India’s edtech sector is reeling from a brutal actuality test, however Alakh Pandey-led PhysicsWallah

The corporate is heading in the right direction to turn out to be the primary Indian edtech startup to hit the general public markets, however the second comes amid a shift within the firm’s strategy and a change in its take a look at prep technique.

The PW IPO stated to be within the vary of INR 4,000 Cr to INR 4,600 Cr isn’t only a take a look at for the corporate but additionally for Indian edtech, which has seen a dramatic reversal of fortunes for the reason that fall of BYJU’S and the troubles at Unacademy.

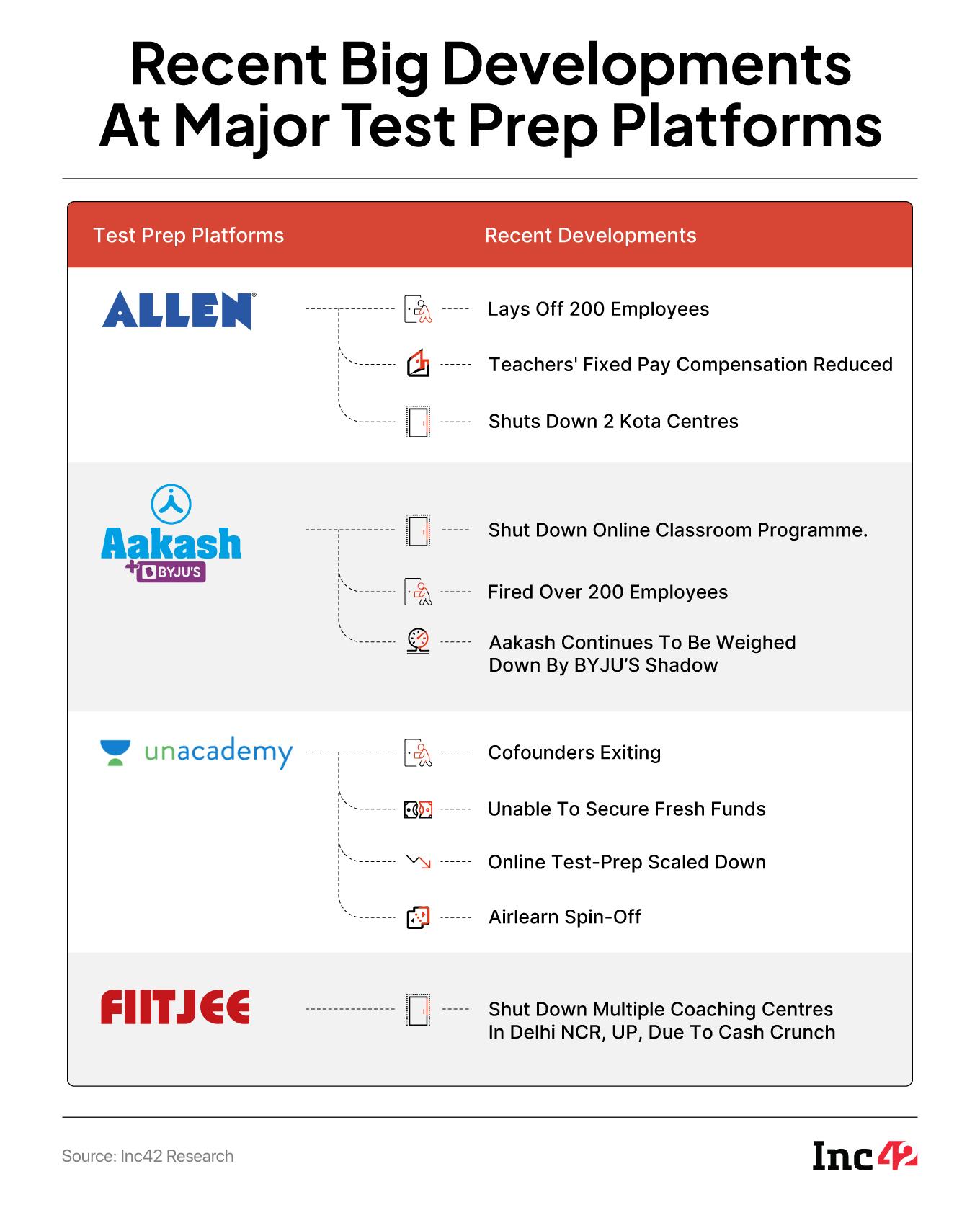

Exterior of those edtech giants, dozens of early stage and progress stage startups additionally shut store, because the online-first edtech sector shifted to a hybrid future. Regardless of billions of {dollars} of funding through the 2018-2021 interval, edtech startups simply couldn’t eke out profitability.

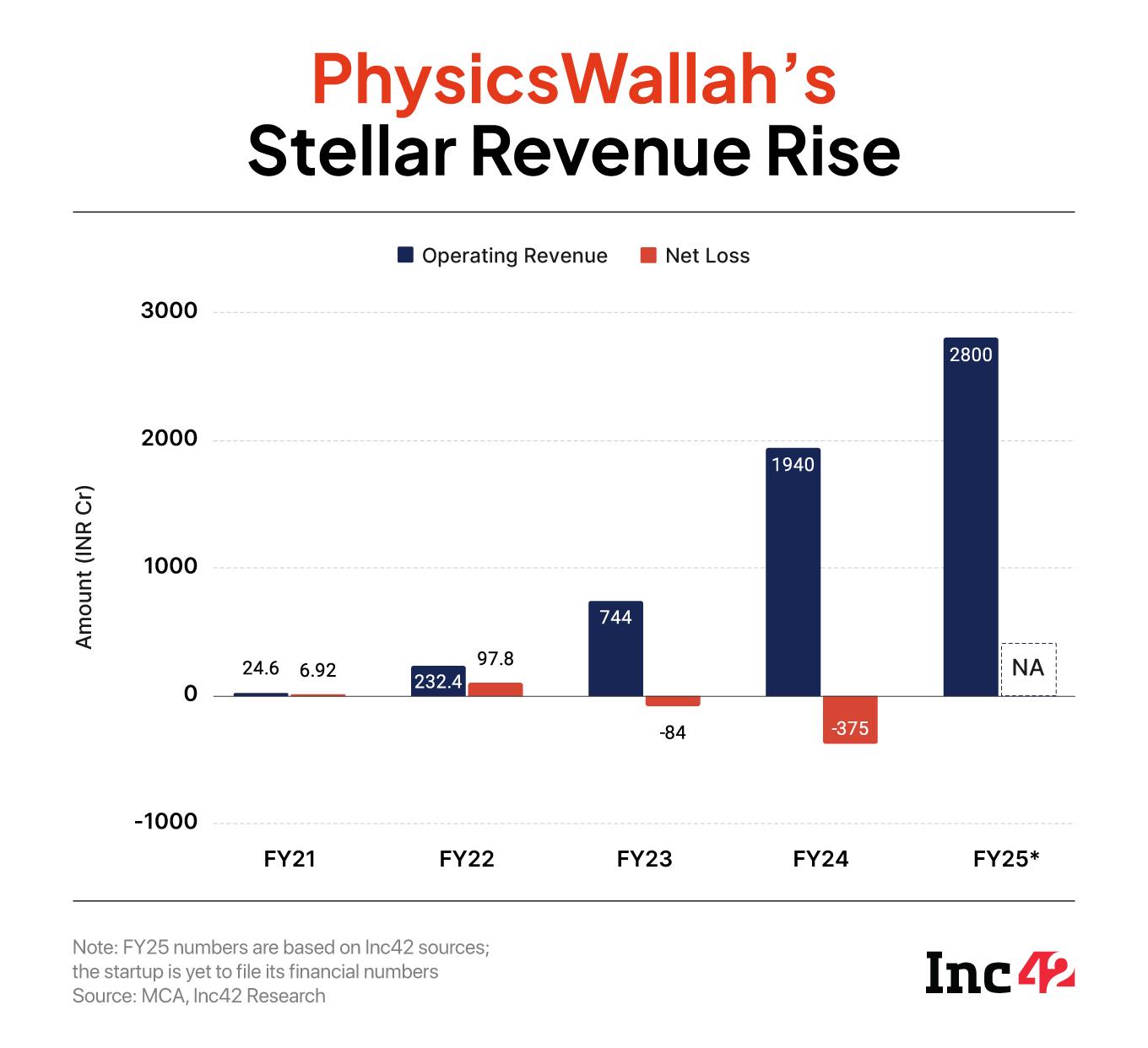

On this context, PhysicsWallah was seen as a ray of hope. Its first main funding spherical in June 2022 turned it right into a unicorn, however not like others within the sector, the startup was worthwhile. This instantly set it other than the remainder, however by some means over the course of the final three years, PhysicsWallah has slipped into losses similar to the rivals it appeared to disrupt.

Its product technique modified — as we famous in our previous protection — and the corporate was burdened with buyer acquisition prices that took a toll on its backside line. The fast enlargement into numerous segments additionally modified the income combine and steadiness.

However because it builds as much as its IPO, PhysicsWallah is trying to clear all nagging doubts. Sources point out that the corporate achieved breakeven in FY25, which would definitely be a significant feat in edtech and a validation of the corporate’s strategy to date.

With that stated, all shouldn’t be rosy. The edtech startup, which continues to chase progress aggressively, has had to surrender a bit little bit of what labored for it prior to now and consequently runs the danger of slipping again into losses. As we’ll see, profitability in edtech is not only a matter of making a flywheel as soon as, however sustaining it 12 months after 12 months.

Whereas the pre-IPO filings with SEBI will clear a number of these doubts, what’s taking place on the edtech unicorn proper now? And is PW set to rewrite edtech’s guidelines once more?

Not So Reasonably priced Anymore

PW, which rose to prominence by addressing the wants of scholars in tier II and tier III cities and smaller cities, is now displaying indicators of evolving right into a worthwhile income machine, one that’s extra targeted on monetisation than it was in its early days.

Earlier, PW carved a distinct segment by fixing an issue that the majority urban-focused edtech startups ignored: accessibility for rural and economically deprived college students. Its platform was in-built a approach that it might assist low-data environments, and pricing was intentionally saved reasonably priced.

Whereas the likes of Allen Digital, Vedantu, BYJU’S and Unacademy priced their annual programs between INR 30,000 and INR 80,000, PW zagged and selected the reasonably priced phase for its go-to-market.

PW’s programs have been priced at INR 4,000 to INR 5,000, and this was primarily an internet enterprise. It’s solely after elevating funds that PhysicsWallah ventured into excessive worth programs. Initially, the objective for the corporate was easy: scale by way of quantity and obtain higher unit economics.

Since 2022, PW has been in an aggressive stance, buying a number of startups alongside the best way. However with this got here rising prices, and for the primary time, the startup dipped into the crimson. In FY23, the startup reported its lack of INR 84 Cr.

Naturally, many requested the query: Is PhysicsWallah simply one other loss-making edtech startup?

To counter the slowdown and bolster income, PW launched “Infinity Universe” in early 2024, a layered subscription mannequin pitched as an improve for an present course. What was as soon as a easy INR 4,000 base plan now has further paid tiers: an INR 6,400 “Infinity” plan, and a premium “Infinity Professional” plan priced above INR 20,000.

“They ditched their USP. They have been recognized to supply reasonably priced programs, however since final 12 months, they’ve been tweaking their costs each on-line and offline. PhysicsWallah programs aren’t reasonably priced anymore,” stated an trade insider who tracks PW intently.

This transfer appears at odds with the corporate’s preliminary technique. Whilst Alakh Pandey repeatedly reassured college students that programs would by no means value greater than INR 5,000, PW’s pricing technique was going the opposite approach.

It was a transparent try and extract a better pockets share from mother and father, one thing a number of edtech startups tried prior to now however failed to grasp.

PhysicsWallah declined to answer questions on its buyer acquisition and pricing technique.

Did PhysicWallah Stretch Itself Too Skinny?

PW’s unique mannequin was simple however disruptive. It started as a YouTube channel in 2016, with Alakh Pandey as its face. With the assistance of this channel, Pandey rapidly turned a family identify amongst JEE and NEET aspirants throughout India. It was solely in 2020, PW was formally included, with Prateek Maheshwari becoming a member of as cofounder to handle the enterprise aspect, whereas Pandey continued to concentrate on instructing.

By leveraging a YouTube subscription base of hundreds of thousands of subscribers, PW was capable of construct its platform with considerably decrease buyer acquisition value (CAC), a big edge in a sector the place advertising spends typically eat income. The corporate’s early progress was largely natural, pushed by Pandey’s credibility and mass enchantment within the engineering and medical entrance take a look at preparation segments.

Nonetheless, replicating the identical method past the JEE-NEET base has proved to be troublesome.

“The Alakh Pandey impact didn’t translate nicely to different classes,” stated one trade insider monitoring the corporate. “A scholar making ready for JEE or NEET is aware of Pandey. They belief him. However a CA or UPSC aspirant? They don’t relate to him the identical approach. His model doesn’t carry over.”

Publish its maiden fund increase, PhysicsWallah aggressively diversified, venturing into UPSC, CA, LLB, and even launching a research overseas platform known as AcadFly.

All in all, PhysicsWallah claims to be working in 37 classes throughout the edtech area in segments comparable to take a look at prep, research overseas, Okay-12, skilling and govt schooling. However constructing credibility in all these segments takes time, particularly in a class like UPSC and LLB, the place an aspirant takes years making ready.

Regardless of PW’s aggressive pricing, aspirants in these segments are likely to prioritise ranks, which the startup is but to ship in its newer verticals.

In a bid to enhance its credibility, PW has shifted to acquisitions. It acquired OnlyIAS in 2022 to enter the UPSC market, and as per media studies, was in talks to amass Drishti IAS, probably the most recognisable UPSC prep manufacturers. Although these talks fell by way of, the startup is claimed to be holding talks with a number of different UPSC take a look at prep corporations, together with Chaitanya Academy, Rau’s IAS Research Circle, amongst others.

Whereas the inner efficiency in these new verticals stays unclear, Inc42 sources estimated that fewer than 900 college students are enrolled in AcadFly.

Apart from, the startup has forayed into PW College of Startups, PW College of Innovation, and PW Expertise, amongst others.

“No matter they noticed, they entered. That’s not how companies are constructed,” added a founding father of an edtech startup.

PW’s Offline Recreation: Excessive Danger, Excessive Reward

PW, which constructed its model on the again of an online-first mannequin, pivoted to the offline world similar to its opponents quickly after turning right into a unicorn in 2022. Since then, the corporate has quickly expanded its bodily footprint, now working greater than 250 offline centres throughout 100 cities. These centres already account for practically half of PW’s income, a robust contributor to the corporate’s topline and its technique.

In reality, as per sources, the startup closed its FY25 financials with a income of INR 2,800 Cr to INR 3,000 Cr.

The economics of this offline push are telling. Whereas the typical income per consumer for on-line stood at INR 4,000, this quantity turns into INR 65,000 for offline, greater than 16X larger.

It’s a bit shock then that cofounder Pandey has repeatedly said the corporate’s intent to open “as many (offline centres) as attainable.” The offline mannequin is extra profitable, at the very least on paper.

It’s pertinent to notice that prime income doesn’t essentially translate into sturdy profitability. It’s a nicely established incontrovertible fact that offline centres are extra capital intensive. From leasing prime rental property, hiring instructing workers to organising infrastructure, and spending on advertising, the upfront funding is critical. Furthermore, within the early years, these centres typically operated at a loss, particularly as these platforms provided aggressive reductions to draw new college students.

This preliminary discount-driven progress comes with long-term dangers. “The primary few months may see packed lecture rooms attributable to promotional pricing, however the true take a look at comes two to 3 years later when charges normalise, ranks are few, and retention turns into more durable,” stated one other trade insider.

One other hurdle is credibility. In contrast to incumbents comparable to Allen or Aakash, which have spent a long time constructing belief, PhysicsWallah is a comparatively new entrant within the offline take a look at prep area.

“Established gamers have structured techniques and constant outcomes. That’s a spot that new-age gamers like PW nonetheless must fill,” added the insider.

Extra importantly, even Pandey accepts the monetary drag. He has said publicly that these offline centres sometimes take three years to show worthwhile. This implies whereas the corporate expands aggressively, its rising community of centres is more likely to stay a drag on the underside line within the close to time period. Because of this there will likely be a danger of mounting losses, except it’s balanced with a robust efficiency.

The identical will be mirrored within the startup’s monetary efficiency. In FY24, the startup’s internet loss surged by 4X to INR 376 Cr. By the way, this is identical time when the startup laid off over 100 staff.

One other factor to spotlight is that PW’s offline programs are primarily targeted in the direction of providing lessons for JEE and NEET aspirants. Nonetheless, within the latest previous, each these classes have proven indicators of saturation or different pressure.

Kota, India’s teaching capital, the place PW opened its first offline centre in 2022, witnessed a pointy 40% drop in scholar enrollment final 12 months. Different startups and established gamers have suffered simply as a lot as PW on this regard, nevertheless it exhibits that traction is slowing down throughout the trade. As per sources, PW noticed 15-20% decline in scholar enrollment in Kota.

With demand plateauing in its core segments, PhysicsWallah can now not afford to rely solely on JEE and NEET to scale its offline enterprise. Offline diversification into different classes is important. As per sources, JEE and NEET proceed to contribute round 60% of the consolidated income.

As PW tries to scale offline, it should keep away from the identical pitfalls as BYJU’S and Unacademy, each of which pursued offline progress aggressively, solely to face a number of monetary challenges later. Because it stands right now, PW’s offline play is a high-risk, high-reward, and the subsequent three to 4 years will decide whether or not it may well pull it off with out bleeding too closely, particularly when it’s a public firm and faces public scrutiny.

Whereas insiders anticipate that PhysicsWallah’s IPO will see a robust response, nobody is aware of how public market traders take into consideration the edtech sector.

So the query to ask is, can PhysicsWallah persuade Dalal Road and tech retail traders a factor or two about learn how to consider edtech companies? Even so, issues about its long-term sustainability will linger on given the corporate’s up-and-down profitability document.

Edited By Nikhil Subramaniam

[ad_2]