BharatPe Charts A Full Turnaround

As soon as the casualty of a full-blown boardroom brawl, BharatPe

The Numbers Sport: The fintech large claimed an adjusted revenue, excluding tax and ESOP bills, of INR 6 Cr in comparison with a internet lack of INR 342 Cr in FY24. Revenues grew a mere 17% YoY to INR 1,667 Cr in FY25. So, what helped BharatPe flip its ship round?

The Service provider Lending Candy Spot: CEO Nalin Negi credit the turnaround to doubling down on service provider lending when others retreated. A pointy give attention to reining in credit score disbursal prices and value financial savings from leveraging its personal NBFC, Trillion Loans, helped the fintech main enhance effectivity whereas rising scale.

Navigating The Regulatory Maze: In FY25, BharatPe additionally quietly went into execution mode – engaged on stronger underwriting guidelines, KYC norms and constructing confidence measures with banks. Partnering with 5 different NBFCs in FY25 additionally decreased over-reliance on one entity.

The RBI crackdown additionally helped clear the air round opaque digital lending guidelines, permitting the fintech large to focus extra on high quality over amount – a method that paid dividends when rivals like Paytm and MobiKwik shut a lot of their merchandise.

BharatPe’s Subsequent Leap: Whereas lending drives progress, BharatPe has broader long-term ambitions. The corporate is carefully watching debates round a possible return of the service provider low cost fee for UPI funds, which may unlock new income streams however at steep prices. It additionally desires to develop holistically slightly than being seen as a one-dimensional digital lender.

As of now, BharatPe has cleared the essential profitability checkpoint, and right here’s how the fintech large fared in FY25.

From The Editor’s Desk

The Trump Tariff Chill: Business insiders see the tariffs having a direct bearing on IPO-bound startups that derive a big portion of their income from exports to the US. Moreover, an lively tariff struggle may sluggish funding and result in valuation corrections.

Truemeds Nets $85 Mn: The digital pharmacy has closed its Sequence C spherical, which noticed participation from Accel, Peak XV Companions, and others. The spherical additionally included a $20 Mn secondary deal, which noticed some early buyers taking an exit.

BlueStone IPO Day 1: The omnichannel jewelry model’s IPO was subscribed 39% on the primary day of bidding, receiving bids for 63.9 Lakh shares in opposition to 1.6 Cr shares on provide. QIBs led the present, inserting orders for 50.8 Lakh shares in opposition to 88.6 Lakh shares reserved for them.

Presolv360 Eyes $4.7 Mn: The authorized tech platform is planning to lift the funds from Elevation Capital, current backer MGA Ventures and different angel buyers. Presolv360 is an internet dispute decision platform that leverages expertise to assist its shoppers settle disputes.

EaseMyTrip Hits File Low: Shares of the net journey aggregator hit a recent all-time low of INR 8.76 in the course of the intraday buying and selling on August 11 on the BSE. The inventory has been on a decline for the reason that begin of the 12 months amid promoters dumping stakes and regulatory scrutiny.

CCI Digs Deeper Into Q-Comm: The watchdog has sought further info from AICPDF, which has accused Blinkit, Instamart and Zepto of anti-competitive practices. The watchdog is gathering proof to see if a probe is warranted in opposition to the three giants.

Graas Nets $9 Mn: The AI-powered ecommerce resolution supplier has raised the capital in its Sequence B spherical led by Tin Males Capital. Grass deploys AI brokers to supply options corresponding to marketing campaign efficiency evaluation, organising unstructured knowledge into motion and buyer assist.

Awfis’ Q1 Revenue Zooms: The listed coworking house supplier’s internet revenue zoomed over 257% to INR 10 Cr in Q1 FY26 from INR 2.8 Cr within the year-ago quarter. In the meantime, working income zoomed 30% YoY to INR 334.7 Cr in the course of the interval underneath assessment.

Inc42 Startup Highlight

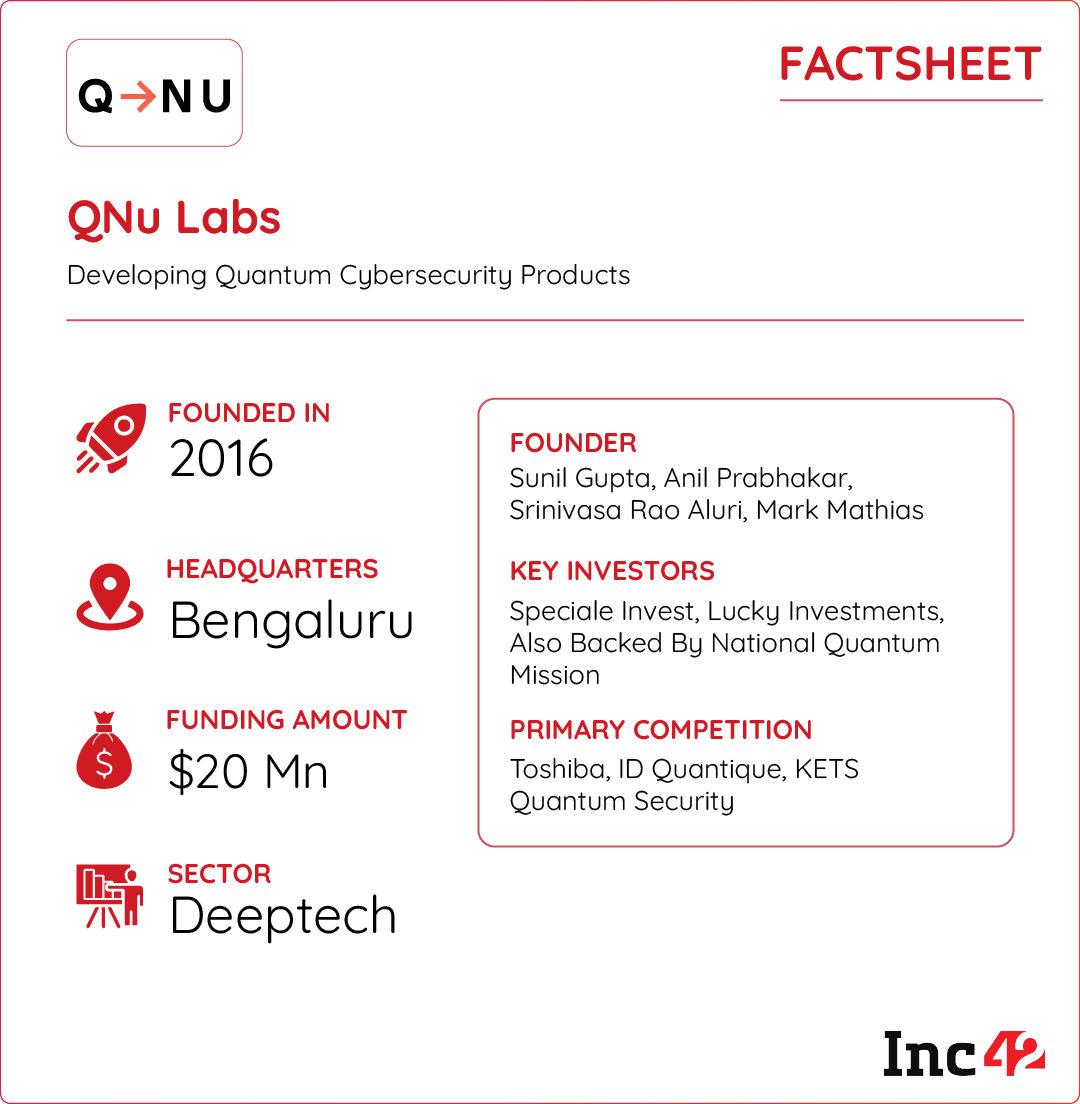

Can QNu Supercharge India’s Quantum Leap?

Quantum computing’s eventual arrival may break right this moment’s encryption in minutes, exposing delicate knowledge to malicious actors. Stopping India’s $1 Tn digital financial system from falling prey to superior cyberattacks, QNu is ushering in a brand new period of quantum computing within the nation.

The Quantum Help: Based in 2017, QNu Labs specialises in quantum cryptography and encryption options. Whereas its Armos providing makes use of quantum mechanics to create and securely distribute cryptographic keys over optical fibre networks, Tropos generates really random numbers utilizing quantum processes to bolster encryption.

QNu additionally presents post-quantum cryptography (Hodos) options for defence, enterprises, satellites, drones, and wi-fi networks.

Decrypting QNu’s Prospects: As the worldwide quantum financial system is projected to develop to a dimension of $4.89 Bn by 2029, QNu’s patented options, early market entry, and growth into chip-based, smaller-form-factor merchandise place it properly for international demand.

What’s On The Horizon? To date, QNu has raised practically $20 Mn, arrange India’s first quantum lab for the armed forces, and posted INR 24 Cr in FY24 income. Going ahead, it plans to focus closely on scaling up tech stack and constructing chips with decreased kind issue.

Whereas profitability is distant, can QNu’s quantum-safe imaginative and prescient make it India’s first international cybersecurity large?

[ad_2]