To say that Tata Metal is an Indian multinational and one of the vital well-known names in iron and metal exports can be an understatement. The birthplace of Tata Metal shouldn’t be Mumbai, for that’s the place the Tata flagship was born; it somewhat unfold its huge manufacturing bases far and vast from India to Europe and Asia. However then, one could cower earlier than the scale of Tata Metal, in direct steel-making capability scales of greater than 35 million tons.

The foremost manufacturing facilities in Jamshedpur and Kalinganagar are thought to be examples of operational excellence and high quality in India. First in privately owned India to enter built-in metal manufacturing, Tata Metal absolutely undertook this course of – from mining its uncooked supplies to distributing high-end merchandise. This instance of built-in steel-making was fast-tracked and befell with none procurement from exterior, thereby guaranteeing pure high quality and consistency. Tata Metal, with over 78,000 workers unfold all through 5 continents, is aimed toward addressing the ever-growing wants of numerous industries from automotive to development and infrastructure.

Tata Metal Enterprise Mannequin

How Tata Metal Makes Cash I Income Mannequin of Tata Metal

Tata Metal’s Distinctive Promoting Proposition

Tata Metal’s SWOT Evaluation

About Tata Metal

In that yr of 1907, Tata Metal got here into being and commenced forging the metal growth, a course of initiated by Jamsetji Tata and his son Sir Dorabji Tata, who had been then observing a fracture that existed within the metal business of India. Collectively, they resolved to place Sakchi-now Jamshedpur-among the very first built-in metal vegetation in India. The transfer was audacious and proved to be extra prescient, as in 1912-the first metal ingot was forged by the company-within a yr after the commissioning of its blast furnace. Together with growth got here the worth; in fact, cash counted, and so did expertise, however it was an extended, arduous path, and saved by the native supporters ever – diligent buyers.

Throughout the First World Warfare, Tata Metal was one in every of a significant contribution to output that drove the warfare efforts and thus constructed up a substantial institution as an industrial home. After having claimed industrial improvements by introducing the eight-hour workday in 1920-an extraordinarily progressive step for India-performing even faster on the uptake for innumerable strains of modernization data throughout the Fifties and past. Nicely into the brand new millennium, there have been rounds of worldwide enlargement by Tata Metal, with its final and most important being the acquisition of Corus in the UK.

Tata Case Examine | Success Story Of The Tata Group

Case examine of Tata Group, an Indian world mixture holding group headquartered in Mumbai, established in 1868 by Jamsetji Tata. Learn Extra!

Tata Metal Enterprise Mannequin

Expectedly, Tata Metal claims to have a vertically built-in firm, which takes care of the entire metal worth chain: from mines and uncooked supplies extraction by means of to end-making and distributing completely different grades of metal merchandise. The 4 pillars that characterize this integration are uncooked materials safety, value competitiveness, and stringent high quality checks, lending itself to being the world’s most effective metal producer. The car sector, the development sector, agriculture, and engineering are among the sectors serviced by Tata Metal, which has a longtime presence throughout 5 continents, most of that are the growing and developed markets. Revenue sources are derived from typical metal grades, superior value-added merchandise, and revenue from mining and consultancy companies.

For the strategic competitiveness and adaptive sustainability of its enterprise, Tata Metal retains investing in analysis, digital transformation, and sustainability. The first focus of Tata Metal prior to now few years has been capability constructing in India with the goal of bettering buyer deliveries, and investing in such applied sciences as Business 4.0 and AI for optimizing operations and chopping prices. To additional diversify the revenue streams, strengthen resilience towards market motion, and consolidate management positioning throughout the business, it’s this very combination-global presence, innovation, built-in provide chain, and customer-centricity-that makes Tata Metal distinctive.

How Tata Metal Makes Cash I Income Mannequin of Tata Metal

Tata Metal’s main steelmaking operations are positioned in India and Europe, with manufacturing and gross sales models additionally serving world business pursuits. Main contributions to its revenues embrace the provision of metal to the auto, development, engineering, and infrastructure sectors. As per the consolidated monetary statements in latest instances, complete revenues had been hovering because of elevated volumes in Indian deliveries and the sale of value-added merchandise. Essentially the most voluminous contributions got here from among the principal vegetation at Jamshedpur and Kalinganagar, plus new enterprise segments together with business shipbuilding and superior automotive metal.

The minor income contributions come from mining actions for iron ore and coal extraction, and sure utility and infrastructure actions. This full integration mannequin has helped in sustaining value efficiencies: income era from exports and the consultancy division. With a robust give attention to innovation, R&D funding incentives, progressively nurturing sustainability concerning revenue era, agility related to optimizing operational excellence, and discerning for wonderful consumer service are the routes for continuously shaping income into margin augmenters.

| 12 months (Mar) | Complete Income (INR Cr.) | Complete Revenue (INR Cr.) |

|---|---|---|

| 2025 | 1,34,763.56 | 13,969.70 |

| 2024 | 1,44,110.34 | 4,807.40 |

| 2023 | 1,32,332.10 | 15,495.11 |

| 2022 | 1,30,473.37 | 33,011.18 |

| 2021 | 84,888.03 | 17,077.97 |

| 2020 | 60,840.09 | 6,610.98 |

| 2019 | 73,015.79 | 16,227.25 |

| 2018 | 60,380.48 | 6,638.25 |

| 2017 | 48,407.48 | 5,356.93 |

| 2016 | 42,101.04 | 6,126.5 |

Tata Metal’s Distinctive Promoting Proposition

Tata Metal defines its USP in an built-in means primarily based on captive mining of iron ore and coal for amount manufacture and advertising of completed metal merchandise, such that uncooked materials safety, value benefits, and management over high quality make Tata Metal probably the most cost-efficient producer in Asia. Its diversified merchandise cowl virtually each market-from automotive development to agriculture-making income resilient over financial cycles. The corporate derives a wonderful operational profit from large-scale manufacturing with a close to 100% capability utilization in its flagship vegetation inside India.

Tata Metal will get its energy from being current in additional than 26 nations and from the goodwill and belief related to the Tata model. The clear presence of sturdy investments in expertise and innovation and its sustainability path towards low-carbon steelmaking form the id of the enterprise, most notably in Europe, which has a number of strategic transformation packages particularly devoted to making sure its competitiveness out there and environmentally aware manufacturing. That is how Tata Metal’s worth proposition completes the story: strategic agility, monetary resilience, and customer-centricity development setter for future progress in high-end and rising markets.

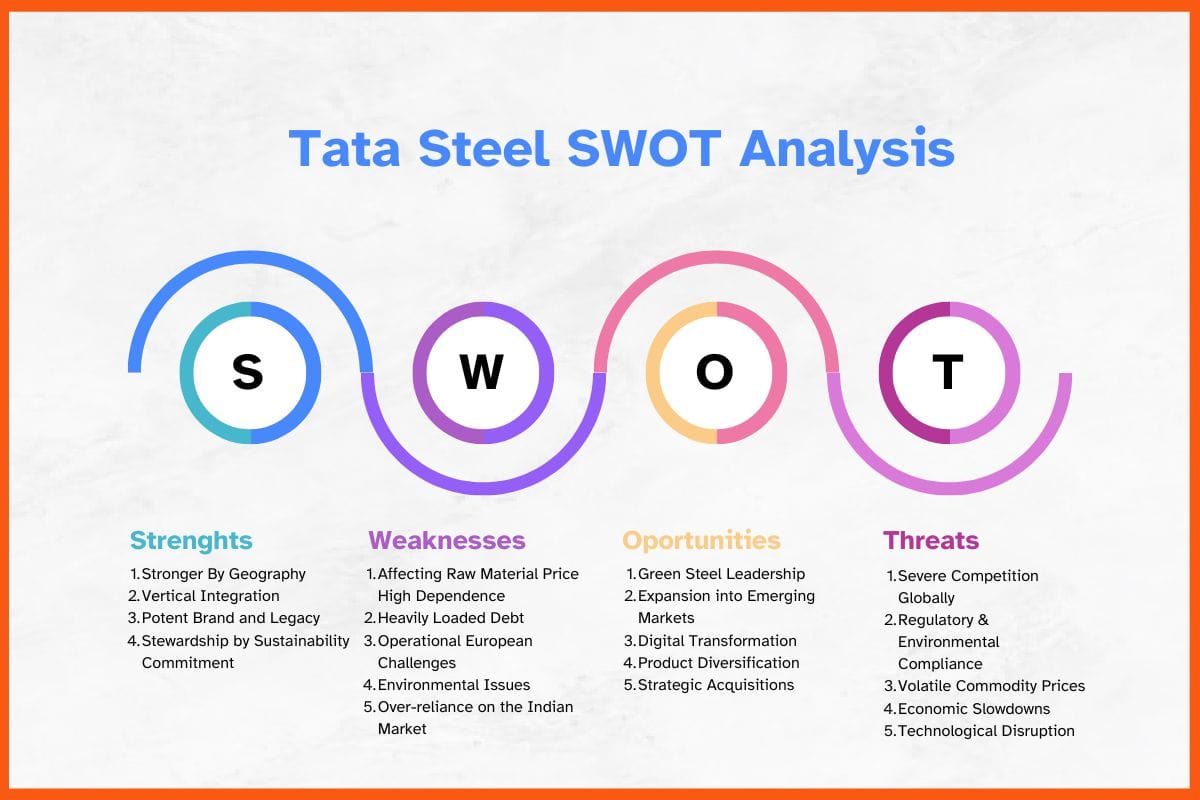

Tata Metal’s SWOT Evaluation

Strengths

- Stronger By Geography: Operations in additional than 26 territories present completely different revenue streams to cut back dependence on any market.

- Vertical Integration: Management of mining, manufacturing, and distribution ensures value effectivity and compelling high quality.

- Potent Model and Legacy: Tata Metal has obtained plenty of belief within the Tata model, whose over-a-century-old business management advantages it.

- Stewardship by Sustainability Dedication: Shortly shifted towards low-carbon metal and utilizing inexperienced applied sciences that may heighten its picture, particularly throughout Europe and India.

Weaknesses

- Affecting Uncooked Materials Value Excessive Dependence: Modifications in worth have an effect on ore, iron, and coal, which have an effect on profitability due to worth actions.

- Closely Loaded Debt: Debt has elevated on account of its previous acquisitions, notably inside Europe.

- Operational European Challenges: Elevated prices and problems with integration additional impression profitability inside these models.

- Environmental Points: Steelmaking remains to be carbon-intensive, with a relentless want for funding to adjust to regulatory requirements.

- Over-reliance on the Indian Market: The share is sort of excessive for home demand when it comes to income, thus being susceptible to the market downturn.

Alternatives

- Inexperienced Metal Management: Investments in carbon-free and round manufacturing applied sciences might place Tata Metal because the frontrunner in sustainable manufacturing practices among the many business.

- Growth into Rising Markets: The urbanization and development increase in Southeast Asia and Africa supply big progress potential.

- Digital Transformation: Price effectivity is elevated, coupled with superior provide chain administration by means of AI, large information, and course of automation.

- Product Diversification: Specializing in metal for EVs, renewable energies, and specialised purposes may even enhance margins.

- Strategic Acquisitions: Development by means of mergers and acquisitions, and new partnerships to make use of applied sciences and the market.

Threats

- Extreme Competitors Globally: Bulge rivals like ArcelorMittal, JSW Metal, POSCO, and Nippon Metal put large stress on costs and threaten their market parts.

- Regulatory & Environmental Compliance: The prices of compliance are nonetheless racking up excessive payments as they transfer towards being ‘inexperienced’.

- Risky Commodity Costs: Iron ore and coal costs proceed to show very unstable, and this could in the end eat closely into income.

- Financial Slowdowns: They’re very delicate to cycles of worldwide recession and home downturn within the development and particularly automotive sectors.

- Technological Disruption: Improvements utilizing different supplies or manufacturing strategies might doubtlessly cut back the metal demand of sure purposes.

Conclusion

Tata Metal is a vertically built-in firm, that means it controls the whole worth chain of metal manufacturing from mining to the manufacturing of completed items. This construction affords it value effectivity, high quality assurance, and insulation towards provide chain disruptions. A bonus of worldwide deployment in so many merchandise is serving so many alternative industries that Tata Metal is not going to be beholden to anybody market. Investments in expertise, digitalization, and sustainability are steady with the intention to maintain this firm aggressive, and worth addition retains the margins wholesome. Added to this are the belief held by the Tata model and the strategic evolutionary adaptability of the corporate, each of which can help the agency in mitigating market volatility and reaching long-term progress on this world metal business.

Listing of All of the Tata-Owned Corporations | Tata Group

Tata Group of Industries is an Indian multinational conglomerate based by Jamshedji Tata. Right here’s a listing of all the businesses owned by Tata.

FAQs

What’s Tata Metal ?

Tata Metal is an Indian multinational metal manufacturing firm.

The place is Tata Metal headquartered?

Tata Metal is headquartered in Mumbai, India, with main manufacturing facilities in Jamshedpur and Kalinganagar.

When was Tata Metal based and by whom?

Tata Metal was based in 1907 by Jamsetji Tata and Sir Dorabji Tata, establishing one in every of India’s first built-in metal vegetation in Jamshedpur.

How does Tata Metal generate income?

Tata Metal earns income by means of the sale of metal merchandise, mining operations, consultancy companies, and exports, with important contributions from its Indian operations and world vegetation.

WIDGET: questionnaire | CAMPAIGN: Easy Questionnaire