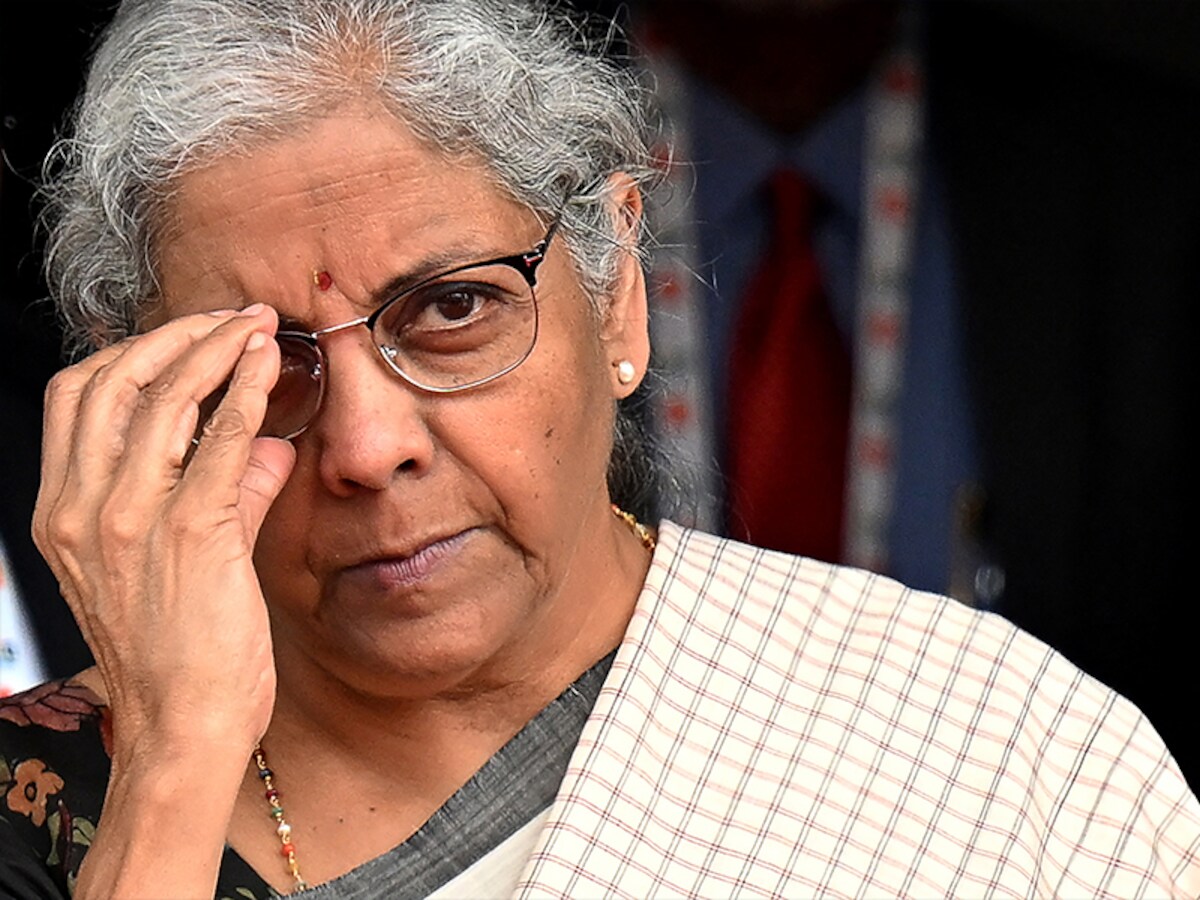

As India approaches the pre-poll Interim Finances announcement, the BJP-led authorities is predicted not solely to provide you with a plan for the approaching years however might even have underpinnings for the following 25 years main as much as the nation’s centennial of independence. On February 1, worldwide consideration will firmly relaxation on Finance Minister Nirmala Sitharaman. Despite the fact that it is a vote-on-account, a assured authorities that believes it’ll return to energy after elections will use this chance to current a abstract of its achievements thus far and lay down the trail for governance reforms and monetary consolidation within the coming years. Furthermore, it’ll purpose to take a strong step in its quest to emerge as a preeminent vacation spot for world funding and resolve the issues of the worldwide south.Below the stewardship of its authorities, India, the world’s largest democracy with essentially the most populous citizens, has navigated via a labyrinth of unprecedented challenges. Areas like the price of doing enterprise (compliance price), inflation and jobs are challenges that might be talked about. The upcoming finances, laden with substantial expectations, is anticipated to unveil a plan for India’s “Amrit Kaal” – a defining 25-year interval main as much as the nation’s centennial of independence. The PM has already spoken about farmers, youth, girls, and socially backward as important for India, and one expects the finances to concentrate on them as nicely. I focus on the necessity for unwavering dedication to eight key areas that can form India’s financial and social future and might be important for reaching this tall imaginative and prescient:

1) Balancing Progress and Fiscal Deficit

2) Job Creation

India’s demographic dividend is not merely a statistic, the place half of the graduates nonetheless qualify as a possible strong workforce to be employed, but in addition financial drivers that want mobilising. Skilling initiatives must be laser-focused on sectors like renewable vitality and digital infrastructure, together with AI, telecom and cybersecurity, that are collectively anticipated to witness a growth incomes billions in funding and market dimension. Evergreen sectors of building, MSME manufacturing and FMCG may even want assist in reskilling and efforts in direction of a digital-like listing. Streamlining its labour legal guidelines, as seen within the current fixed-term employment reforms, and incentivising startups in these high-growth areas can create not simply jobs however high-value careers. Re-envisioning Ability India is one thing that could possibly be on the agenda.

3) Nurturing Innovation

India’s tech prowess is plain, however its deeptech ambitions require aggressive nurturing. The Nationwide Deeptech Startup Coverage effectuates a very good begin to the method. India ought to have devoted and elevated allocation in GDP (benchmarking towards world leaders like Israel’s 4.8 %) to R&D in AI, robotics, area tech and quantum computing. The present allocation is lower than one %. The rising momentum round semiconductors means that India ought to pivot its coverage focus to design and manufacturing fairly than the present focus round meeting, particularly when the previous can avail the big expertise pool. Different rising developments like blockchain and web3 may even require an ecosystem of immense assist, together with business collaborations, to redefine India as the worldwide thought chief in innovation.

4) Governance 3.0

A Twenty first-century India wants a Twenty first-century authorities. Mission Karmayogi must be turbocharged, upskill bureaucrats in information analytics and digital governance, streamline processes via automation, and leverage expertise for enhanced transparency. Proactive problem-solving platforms, just like Singapore’s ‘Good Nation’, can foster public belief and collect invaluable information for policymaking. This is not nearly effectivity; it is about establishing India as a global benchmark in good governance.

5) Farmers’ Revenue

The agriculture sector can see a brand new wave of change. The Soil Well being Card Scheme can tailor irrigation interventions and assist optimise fertiliser use. The function of R&D, extension providers, and rural bodily infrastructure for the agriculture sector has been nicely documented. Chilly chain amenities, beforehand launched by 2016’s Pradhan Mantri Kisan Sampada Yojana, want a higher push to cut back post-harvest losses, estimated at a staggering 22 %. Entry to finance additionally turns into essential for farmers, together with constructing extra monetary entry factors and specializing in implementable mortgage restoration methods. Small farmers are extra weak, so devoted assist is required for farmers with small holdings, particularly people who use sustainable strategies. All these are crucial standards for realising the efforts in direction of doubling farmers’ revenue and rural rejuvenation. FPO Scheme wants a push to turn out to be simpler on the bottom.

6) Going Past People

7) Funding in Infrastructure

India’s infrastructure improvement is ready for a major surge, with spending anticipated to double to Rs143 lakh crore between fiscal years 2024 and 2030. The function of personal capital on this progress section is pivotal, with infrastructure sectors like roads, highways, renewable vitality, and ports attracting investor curiosity, and additional supported by insurance policies and conducive funding local weather. To maintain this, constant coverage assist might be essential, alongside a concentrate on well timed execution. The long run infrastructure panorama ought to doubtless incline in direction of bigger, mega-scale initiatives. A mix of elevated bond market exercise, international funding, and financial institution lending might be important to fulfill the huge funding necessities.

Leave a Reply