On the time of submitting the DRHP, the promoters and promoter group collectively held 95.73% stake in LEAP India

Vertical Holdings II Pte. Ltd. is the most important shareholder with a 73.94% stake, adopted by founder and MD Sunu Mathew with 21.34% stake

Amongst institutional buyers, Sixth Sense Ventures has a 1.41% stake, whereas First Bridge Funding has 1.21% shareholding

Provide chain options supplier LEAP India filed its draft purple herring prospectus (DRHP) with SEBI final week to lift INR 400 Cr via a contemporary difficulty of shares. The preliminary public providing (IPO) may even embrace a proposal on the market (OFS) of as much as INR 2,000 Cr, taking the whole difficulty measurement to INR 2,400 Cr.

By means of the OFS, promoter KKR-owned Vertical Holdings II will promote shares value as much as INR 1,998.6 Cr, whereas promoter group entity KIA EBT Scheme 3 will offload shares value round INR 1.38 Cr.

The 469-page DRHP additionally gives insights into LEAP India’s possession patterns and key leaders. On the time of submitting, the promoters and promoter group collectively held 95.7% stake within the firm. Vertical Holdings II Pte. Ltd. led with a 73.9% stake, adopted by founder, chairman and MD Sunu Mathew with 21.3% stake.

Amongst institutional buyers, Sixth Sense Ventures (through Sixth Sense India Alternatives III Fund) owned 1.4% stake, whereas First Bridge Funding (through First Bridge India Development Fund) held a 1.2% stake.

Madhurima Worldwide, working in specialty finance and commodity buying and selling, additionally held 1.01%.

Based in 2013, LEAP India positions itself because the nation’s largest on-demand asset pooling supplier in provide chain administration. It gives pallets, containers, and different materials dealing with tools that assist purchasers minimize prices and enhance logistics effectivity. As a substitute of proudly owning and managing their very own belongings, firms can lease and return them as required.

The corporate serves sectors similar to FMCG, drinks, ecommerce, automotive, and retail. It claims to have 8.8 Cr pallets and 40,000 containers in circulation, supported by a community of 20+ warehouses and repair centres nationwide.

On the monetary entrance, its working income grew 27.8% to INR 466.4 Cr in FY25 from INR 364.9 Cr in FY24. Internet revenue remained flat at INR 37.5 Cr in comparison with INR 37.1 Cr within the earlier 12 months.

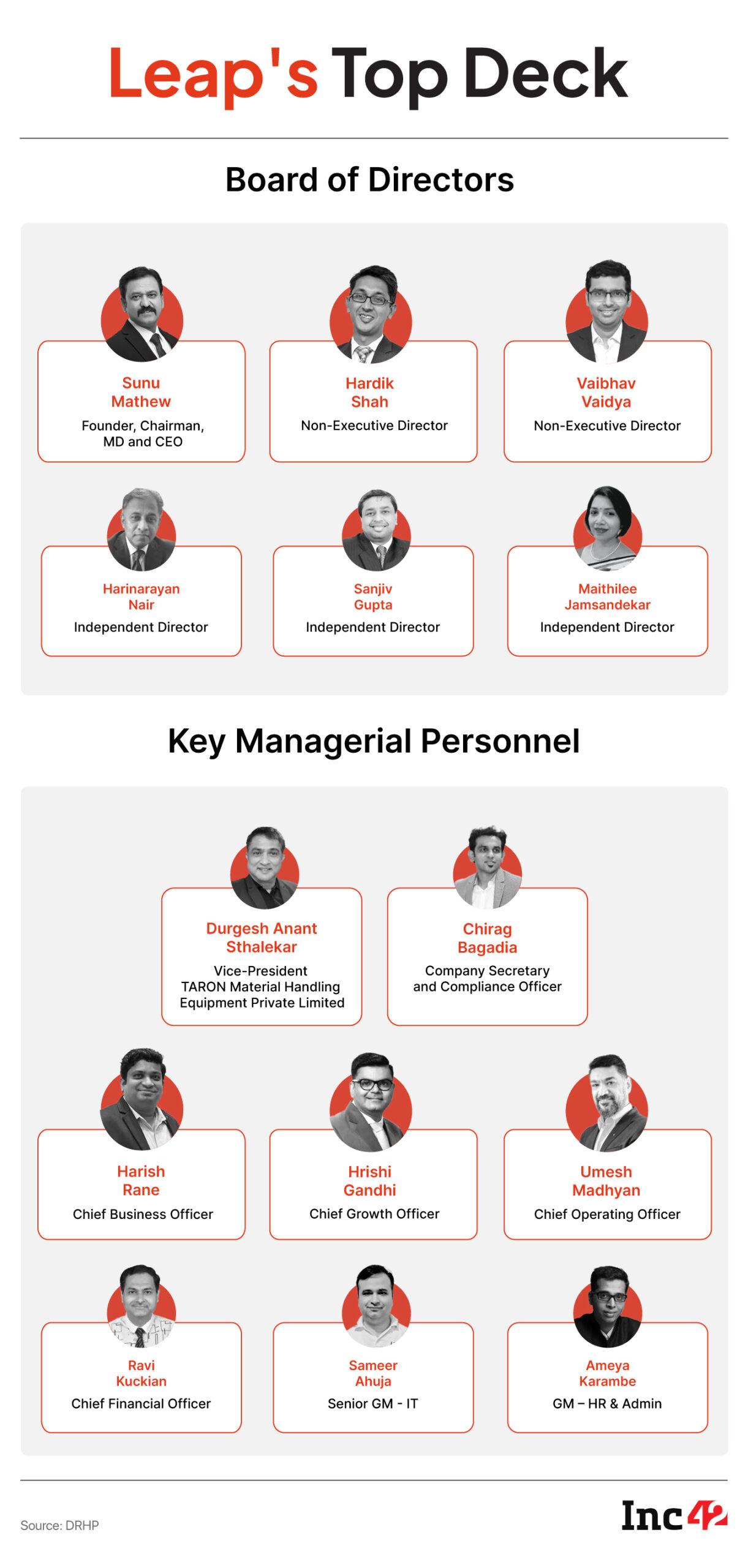

Now, let’s check out the corporate’s board of administrators and key executives.

Decoding LEAP India’s Management Crew

Board of Administrators

Sunu Mathew

Mathew is the chairman, managing director and chief government officer of the corporate. He has over 26 years of expertise and has beforehand labored with CHEP India and L’Oréal India. His remuneration shall be INR 17.96 Lakh monthly in FY26.

Hardik Bhadrik Shah

Shah is a non-executive director on the firm. He’s at the moment a companion on the Asia-Pacific Infrastructure workforce at KKR India Advisors. Shah didn’t obtain any pay in FY25.

Vaibhav Vaidya

Vaidya is a non-executive director. He’s designated as director at KKR India Advisors and has earlier labored with KKR India Asset Finance, Motilal Oswal Funding Advisors and JM Monetary Credit score Options. Vaidya didn’t obtain any pay in FY25.

Harinarayan Nair Sreedharan

Sreedharan is an impartial director on the firm. He has round 28 years of labor expertise and has held management roles at Signode India and Wipro PARI, the place he final served as vice-president.

In FY26, he’s entitled to a sitting payment of INR 50,000 per board assembly, INR 25,000 per committee assembly, together with a profit-linked fee.

Sanjiv Gupta

Gupta is an impartial director. He has beforehand served as CEO of Spice Xpress and Logistics and held management roles at Coca-Cola India.

In FY26, he’s entitled to a sitting payment of INR 50,000 per board assembly, INR 25,000 per committee assembly, together with a profit-linked fee.

Maithilee Jamsandekar

Jamsandekar is an impartial director. She has over 17 years of expertise and has labored with A-1 Fence Merchandise, PwC India, Thoughtworks Applied sciences and Mahindra & Mahindra.

In FY26, she is entitled to a sitting payment of INR 50,000 per board assembly, INR 25,000 per committee assembly, together with a profit-linked fee.

Key Managerial Personnel

Ravi Kuckian

Kuckian is the chief monetary officer of LEAP India. He has over 17 years of expertise and beforehand labored with Johnson & Johnson, SUN Mobility as head – finance, and CHEP India as finance controller. In FY25, he drew an annual remuneration of INR 45 Lakh.

Chirag Bagadia

Bagadia is the corporate secretary and compliance officer. He has near 17.5 years of labor expertise, having beforehand labored with Inspira Enterprise India as assistant vice-president, Music Broadcast as deputy basic supervisor and Ackruti Metropolis as manager-secretary. He acquired a remuneration of INR 21 Lakh in FY25.

Harish Vasant Rane

Rane is the chief enterprise officer on the firm. He has greater than 21 years of expertise and earlier labored with Kellogg India, Mattel Toys (India), Ferrero India and L’Oréal India. In FY25, he drew a remuneration of INR 80 Lakh.

Hrishi Gandhi

Gandhi joined the corporate as its chief development officer earlier this 12 months. He brings over 24 years of expertise within the monetary providers sector, having beforehand labored with Sure Securities (India), NewSpace Analysis & Applied sciences, IL&FS International Monetary Providers (ME) and ICICI Financial institution. He joined the corporate in FY26.

Umesh Madhyan

Madhyan is the chief working officer on the firm. He has greater than 24 years of expertise and beforehand labored with Hindustan Coca-Cola Drinks, Heinz India and L’Oréal India. In FY25, he acquired a remuneration of INR 63 Lakh.

Durgesh Anant Sthalekar

Sthalekar is the vice-president of the corporate’s subsidiary, TARON Materials Dealing with Tools. He has greater than 20 years of expertise and earlier labored with L’Oréal India and Fareast Mercantile. He drew a remuneration of INR 58 Lakh in FY25.

Sameer Ahuja

Ahuja is the senior basic supervisor – info expertise on the firm. He has 19 years of expertise, having labored with UltraTech Cement, Reliance Retail, Trent, Cognizant, Raymond and Aditya Birla Retail. In FY25, he acquired a remuneration of INR 49 Lakh.

Ameya Vijay Karambe

Karambe is the final supervisor – HR, admin and studying on the firm. He has greater than 8 years of expertise and labored with Mahindra & Mahindra, Kanakia Area Realtors, HDFC Asset Administration and Carnival Capital earlier. In FY25, he acquired a remuneration of INR 36 Lakh.

[ad_2]