At the same time as digital lending in India goes by means of a transition section with shrinking revenues for main lending apps, Mumbai-based Kissht

By the way, the corporate goes into the IPO run with a decline in income within the earlier fiscal 12 months, regardless of working an NBFC-led mannequin. Consequently, there can be loads of give attention to whether or not Kissht’s lending enterprise can proceed to indicate excessive profitability even after the IPO.

The timing of the proposed difficulty is on Kissht’s facet — it comes amid optimistic market sentiment and forward of the DRHPs of its greater rivals corresponding to Navi Finserv, Fibe, and Kreditbee, all of whom are getting ready for their very own public listings.

Towards this backdrop, we determined to take a more in-depth take a look at how well-positioned Kissht is for a clean market debut.

Backed by marquee names corresponding to Vertex Ventures, Endiya, Alteria Capital, and cricketer Sachin Tendulkar, amongst others, the startup has initiated regulatory proceedings to go public after a decade of constructing its enterprise in lending, which at present has about INR 4,100 Cr asset underneath administration (AUM).

Stories doing rounds earlier this 12 months hinted at nearly an INR 2,000 Cr providing, however as per its draft papers, Kissht is elevating INR 1,000 Cr in recent funds.

From Unsecured Loans To Secured Lending

Kissht’s enterprise empire is constructed on unsecured lending, the section through which the Reserve Financial institution of India (RBI) elevated danger weightage in November 2023, main to an enormous outcry throughout the lending tech ecosystem.

Paytm confronted a tough time following the incident, ZestMoney shut down, whereas many different corporations needed to begin pivoting or decrease publicity to this section. Even the likes of MobiKwik have seen digital lending income shrink and the main focus has turned to different segments.

The RBI’s elevated scrutiny on unsecured loans began after a number of complaints in opposition to digital lending apps, which frequently resorted to malpractices to get better loans from prospects. At this time, the business is regularly shifting in direction of service provider loans and secured loans.

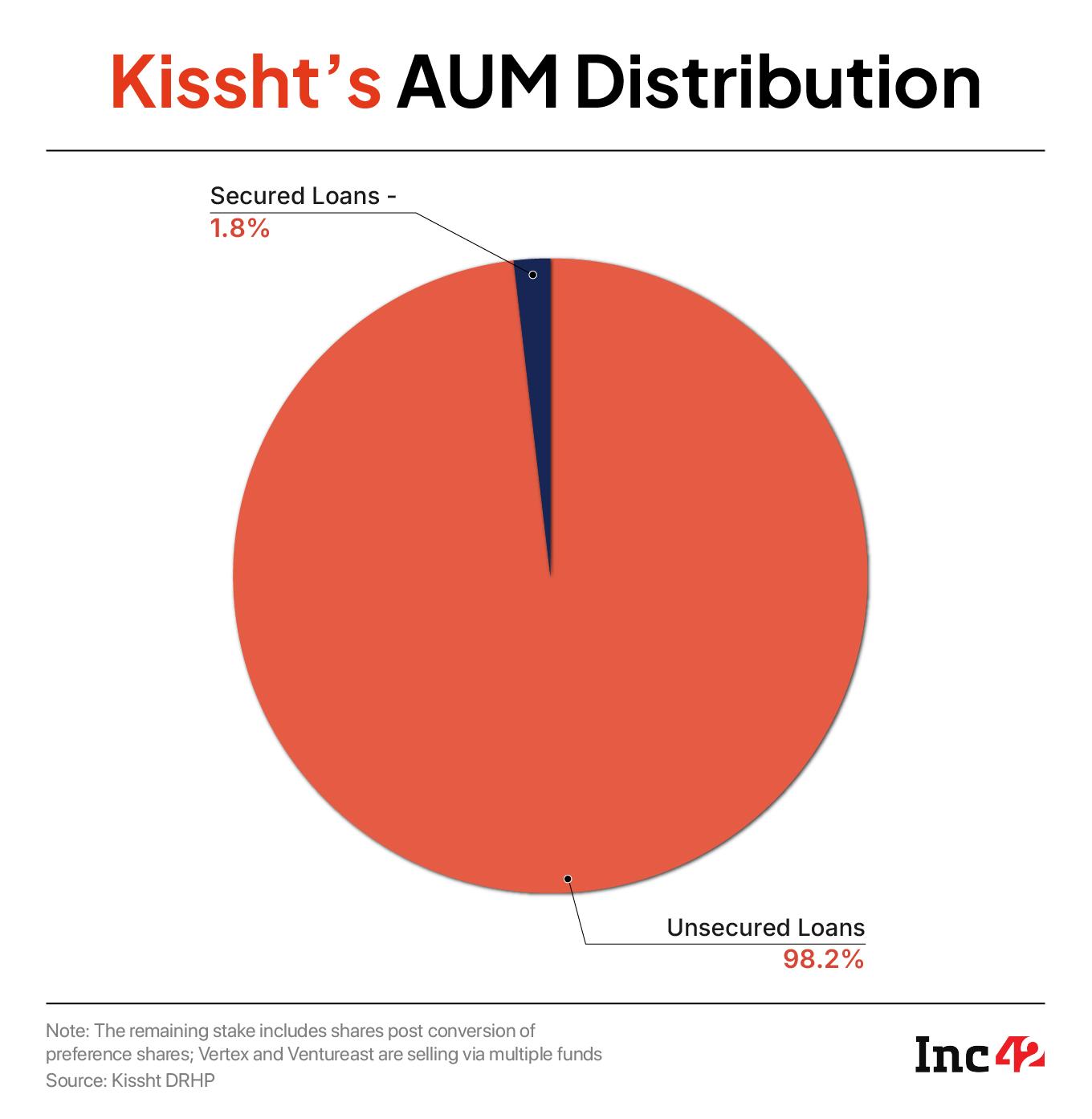

Nevertheless, Kissht’s unsecured private lending in the present day contributes to 98% of its AUM (as of FY25). This explains the income shrinking to some extent.

The corporate goals to channelise INR 750 Cr from the IPO proceeds to reinforce the capital base Si Creva, which is Kissht’s NBFC arm. Private loans are disbursed by means of Si Creva, which alone includes greater than 60% of Kissht’s whole AUM, and different NBFC companions.

Apart from private loans, Kissht has added secured loans by means of loans in opposition to property (LAP) within the This autumn FY24, however this contributed to lower than 2% to its whole AUM in FY25.

Kissht has a hybrid mannequin providing a bodily expertise and at present gives LAP by means of 62 branches throughout six states and one union territory.

Whereas it’s fairly clear that Kissht is making an attempt to make a transition from unsecured to secured lending house, which might be important for the corporate’s future development, it continues to have a major publicity to the unsecured loans section.

Third-party NBFCs comprise 39.4% of Kissht’s AUM at present, however going ahead, Kissht would wish to scale back this share and earn extra by straight lending by means of Si Creva, the place it’s trying to pump a majority of the funds raised within the IPO.

There are two crimson flags at Si Creva, although, together with an Enforcement Directorate (ED) discover from 2023 and a earlier classification of the entity as a ‘Excessive Threat Monetary Establishment’ by the Monetary Intelligence Unit of the central authorities. It’s not clear whether or not the NBFC has steered clear of those compliance and potential authorized roadblocks.

What’s Hurting Kissht’s Profitability?

Regardless of a slowdown within the unsecured lending house, Kissht AUM by way of its NBFC continued to develop. As per its DRHP, Si Creva sanctioned loans value INR 252.4 Cr within the final monetary 12 months (FY25), which grew 68% year-on-year (YoY).

Nevertheless, its whole AUM development slowed to 56.92% YoY in FY25 in comparison with 105% YoY within the earlier 12 months.

As of March 31, 2025, the corporate acquired 53.23 Mn registered customers and served 9.16 Mn prospects. Nevertheless, Kissht’s earnings have diminished within the final fiscal 12 months.

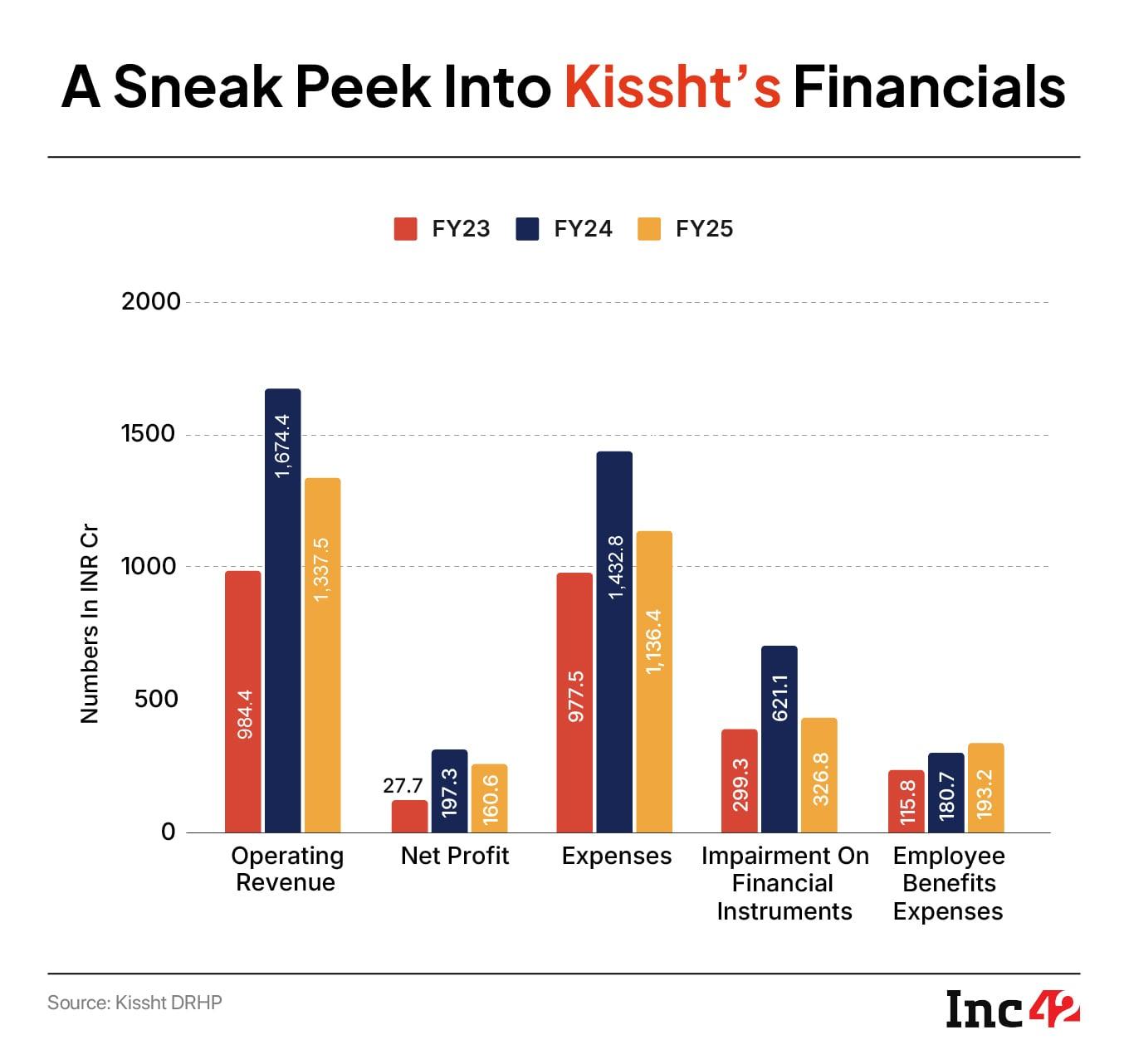

Its working income fell over 20% to INR 1,337.47 Cr in FY25 from INR 1,674.45 Cr in FY24 because the earnings from curiosity on loans crashed.

Consequently, the underside line additionally took a success. Kissht’s internet revenue was down 18.6% to INR 160.62 Cr in FY25 from 197.29 Cr within the earlier fiscal 12 months.

After rising 70% YoY by way of income in FY24 and a whopping 613% YoY development in income, this was a disappointing fiscal 12 months for the corporate.

Kissht has straight cited its AUM development slowdown for the income decline. From short-term lending at excessive rates of interest, that are normally large income drivers, it’s shifting to longer tenured loans.

“Now that the corporate is switching and altering that enterprise mannequin, from short-term loans to digital LAP, its income has taken a success,” stated a digital lending startup exec requesting anonymity, given Kissht’s DRHP is now underneath regulatory scrutiny.

What’s worrisome is that income have plummeted simply as a lot because the income. On this context, it’s additionally pertinent to notice that Kissht’s write-offs have additionally elevated. It wrote off INR 438 Cr of economic property within the final fiscal, which rose from INR 349 Cr in FY24 and INR 258 Cr in FY23.

The corporate’s anticipated credit score loss in opposition to normal property stood at INR 165 Cr in FY25, and internet money stream worsened to a unfavourable INR 661.4 Cr from unfavourable INR 637.4 Cr in FY24.

As a BFSI firm, Kissht would want to indicate strong and sturdy fundamentals to face out for buyers. Constructive money stream is a extremely necessary metric, and right here Kissht must do loads of work to show to buyers that it will probably flip issues round.

If and when the corporate releases its pre-IPO RHP after the SEBI approval, these questions can be answered to a sure extent as that would come with additional disclosures.

The Digital Lending Pink Flags

There are a number of areas the place Kissht may stumble in its path to going public, in addition to its earnings slowdown. This contains the case led by ED underneath the Prevention of Cash Laundering Act in addition to different crimson flags in its NBFC enterprise.

Whereas Kissht stated that it has not obtained any additional communications from the ED since submitting the responses, it additionally talked about that there are potentialities of future inquiries into the matter, which “might escalate to investigations, authorized proceedings or any potential penalties”.

For corporations which can be regulated entities underneath the RBI, checks and balances are accomplished by two regulatory authorities: SEBI and RBI, earlier than they get listed. In actual fact, Kissht has clearly disclosed that it’s uncovered to common inspection by the central financial institution.

Ayush Mohata, associate of capital markets workforce at Khaitan & Co, stated that in such cases, SEBI sometimes all the time writes to the related sectoral regulator (RBI on this case) to hunt their suggestions/considerations on the IPO-bound entities, and to test whether or not there are any excellent regulatory actions or investigations pending pertaining to the entity and related individuals, earlier than the market regulator provides clearance for the IPO.

In the meantime, Kissht additionally operates in a really dangerous space the place it has to stroll the tight rope of buying and retaining prospects in a extremely aggressive lending market whereas abiding by the authorized and moral practices.

Whether or not it’s Kissht or different lending gamers, it’s not a hidden secret that these corporations typically embrace darkish patterns in buyer acquisition and mortgage restoration processes. From Reddit to X, there are hoards of consumer complaints even in the present day in opposition to Kissht pointing at recurrent consumer harassment.

In actual fact, in 2020, the Andhra Pradesh Police and Crime Investigation Division (CID) deemed Kissht, amongst 29 others together with Straightforward Mortgage, Fortune Bag, Rupee Mortgage, Udhaar Mortgage, Robo Money, CashTM, Fast Money, as ‘problematic’ for a number of complaints associated to consumer harassment.

In 2023, Kissht was additionally among the many 94 mortgage apps banned that have been banned by the Ministry of Electronics and Info Know-how (MeitY) for alleged China hyperlinks, which was revoked after a number of months.

Clearly, Kissht and a few of its new-age rivals have repeatedly come underneath the scanner for his or her alleged affiliation with unlawful actions. Regardless of that, India’s digital lending market has boomed over the previous few 12 months and continues to develop, Kissht has continued to boost funding (greater than $140 Mn raised in whole), roped in a star determine like Sachin Tendulkar as investor and model ambassador in 2024, and is now headed for the general public market.

Will Kissht Persuade Buyers?

Regardless of the above dangers and operational challenges, it goes with out saying that Kissht operates in a profitable market. Inc42’s report means that the nation’s digital lending alternative will attain $1.3 Tn by 2030 from $402 Bn in 2024, comprising 60% of the whole fintech market.

As per one other report, as talked about in Kissht’s DRHP, digital lending throughout the mass market section is projected to surge 7X to INR 4,100 Cr by FY30, rising at a 48% CAGR from FY25, outdoing the expansion of typical gamers.

In actual fact, although there are legacy rivals like Bajaj Finserv, Cholamandalam, HBD Monetary Providers, amongst others, with a lot increased AUM and income in comparison with Kissht, the latter’s AUM development fee between FY23-25 has been increased than the remaining.

Nevertheless, the true main competitors the corporate faces is from the opposite new-age gamers like Kreditbee (which crossed INR 2,000 Cr in income whereas revenue jumped 66% in FY25), Fibe (which has a lot decrease rates of interest in comparison with Kissht and in addition gives loans to salaried professionals), and Navi Finserv (additionally has increased income in comparison with Kissht).

“Kissht’s IPO units the stage for greater NBFCs and digital lending gamers which can be additionally mulling their IPOs within the coming months. If the market is prepared for a mid-sized IPO like this, by the point it’s listed, I believe the massive mutual funds and different public market buyers can have extra confidence for the following degree and larger gamers coming in,” stated the founder at one other IPO-bound digital lending platform, requesting anonymity, citing the sensitivity of the matter.

For example, final 12 months, a lot of NBFCs began getting listed. Following that surge, when HDB’s IPO occurred, there was no dearth of subscriptions regardless of it being one in all India’s largest IPOs up to now. Nevertheless, there appears to be a sudden change within the NBFC IPO trajectory after a sudden surge.

Sourav Choudhary, MD at Raghunath Capital, famous that NBFC IPOs are taking a flip: from euphoria to selectivity.

“The market temper has cooled, however that is much less a slowdown and extra a shift in direction of high quality. Buyers at the moment are wanting past development tales, specializing in steadiness sheet power, governance, and sustainability.”

Choudhary additionally believed that Kissht’s DRHP submitting captures this variation. “The corporate has constructed a robust digital lending platform, however with slowing disbursements and softer income, the IPO will check how fintech-NBFCs are valued in in the present day’s extra discerning market.”

For now, the choice is on SEBI. However, as the general public market buyers get selective, and scale, governance and fundamentals proceed to command higher demand, Kissht has much more to do to persuade buyers.

[Edited by Nikhil Subramaniam]

[ad_2]