Yole Group has launched Automotive White Paper, Vol. 2, a part of the 2025 Yole Group White Paper Assortment. Following the success of Quantity 1, this newest version dives deeper into the transformative forces shaping the way forward for automotive semiconductors.

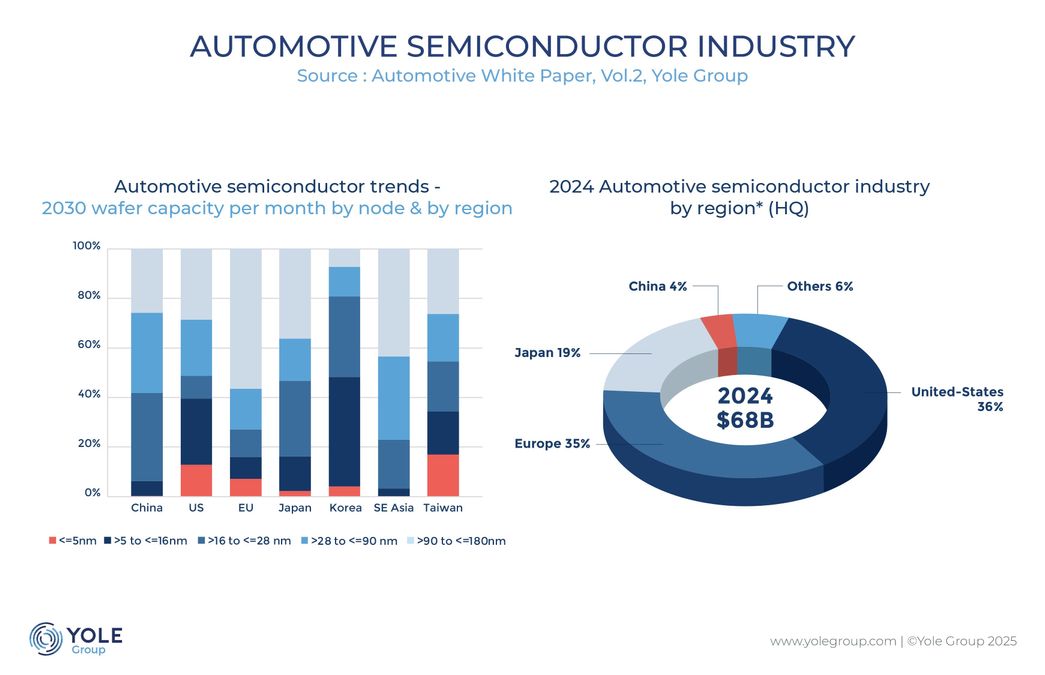

Whereas the worldwide automotive market is about to develop at a modest 2% CAGR between 2024 and 2030, the semiconductor section is surging dramatically, rising from $68 billion to $132 billion over this era. This divergence underscores the central function of semiconductors as automobiles evolve into software-defined, related, and more and more autonomous platforms.

The white paper examines how established semiconductor leaders and rising challengers are repositioning themselves to seize worth on this quickly increasing market.

Some are strengthening their positions in energy administration, electrification, and security methods, whereas others are driving advances in computing platforms for ADAS, infotainment, and LiDAR; China, for instance, is making LiDAR a differentiator in its home EV race.

The worldwide aggressive panorama is shifting. U.S. and European gamers proceed to leverage scale, IP depth, and established OEM relationships to defend management. In the meantime, Chinese language firms, fueled by nationwide assist, are aggressively constructing capabilities to safe a self-sufficient semiconductor ecosystem.

On the similar time, OEMs like Tesla, BYD, and Nio are accelerating vertical integration, additional disrupting conventional provide chains and reshaping how worth is captured throughout the ecosystem. But challenges loom: geopolitical dangers, AI-driven compute necessities, and the architectural shift towards centralized car platforms will check the resilience of the complete provide chain.

Pierrick Boulay, Principal Analyst, Automotive Semiconductors at Yole Group, stated: “Automotive semiconductors are not a hidden enabler. They’re the inspiration of future mobility. Yole Group’s Automotive White Paper, Vol.2, exhibits how technological selections and strategic bets within the subsequent 5 years will outline the winners and losers of this business.”

The paper additionally highlights the method of node evolution and the rise of chiplet design, analyzing their implications for provide safety and innovation. With TSMC and Samsung absolutely booked on sub-16nm capability by 2027, questions on availability and strategic alignment with automakers are essential.

Yu Yang, Principal Analyst, Automotive Semiconductors at Yole Group, added: “The worldwide race is accelerating. Whereas incumbents maintain sturdy in ADAS and autonomous compute, challengers should show reliability to earn belief. The winners can be those that align know-how innovation with OEMs’ evolving roadmaps.”

Key takeaways

* The automotive semiconductor market will soar from $68 billion in 2024 to $132 billion in 2030, rising at a ten% CAGR, 5 instances quicker than the automotive market itself.

* The highest 5 gamers management half the market, but rising challengers are reshaping competitors.

* Infineon Applied sciences leads globally with greater than $8 billion in automotive income in 2024, adopted carefully by NXP and STMicroelectronics.

* U.S. companies dominate in superior computing, analog, and reminiscence, holding 36% market share.

* Chinese language suppliers, backed by nationwide insurance policies, are advancing quickly in cockpit, ADAS, and energy SiC.

* OEMs, together with Tesla, BYD, and Nio, are integrating vertically, disrupting conventional provide chains.

* TSMC and Samsung preserve management of sub-16nm automotive nodes, absolutely allotted by 2027.

Leave a Reply