr) | Present Market Cap (INR Cr) | % Change | Itemizing Worth | Present Inventory Worth | % Change | Gross sales (FY25) (INR Cr) | YoY Change % | Internet Revenue (FY25) (INR Cr) |

| Arisinfra Options | Actual Property Tech | NSE, BSE | 2025 | 1,661 | 1,176 | -29% | 205 | 145 | -29% | 697 | -7% | -19 |

| Awfis | Actual Property Tech | NSE, BSE | 2024 | 3,101 | 4,332 | 40% | 435 | 608 | 40% | 1,208 | 42% | 68 |

| Ather Vitality | Clear Tech | NSE, BSE | 2025 | 12,217 | 12,451 | 2% | 328 | 334 | 2% | 1,751 | -2% | -812 |

| Blackbuck | Logistics | NSE, BSE | 2024 | 5,032 | 8,338 | 66% | 281 | 465 | 65% | 427 | 44% | -9 |

| CarTrade | Ecommerce | NSE, BSE | 2021 | 7,598 | 8,999 | 18% | 1,600 | 1,895 | 18% | 641 | 31% | 135 |

| Delhivery | Logistics | NSE, BSE | 2022 | 36,971 | 31,756 | -14% | 495 | 425 | -14% | 8,932 | 10% | 162 |

| Digit Insurance coverage | Fintech | NSE, BSE | 2024 | 26,376 | 32,190 | 22% | 286 | 349 | 22% | 9,371 | 15% | 425 |

| Droneacharya | Superior {Hardware} & Know-how | BSE (SME) | 2022 | 279 | 190 | -32% | 117 | 79 | -32% | Not Obtainable | Not Obtainable | Not Obtainable |

| E2E Networks | Enterprise Tech | NSE | 2018 | 111 | 3,097 | 2682% | 77 | 2,140 | 2683% | 164 | 74% | 47 |

| Easemytrip | Journey Tech | NSE, BSE | 2021 | 2,408 | 3,757 | 56% | 7 | 10 | 52% | 587 | -1% | 107 |

| Everlasting (Zomato ) | Foodtech | NSE, BSE | 2021 | 177,829 | 281,977 | 59% | 196 | 311 | 59% | 20,243 | 67% | 527 |

| FINO Fee Financial institution | Fintech | NSE, BSE | 2021 | 4,530 | 2,269 | -50% | 544 | 273 | -50% | 1,747 | 25% | 93 |

| FirstCry | Ecommerce | NSE, BSE | 2024 | 31,393 | 17,220 | -45% | 651 | 357 | -45% | 7,660 | 18% | -191 |

| Ideaforge | Superior {Hardware} & Know-how | NSE, BSE | 2023 | 5,615 | 2,038 | -64% | 1,300 | 472 | -64% | 161 | -49% | -62 |

| IndiaMart | Ecommerce | NSE, BSE | 2019 | 3,478 | 15,366 | 342% | 580 | 2,561 | 342% | 1,388 | 16% | 551 |

| Infibeam | Fintech | NSE, BSE | 2016 | 2,907 | 4,457 | 53% | 9 | 16 | 70% | 3,993 | 27% | 225 |

| Information Edge | Client Providers | NSE, BSE | 2006 | 1,412 | 92,991 | 6486% | 22 | 1,437 | 6432% | 2,850 | 12% | 1,310 |

| ixigo | Journey Tech | NSE, BSE | 2024 | 5,390 | 8,584 | 59% | 138 | 220 | 59% | 914 | 39% | 60 |

| Justdial | Client Providers | NSE, BSE | 2013 | 4,999 | 7,243 | 45% | 588 | 852 | 45% | 1,142 | 9% | 584 |

| Mamaearth | Ecommerce | NSE, BSE | 2023 | 10,731 | 8,575 | -20% | 330 | 264 | -20% | 2,067 | 8% | 73 |

| MapmyIndia | Enterprise Tech | NSE, BSE | 2021 | 8,475 | 9,980 | 18% | 1,557 | 1,834 | 18% | 463 | 22% | 147 |

| Matrimony | Media & Leisure | NSE, BSE | 2017 | 2,058 | 1,135 | -45% | 955 | 526 | -45% | 456 | -5% | 45 |

| Menhood (Macobs Tech) | Ecommerce | NSE (SME) | 2024 | Not Obtainable | 164 | Not Obtainable | 96 | 168 | 75% | 24 | 15% | 3 |

| Mobikwik | Fintech | NSE, BSE | 2024 | 3,439 | 2,005 | -42% | 440 | 257 | -42% | 1,170 | 34% | -122 |

| Nazara Tech | Media & Leisure | NSE, BSE | 2021 | 9,215 | 12,878 | 40% | 995 | 1,391 | 40% | 1,624 | 43% | 76 |

| Nykaa | Ecommerce | NSE, BSE | 2021 | 96,167 | 60,702 | -37% | 336 | 212 | -37% | 7,950 | 24% | 66 |

| Ola Electrical | Clear Tech | NSE, BSE | 2024 | 31,736 | 17,244 | -46% | 76 | 41 | -46% | 4,514 | -10% | -2,276 |

| Paytm | Fintech | NSE, BSE | 2021 | 124,467 | 68,153 | -45% | 1,950 | 1,068 | -45% | 6,900 | -31% | -659 |

| Policybazaar | Fintech | NSE, BSE | 2021 | 52,666 | 81,583 | 55% | 1,150 | 1,781 | 55% | 4,977 | 45% | 353 |

| Rategain | Enterprise Tech | NSE, BSE | 2021 | 4,248 | 5,255 | 24% | 360 | 445 | 24% | 1,077 | 13% | 209 |

| Smartworks | Actual Property Tech | NSE, BSE | 2025 | 4,965 | 4,759 | -4% | 436 | 417 | -4% | 1,374 | 32% | -63 |

| Swiggy | Foodtech | NSE, BSE | 2024 | 96,185 | 93,871 | -2% | 420 | 408 | -3% | 15,227 | 35% | -3,117 |

| TAC Infosec | Enterprise Tech | NSE (SME) | 2024 | Not Obtainable | 929 | Not Obtainable | 290 | 887 | 206% | 30 | 150% | 15 |

| TBO Tek | Journey Tech | NSE, BSE | 2024 | 15,171 | 14,584 | -4% | 1,426 | 1,371 | -4% | 1,737 | 25% | 230 |

| Tracxn | Enterprise Tech | NSE, BSE | 2022 | 905 | 603 | -33% | 85 | 56 | -34% | 84 | 2% | -10 |

| Belief Fintech | Fintech | NSE (SME) | 2024 | 341 | 146 | -57% | 143 | 61 | -57% | 23 | 28% | 4 |

| Unicommerce | Enterprise Tech | NSE, BSE | 2024 | 2,427 | 1,269 | -48% | 235 | 123 | -48% | 135 | 30% | 18 |

| Veefin Options | Enterprise Tech | BSE (SME) | 2023 | 187 | 882 | 372% | 82 | 388 | 373% | 79 | 215% | 16 |

| Yatra | Journey Tech | NSE, BSE | 2023 | 2,001 | 1,477 | -26% | 128 | 94 | -27% | 791 | 119% | 37 |

| Yudiz | Media & Leisure | NSE (SME) | 2023 | 191 | 37 | -81% | 185 | 36 | -81% | 21 | -20% | -3 |

| Zaggle | Fintech | NSE, BSE | 2023 | 2,201 | 5,142 | 134% | 164 | 383 | 134% | 1,304 | 68% | 88 |

|

Supply: Inc42 Evaluation, Public Market Knowledge |

||||||||||||

|

Notes: The numbers are rounded off | Solely India listed firms have been included |

||||||||||||

|

*Present Market Cap & Inventory Worth: Final up to date on 25 July 2025 |

||||||||||||

|

**Debut Market Cap: The market capitalisation on a inventory’s first buying and selling day closing |

||||||||||||

|

***Itemizing Worth: The opening inventory value on the day it first begins buying and selling publicly |

Learn our methodology right here.

Inside The Dalal Road Startup Trip

Indian startups had gained a repute for being “loss making” by prioritising development in any respect prices and market share over quick profitability. The pattern of placing scale forward of the underside line was at its peak amid the funding increase of 2020-22.

Whereas prioritising development shouldn’t be improper for startups, particularly at early phases, the beginning of funding winter in 2022 gave a actuality examine to the Indian startup ecosystem. Subsequently, startups began pushing for profitability. Giving additional wings to the aggressive profitability push was the ambition to listing on the exchanges.

Whereas new-age tech firms look to show worthwhile earlier than submitting their draft IPO papers, those who cross the road handle to remain within the inexperienced, knowledge exhibits. Over 70% of the listed new-age tech firms are at the moment worthwhile.

By way of earnings, Sanjeev Bikhchandani-led web firm Information Edge towers over the remainder. It posted a web revenue of INR 962 Cr in FY25. Distinguished web firms Justdial and IndiaMART path Information Edge by way of profitability, raking in earnings of INR 584 Cr and INR 551 Cr in FY25, respectively.

It’s pertinent to say that these firms have been listed on the bourses for years now, with Information Edge making its public market debut in 2006. Whereas these firms hint their origin again to the 90s, a big majority of the new-age tech shares below Inc42’s purview are a couple of decade outdated.

From a broad perspective, Inc42 knowledge displays that the median time taken for a startup to get listed on the bourses is 12 years. Whereas itemizing for 18-year-old ixigo and 19-year-old Fino Funds Financial institution got here comparatively a lot later, lately listed ArisInfra’s IPO materialised inside 4 years of its operations.

![]()

In the meantime, the new-age tech firms which have made their public market debuts previously couple of years haven’t essentially seen their backside strains fare properly. Foodtech main Swiggy, which listed in November final 12 months, incurred the very best web loss in FY25 at INR 3,117 Cr. Its competitor Everlasting recorded a web revenue of INR 551 Cr within the fiscal.

In the meantime, EV makers Ather Vitality and Ola Electrical additionally incurred heavy losses, posting web lack of INR 1,060 Cr and INR 2,276 Cr in FY25, respectively.

Consequently, the cumulative lack of listed new-age tech firms for FY25 stood at INR 7,542.3 Cr ($877 Mn). In the meantime, the overall revenue stood at INR 5,326 Cr ($619 Mn).

On the bourses, buyers have rewarded worthwhile new-age tech firms. The median inventory value enhance for worthwhile firms has been 31% since their itemizing, whereas the loss-making ones have witnessed a decline of 42%.

Sectors Driving India’s Startup IPO Growth

The startup sectors producing essentially the most variety of listed firms is proportional to the personal funding tendencies witnessed within the Indian startup ecosystem. For context, of the overall $12 Bn funding secured by Indian startups in 2024, greater than $2.5 Bn in contemporary capital was netted by fintech startups. Enterprise tech and shopper companies sectors share the second spot, with every elevating $1.8 Bn in 2024.

![]()

According to this, the fintech sector has accounted for eight public listings until date – the very best quantity. Enterprise tech and ecommerce sectors are shut behind with seven and 6 listings, respectively.

The fintech dominance on the bourses is anticipated to proceed because the likes of Groww, Pine Labs and PhonePe are additionally eyeing public listings. In the meantime, the variety of startups hailing from different sectors can be anticipated to surge.

Notably, the variety of listed real-estate tech startups could go as much as six from three at the moment, as WeWork India, Infra.Market, and IndiQube are additionally gearing up for his or her IPOs.

Gurugram Dwelling To Highest Quantity Of Listed Startups

Whereas Bengaluru continues to be the startup capital of India, Delhi and its neighbouring cities Gurugram and Noida account for essentially the most variety of listed new-age tech firms. General, the Delhi NCR area is house to 17 listed new-age tech firms, forward of Mumbai’s eight and Bengaluru’s six.

![]()

Whereas 9 firms, together with Everlasting, Delhivery, and PB Fintech, name Gurugram their house, Awfis, EaseMyTrip, MapmyIndia and E2E Networks are from Delhi. Noida alternatively is house to 4 listed new-age tech firms, together with Paytm and Information Edge.

General, Delhi NCR contributes $67.5 Bn within the cumulative $101 Bn market cap of new-age tech firms.

Transferring ahead, the chart for listed firms from totally different cities goes to see many modifications. Whereas Delhi NCR-based Physics Wallah, City Firm, and Pine Labs have already filed their DRHPs, Bengaluru-based Meesho, Curefoods and Capillary Applied sciences have additionally filed their draft IPO papers.

Final up to date: July 26

The Indian Listed New-Age Tech Firm Tracker will probably be up to date periodically with contemporary knowledge.

[Edited by: Vinaykumar Rai]

[ad_2]