Now and again, there’s a buzzword that grabs the creativeness of the startup ecosystem. Circa 2018, it was neobanking. Immediately dozens of fintech startups — massive and small — had been constructing a neobank.

Some raised enormous seed rounds — see the case of Jupiter or Epifi. However the post-demonetisation bullishness on neobanking has crumbled. India’s neobank dream seems to be over.

Because of RBI guidelines, neobanks couldn’t exchange licensed banks in India, however they expanded the attain of smaller banks by appearing because the digital interface and acquisition channel for the banks. Neobanking startups had been like co-branded cellular banking apps for precise banks, however the diploma of branding depended from startup to startup.

What these startups promised banks is that they might present the most effective consumer expertise due to their tech-first mindset and strategy. This included automating processes and offering add-ons to allow prompt account opening, low charges, customisation and area of interest focusing on.

The latter was the best way for startups to search out their aggressive edge by focusing on freelancers, youngsters, younger professionals, MSMEs, early stage startups and a few worldwide firms.

Briefly, they sought to make banking really feel as easy as utilizing a UPI app. And it lowered a lot of the financial institution’s buyer acquisition prices and other people prices.

Then got here the pandemic. As branches shuttered and other people averted bodily paperwork, the shift to digital banking accelerated dramatically. Neobanking grew to become extra than simply trendy.

From Funding Growth To Bust

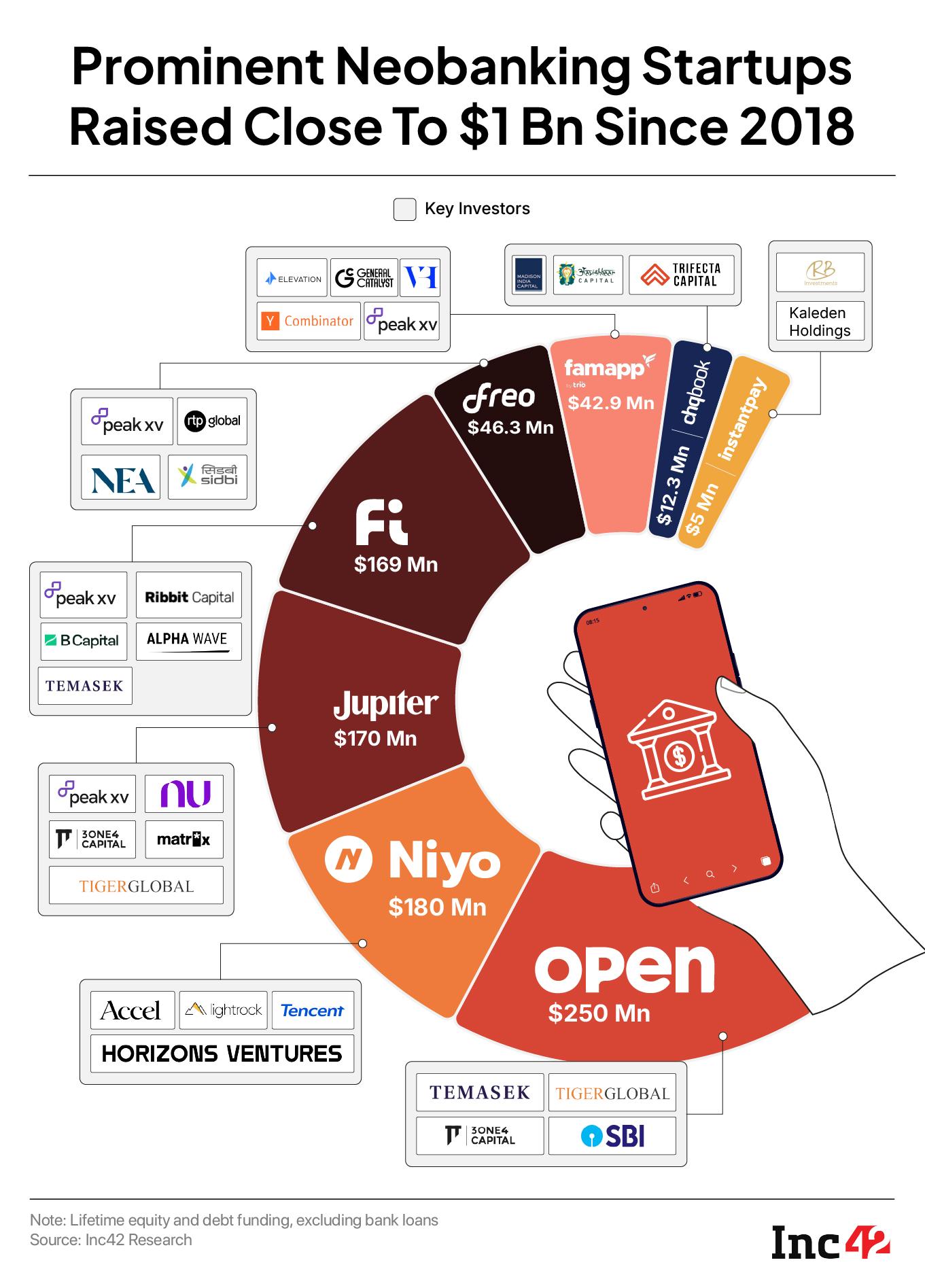

As per Inc42 knowledge, neobanking startups in India raised about billion {dollars} over the course of 2018 to 2023. Open famously grew to become the one centesimal unicorn in India in 2023 and has raised over $250 Mn, whereas Jupiter has raised over $170 Mn. That’s not too removed from Fi’s lifetime funding of $137 Mn. In the meantime, the likes of Niyo raised $180 Mn, whereas ChqBook, FamPay and Freo raised $12.3 Mn, $42.9 Mn, $46.3 Mn respectively.

However it’s been a quiet few years on this area since this increase. Most of those apps at this time provide standalone funds experiences with no checking account. They’re distributors of loans and insurance coverage and low cost broking, and neobanking has taken a backseat.

In July this 12 months, Inc42 reported that Fi Cash laid off greater than 50 staff previously three months alone. Jupiter Cash in the meantime, has doubtlessly laid off greater than 70 folks previously seven months, because the EPFO knowledge suggests. Nevertheless, Inc42 couldn’t confirm this on the time of publishing the story.

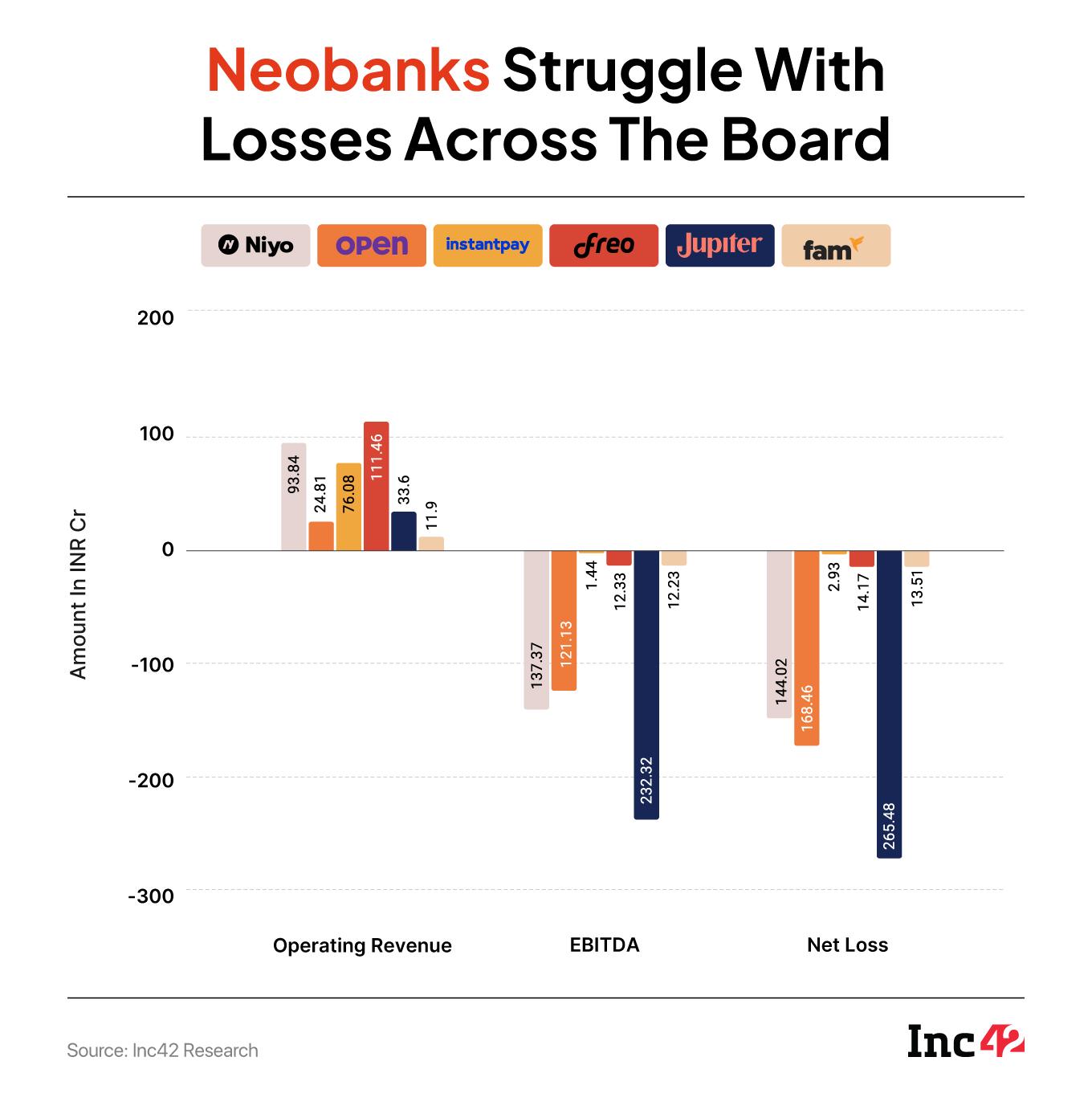

Not one of the startups working within the area has been in a position to present any significant income whereas the losses have gone up astronomically.

Jupiter, for instance, reported a web lack of INR 276 Cr in opposition to income of INR 35.8 Cr in FY24. Equally, Open earned a mere INR 24.8 Cr, on the web lack of INR 169.6 Cr.

Different neobank gamers have additionally been burning money and carrying losses. Freo earned INR 111.4 Cr in FY24, but ended with a web lack of INR 14.1 Cr. Niyo, a neobank which has raised over $179 Mn in funding in its lifetime, clocked income of INR 93.8 Cr and a steep lack of INR 144 Cr in FY24.

These numbers present that startups haven’t been in a position to unlock the income streams that had been promised on account of the expertise, automation and product-first mindset of this class. Whereas a variety of emphasis was positioned on creating apps that had the superior consumer expertise, neobanks struggled with lack of autonomy in operations and being pressured to maneuver in accordance with bigger banks.

Have been Neobanking Startups Caged By Guidelines?

By the way, in geographies such because the Philippines, Brazil, and even the UK, neobanks are extra related. Indonesia boasts the likes of OFBank, UNOBank, GoTyme Financial institution, Maya Financial institution and Tonik, whereas Brazil-based Nubank has over 100 Mn clients in Latin America and is the most important fintech financial institution within the area.

UK’s Revolut just lately entered the Indian market within the funds area, however made a reputation for itself in its house turf as digital-only neobank.

A key distinction in these markets is that regulators have created digital-only banking licences, whereas India nonetheless requires banks to take care of a bodily presence. This meant neobanks in India might by no means really stand alone; they needed to depend on partnerships with established banks for every thing from accounts to playing cards to compliance.

“In markets just like the Philippines, regulators have issued digital financial institution licences. When Indian neobanks launched, many anticipated an analogous licence would ultimately come right here. However it by no means occurred,” Aishwarya Jaishankar, cofounder and COO of Hyperface, instructed Inc42.

Jaishankar, who led HSBC’s digital merchandise and the launch of Kotak Mahindra financial institution’s ‘811’ neobanking app earlier than launching Hyperface, mentioned neobanks have to decide on to both stay a partner-led neobank or attempt to get a small finance financial institution licence, which is extraordinarily troublesome, as a result of the steadiness sheet necessities are steep.

It’s simpler for a microfinance participant to turn into a small finance financial institution than for a digital-first neobank, she claimed.

As per Rajjat Gulati, cofounder of plutos ONE, given the absence of a digital financial institution or neobanking licence in India, these startups are successfully distribution companions for all types of authorised banks. “Which means that they’ve a excessive bar for compliance however restricted visibility on income,” mentioned Gulati.

Jaishankar added that because of this neobanking startups battle; every new product, be it a bank card, mortgage, or foreign exchange card, requires recent partnerships, navigating a number of layers of danger approval, and sometimes lengthy delays. The very promise of pace and agility was slowed down by the dependency on others.

Massive Banks Push Neobanks Out

“At this time, in the event you take a look at our cellular app, we ship every thing a new-age client wants. The UI is clear, and it presents every thing you’d anticipate from a neobank. There’s no purpose for my customers to go to a neobank,” a regional head a tIDFC First Financial institution instructed Inc42 on situation of anonymity.

And therefore, the very providing that the neobanks promised had been matched by massive banks ultimately. With the UI expertise proposition gone, there wasn’t a lot the neobanks might do. So is such an app even related at this time?

The place a standard financial institution might rapidly provide a buyer a mortgage, a bank card, an insurance coverage product, or a set deposit and add to its income streams. A neobank, in contrast, needed to sew every of those by separate agreements, typically at nice price. This made the journey from buyer acquisition to profitability far longer and extra unsure.

“In conventional banks, monetisation comes simply as a result of you’ll be able to cross-sell a number of merchandise, loans, bank cards, funding merchandise. Banks have already got the approvals, algorithms, and infrastructure to plug these in. For neobanks, it’s a lot harder. They’re depending on their accomplice financial institution for the legal responsibility account, and in the event that they need to provide credit score, they should tie up with one other NBFC or acquire a pay as you go licence themselves,” mentioned Hyperface’s Jaishankar.

With out the power to cross-sell a variety of economic merchandise as simply as conventional banks, monetisation grew to become troublesome for the neobanks.

Regulation added additional stress. Initially, co-branded debit or pay as you go playing cards gave neobanks entry to priceless buyer knowledge, which they might use to personalise providers and cross-sell. However because the Reserve Financial institution of India tightened its scrutiny, knowledge sharing grew to become restricted.

At this time, even when a neobank has a card tie-up with a pan-India personal financial institution for example, the info of that individual card goes to the financial institution. The neobank doesn’t acquire something right here besides some touchpoints with the shopper.

Additional, because the money deposits in neobanks are sometimes low, accomplice banks can’t earn a major quantity by such neobank accounts. That is coupled with the truth that a majority of neobanks couldn’t instantly lend, which is the most important income supply for any financial institution or fintech startup for that matter.

The double whammy is that a big a part of the neobank buyer base are people who open accounts for short-term wants or as a backup account. It’s hardly ever the first account for a lot of and even when that’s the case, one can merely transfer on to the official financial institution app to handle the account as an alternative of sticking with the neobank.

“For a lot of the clients, it was like opening a second or third account. And the absence of a banking license creates low belief which additional results in low account steadiness,” mentioned Abhishek Gandhi, cofounder and CBO of Fatakpay.

Reductions performed a job at first when VC funding was flowing, however with this off the desk, development is difficult to come back by. “Many of the clients we acquired got here by heavy cashback presents. As soon as the funding dried up and the cashbacks disappeared, it grew to become clear that the cohorts we had acquired had been low-LTV ones as properly,” an ex-employee of Fi Cash instructed Inc42 on situation of anonymity.

In the meantime, funding tech startups providing mutual funds, SIPs and high-yield investments started to draw the identical younger, city clients that neobanks had been focusing on. With UPI providing free funds, many purchasers requested: why keep a second account with a neobank in any respect?

What makes issues worse is that conventional banks have upgraded their infrastructure and maintain tempo with rising tech extra intently than earlier than. Neobanks not provide the tech benefit they used to.

As we take a look at the neobanking market, it seems an increasing number of like a wasteland of startups that appeared to have the potential however didn’t capitalise on the precise market situations and the VC backing.

Unicorns or not, neobanks like Open, Jupiter, Niyo, Fi and others are quick turning into outdated information.

Edited by Nikhil Subramaniam

[ad_2]