Picture: Shutterstock

The Sensex, India’s benchmark inventory market index, reached a document excessive of greater than 77,000 factors on Monday, sparking ongoing issues about market valuation. Traders are grappling with the query of whether or not it is the correct time to speculate or if they need to look forward to a correction.

Is the market costly?

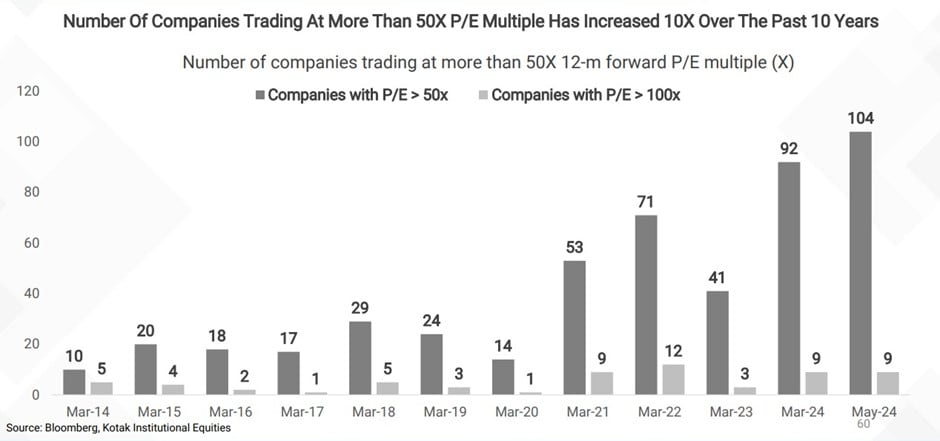

Sure, the market valuation is dear. The Nifty 50’s price-to-earnings (PE) ratio stands at 21.9, barely beneath its one-year common price-to-earning of twenty-two.3. Nifty’s 12-month ahead PE is at 20.76. The variety of corporations proven within the infographic can recommend how one must be selective when investing in shares or sector-specific mutual funds.

Valuation is a significant concern, however must you be anxious? What if the market corrects by 20 % tomorrow? Do you have to keep away from investing attributable to this worry, or fear about your current investments? Earlier than making a choice, take into account asking the next questions:

Do you have to keep out of the market?

Do not take the chance of not investing. Take a look at our nation’s progress potential—are you able to afford to be out of the market?

Rise of the phoenix: India’s financial ascent

India’s financial system is poised for a big surge, pushed by a scorching GDP progress charge of over seven % in FY23 and projected to rise in FY24. With a projected GDP of over $2 trillion by 2030, India is ready to turn out to be the third-largest financial system on the planet by 2027.

Take a look at a number of the predictions throughout sectors for India’s financial system:

> India’s GDP progress charge is predicted to rise in FY24.

> The nation’s per capita revenue is projected to soar to $5,000 by 2030.

> Shopper confidence is excessive, with a 25 % surge in journey bookings and a 38 % enhance in premium meal orders.

> Infrastructure spending and sensible metropolis investments are laying the muse for a booming financial system.

> The surge in retail investor engagement is clear within the Indian fairness realm, with demat accounts rising from Rs 4.1 crore in FY20 to greater than Rs 13 crore in FY24.

> India’s merchandise and companies exports are anticipated to surge to over $2 trillion by 2030.

> The Make in India initiative is poised to raise India’s manufacturing worth chain, with projections indicating a climb to $1 trillion by 2025.

> India’s innovators are reshaping industries, with hi-tech sectors poised to triple by 2030.

> Investments in schooling guarantee a talented workforce able to energy this transformation.

> A $700 billion clear vitality drive positions India as a frontrunner within the sustainability race.

> $45 trillion financial system India’s GDP is predicted to develop from $3.4 trillion financial system at the moment to $45 trillion by 2052.

What must you do?

There isn’t a generic reply for this query.

“Know what you personal and know why you personal it.” — Peter Lynch

Investing is a posh matter. Whether or not to put money into a high-valuation market or look forward to a low valuation will depend on varied components, together with your danger profile, asset allocation, and monetary objectives. Due to this fact, take into account the next earlier than deciding:

Assess your scenario

Earlier than deciding, take a more in-depth take a look at your monetary scenario. Are you investing a good portion of your web price available in the market? Are you in your prime incomes years or nearing retirement? Are your investments aligned together with your monetary objectives and danger tolerance?

Funding quantity: Assess how a lot you intend to speculate and its significance relative to your total web price.

Holding interval: Decide your funding horizon. Are you investing for the brief time period or long run?

Asset allocation: Guarantee your portfolio is well-diversified and aligns together with your age and danger tolerance.

This turns into much more vital when you select to speculate straight in shares versus mutual funds. For mutual funds, when you plan to put money into sector-specific schemes, the market valuation turns into much more vital. Your danger profile, asset allocation, monetary objectives, and age ought to information how a lot and when to speculate.

Winners of yesterday will not be heroes of tomorrow

You’ll be able to’t decide shares indiscriminately. It’s vital not fall in love you’re your shares and undertake a ‘set it and overlook it’ mentality. The shares that gave constant excessive returns up to now might not proceed to take action sooner or later. To navigate the following market rally, you should be extraordinarily sensible and cautious, as fallacious selections may be disastrous. For many, mutual funds are a safer wager except you could have the experience to know what to purchase. So, decide shares fastidiously. Will the likes of HDFC rise once more or will the final two years’ heroes proceed to shine? Solely time will inform.

As funding guru Warren Buffett as soon as stated, “The inventory market is designed to switch cash from the lively to the affected person.”

Make investments correctly and be cautious.

In case your allocation to fairness is presently low, do not wait too lengthy. Progressively deploy funds through mutual funds except you could have the time, cash, and experience to pick out particular person shares. Keep in mind, most buyers have solely been available in the market for the final three to 4 years, experiencing a largely upward development, however it’s important to be cautious.

Make investments correctly, take into account all of the above components to make knowledgeable choices and keep in mind what nice funding guru Benjamin Graham as soon as stated, “Profitable investing is about managing danger, not avoiding it.”

The author is a Chartered Accountant and founding father of NRP Capitals.

Leave a Reply