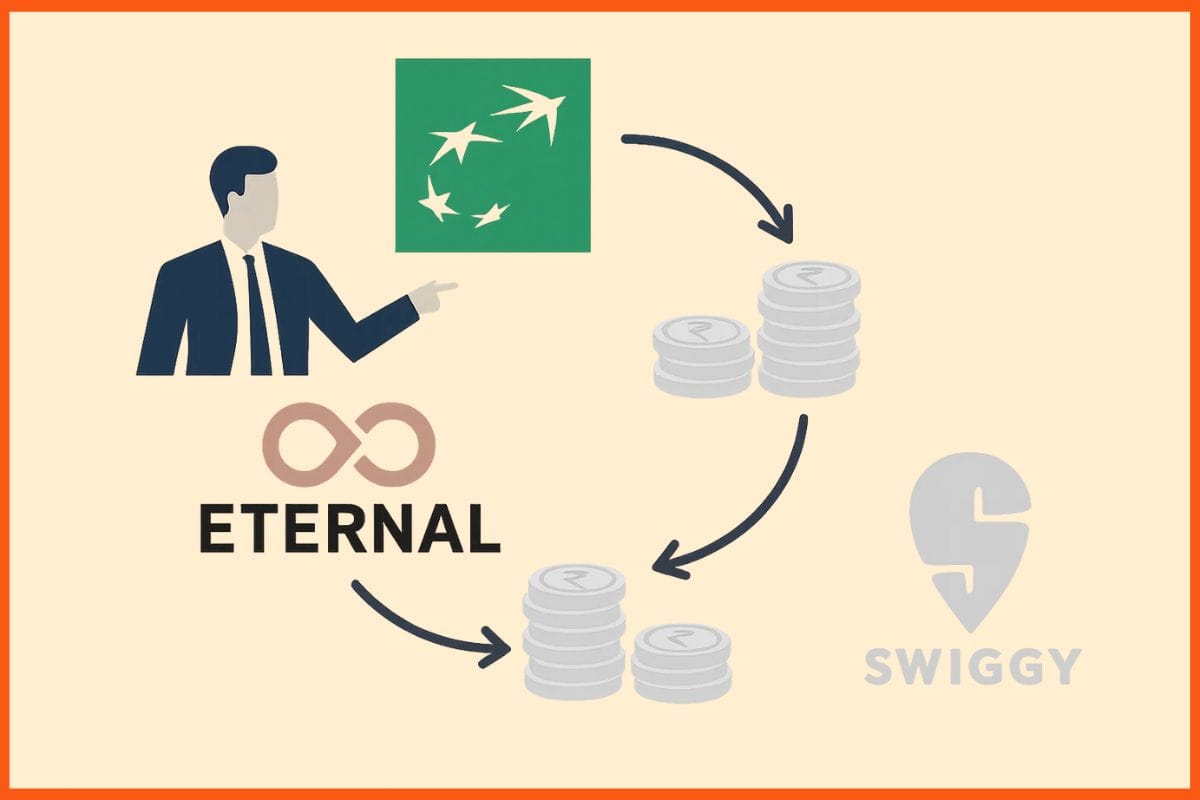

In a block deal on 26 August, BNP Paribas Monetary Markets bought 10.12 Cr shares of Zomato mother or father firm Everlasting and bought 2.69 Cr shares of rival Swiggy. In accordance with NSE data, BNP Paribas paid INR 318.1 per share for Everlasting shares, making the acquisition value roughly INR 3,200 Cr.

Block Deal Particulars: Everlasting and Swiggy Share Transactions

The investor additionally bought 16,083 shares for INR 51.11 lakh in a special bulk transaction. Everlasting’s inventory ended yesterday’s buying and selling session on the BSE 0.5% down, at INR 317.80. On the finish of the session, the market capitalisation of the corporate was INR 3.06 Lakh Cr.

On account of Ganesh Chaturthi, the inventory exchanges are closed at this time. Within the meantime, BNP Paribas bought 2.69 Cr Swiggy shares for INR 430.38 every, leading to an INR 1,158 Cr block deal. It purchased INR 18.54 Cr value of Swiggy shares in a special bulk transaction.

BNP Paribas’ Latest Strikes in Swiggy Stake

Final month, BNP Paribas bought 3.2 lakh Swiggy shares at INR 381 a share. Within the bulk transaction on the time, Citigroup World Markets bought its shares. You will need to word that Swiggy is down greater than 20% this 12 months, whereas Everlasting’s shares have elevated greater than 14%.

Everlasting vs Swiggy: Fast Commerce Rivalry Heats Up

The 2 companies are at present concerned in a fierce battle within the fast commerce area, which coincides with the majority offers. Along with having a duopoly within the foodtech sector, Swiggy and Zomato are investing closely to achieve management of the nation’s shortly increasing quick commerce market.

Blinkit Main Forward of Instamart

Blinkit from Everlasting now leads Swiggy’s Instamart, however corporations like Zepto, Flipkart Minutes, BigBasket, and others are all vying for market share within the majors’ fast commerce sectors. Everlasting and Swiggy are quickly rising their community of darkish shops with the intention to preserve the competitors at bay.

In consequence, the firms’ backside strains have suffered. Within the first quarter of FY26, Blinkit misplaced INR 42 Cr, in comparison with INR 43 Cr in the identical interval the earlier 12 months. On account of its ongoing investments in Blinkit, even Everlasting’s consolidated internet revenue fell greater than 90% to INR 25 Cr from INR 253 Cr in Q1 FY25.

In the same vein, Swiggy’s internet loss elevated 96% from INR 611 Cr within the earlier quarter to INR 1,197 Cr within the June quarter. Within the first quarter of FY26, Instamart’s loss was INR 797 Cr, practically 3 times the INR 280 Cr loss from the identical quarter the earlier 12 months.

|

Fast |

|

•BNP Paribas Offloaded 2.69 Cr Swiggy •BNP Paribas had purchased 3.2 lakh •Everlasting’s Blinkit leads Instamart, •Everlasting up 14% in 2025 YTD; Swiggy |

WIDGET: questionnaire | CAMPAIGN: Easy Questionnaire