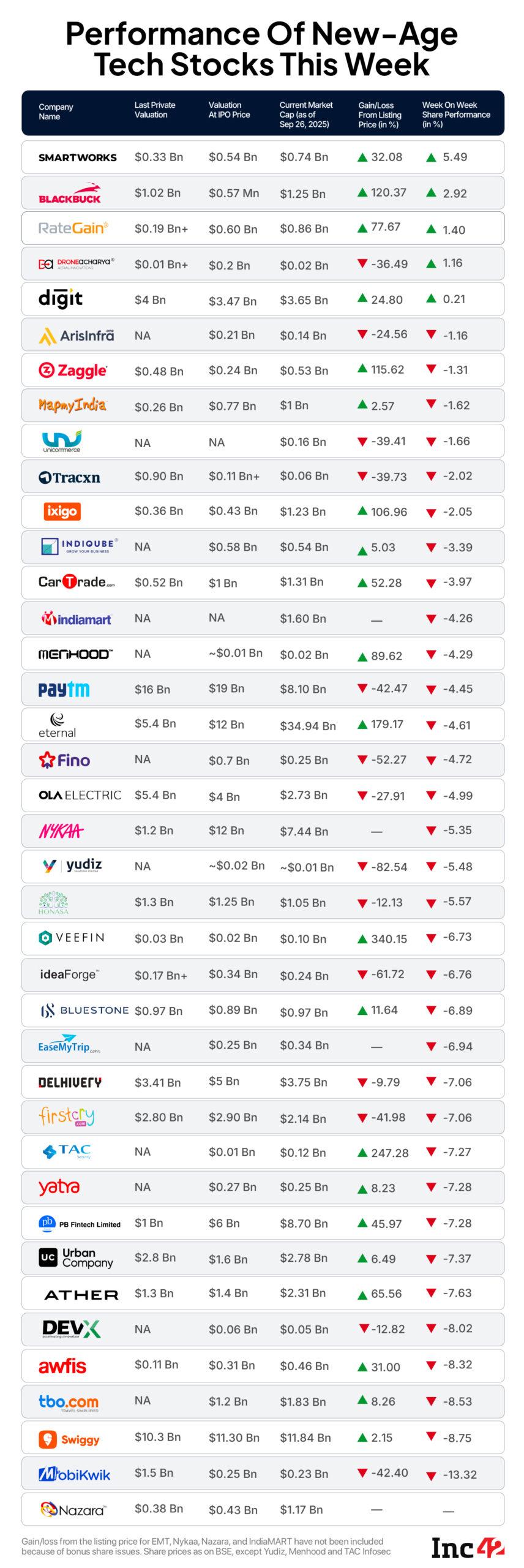

Barring Smartworks, BlackBuck, RateGain, DroneAcharya and Go Digit, 34 of the 39 new-age tech shares beneath Inc42’s protection plunged in a variety of 1.16% to over 13%

The cumulative market capitalisation of those corporations declined over $5 Bn to $104.91 Bn from $110.28 Bn on the finish of the final week

All giant new-age tech corporations bled this week, with Everlasting, Paytm, Ola Electrical, Delhivery seeing main correction to their inventory costs

New-age tech shares bled this week because the Indian equities market broke their three-week successful streak. Barring Smartworks, BlackBuck, RateGain, DroneAcharya and Go Digit, 34 of the 39 new-age tech shares beneath Inc42’s protection plunged in a variety of 1.16% to over 13%.

With this, the cumulative market capitalisation of those corporations declined over $5 Bn to $104.91 Bn from $110.28 Bn on the finish of the final week.

Ather Power’s shares slumped after hovering to an all-time excessive of INR 614.75 on Monday (September 22). The inventory ended the week 7.63% decrease from final week, falling considerably over the past two buying and selling classes. On Thursday (September 25), the corporate introduced its plans to defer the submission of claims for demand incentives to the tune of INR 26.2 Cr beneath the Centre’s PM E-DRIVE scheme because of uncommon earth magnet scarcity.

Not too long ago listed City Firm’s shares additionally touched an all-time excessive of INR 201 throughout the intraday buying and selling on Monday. Nonetheless, the inventory noticed revenue reserving after that and ended the week 7.37% decrease at INR 171.45. The inventory continues to be buying and selling 6.5% above its itemizing value of INR 161.

Coworking area supplier DevX, which made its market debut on the identical day as City Firm, has been beneath stress since itemizing. The inventory ended the week at INR 53.44, down about 13% from the itemizing value and eight.02% week-on-week. It touched an all-time low of INR 52.20 on Thursday.

The rout at EaseMyTrip continued this week, with the corporate’s shares touching yet one more low of INR 8.12 throughout the intraday buying and selling on Friday (September 26). Its shares ended the week at INR 8.18, down about 7% from final week.

In the meantime, all giant new-age tech corporations bled this week. Whereas Zomato-parent Everlasting misplaced about $2 Bn in market cap this week, different notable corporations like Paytm (down 4.45%), Ola Electrical (misplaced about 5%), Delhivery (misplaced over 7%) additionally noticed correction.

So what led to the massacre within the Indian market this week?

Markets Reel Below Tariff Jitters

The Indian equities market noticed its sharpest weekly decline in months, as world commerce tensions and relentless FII outflows triggered heavy promoting throughout the board. The Nifty 50 slumped 2.56% to shut at 24,654.70, whereas the Sensex shed 2.62% to finish at 80,426.46.

The brunt of the correction was borne by mid- and small-cap counters, observes Ajit Mishra, SVP of analysis at Religare Broking.

Retail traders, who had pushed latest positive aspects in these shares, noticed a pointy erosion of their paper earnings as these counters fell quicker than the broader market.

Mishra stated that weak spot in large-cap IT shares, coupled with uncertainty round H-1B visa laws, weighed on market sentiment. He added that mid- and small-cap tech and fintech shares, many buying and selling at stretched valuations, confronted the sharpest corrections as traders reassessed development prospects within the face of exterior dangers.

“Weak point in heavyweights has accelerated the decline, with the Nifty approaching key assist close to 24,400. Continued FII promoting and sector-specific headwinds might maintain the broader pattern fragile,” he added.

Trying forward, subsequent week will probably be data-heavy. Domestically, industrial manufacturing figures, the RBI’s coverage determination, and the expiry of September derivatives contracts might result in volatility.

Globally, updates on the US-India commerce deal will probably be intently tracked. With threat urge for food beneath pressure, analysts advise traders to remain defensive, keep away from high-beta smallcaps, and maintain liquidity helpful till readability emerges.

“Nonetheless, the sustainability of present market valuations hinges on a visual restoration in company earnings and determination of the India-US commerce frictions,” stated Vinod Nair, head of analysis at Geojit Investments.

With that, let’s check out the week’s largest losers — Swiggy and MobiKwik.

MobiKwik Shares Slide After Second Fraud Case in Six Months

MobiKwik’s shares continued their downward trajectory this week, plunging 13.32% to shut at INR 254.75. The inventory is now down 42.40% from its itemizing value. The fintech firm’s woes on the bourses have been compounded by repeated operational lapses and weak financials.

The most recent setback follows a monetary mishap earlier this month, when the corporate reported a fraud of INR 40 Cr.

The corporate later stated that the incident passed off because of a “restricted inner processing error”, which led to sure failed transactions being incorrectly marked as profitable and leading to unauthorised payouts to retailers in Haryana’s Nuh district.

Nonetheless, this isn’t the primary operational lapse for MobiKwik. In March, the corporate reported an inner fraud of INR 1.3 Cr involving a former worker. On the monetary entrance, the corporate’s income from operations fell 20.7% YoY to INR 271.4 Cr in Q1 FY26 and internet loss widened 535% to INR 41.9 Cr, reflecting ongoing challenges in scaling the enterprise profitably.

Eventful Week For Swiggy

Foodtech main Swiggy made headlines this week with two important strategic strikes. Its board authorized the sale of its stake in mobility startup Rapido to current traders Prosus and Westbridge for a whole consideration of about INR 2,400 Cr ($270.4 Mn).

Swiggy had acquired round 12% stake in Rapido throughout its $180 Mn Collection D spherical in 2022. This adopted Rapido’s entry into the meals supply area by way of its Ownly platform, creating a possible battle with Swiggy’s core enterprise. Swiggy described the exit as a shareholder-focussed transfer to grasp funding worth, reportedly reaping a 2.3X return on the wager.

In addition to, Swiggy introduced plans to hive off its fast commerce arm Instamart right into a step-down subsidiary, Swiggy Instamart Personal Restricted, by way of a hunch sale. The transfer is aimed toward making a centered company construction for Instamart, permitting unbiased governance, sharper operational focus, and enhanced flexibility in capital deployment.

Business observers word that this setup paves the way in which for a devoted fundraise, enabling the corporate to herald contemporary capital with out impacting Swiggy’s core enterprise construction. Taken collectively, the Rapido exit and Instamart spin-off sign a strategic recalibration.

In the meantime, the corporate’s shares bled 8.75% to shut the week at INR 420.85.

[ad_2]