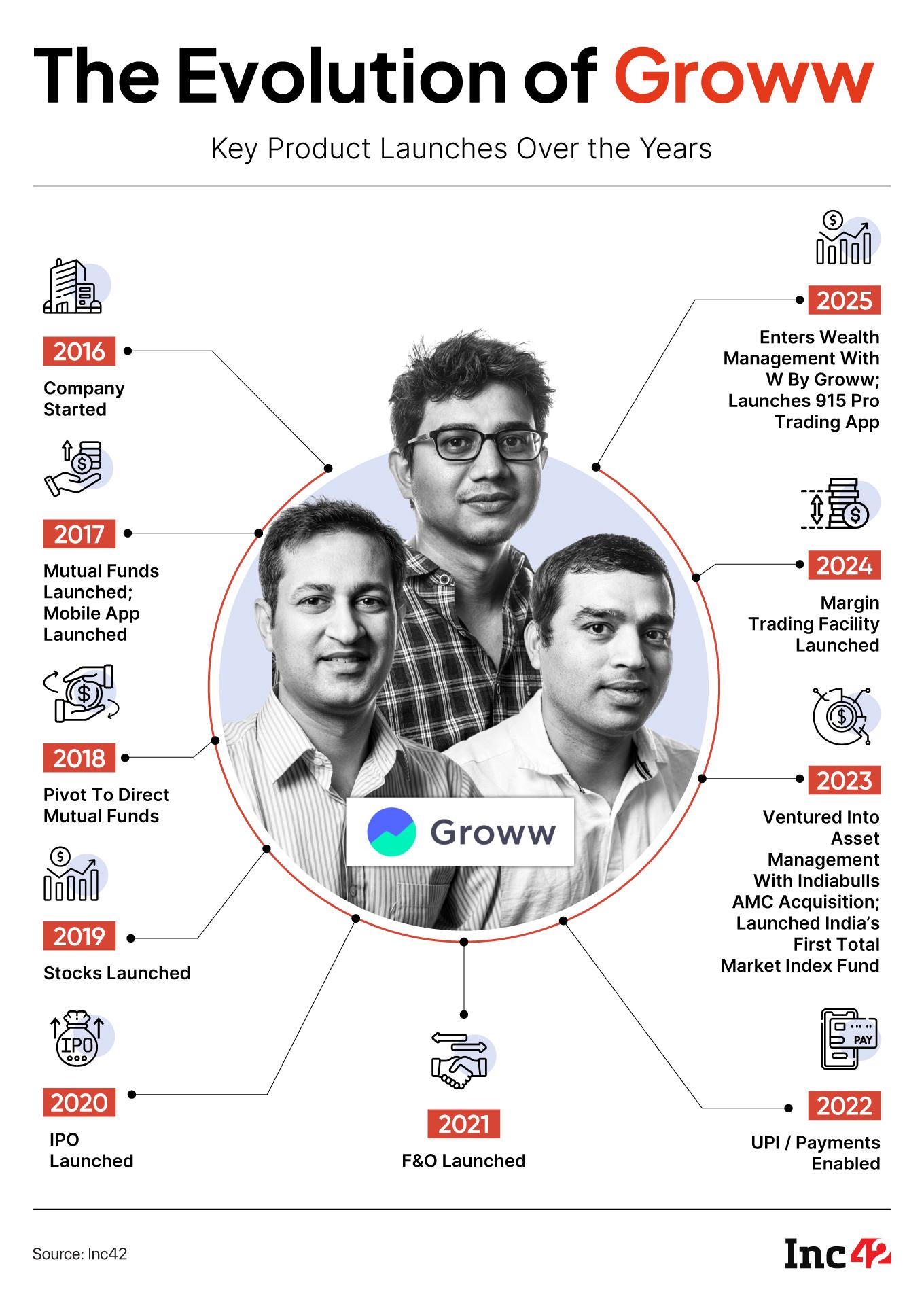

For years, the Groww

It was a technique that paid off handsomely, catapulting the Bengaluru-based unicorn previous its arch-rival Zerodha in lively consumer numbers and setting it on a seemingly unstoppable march in the direction of a blockbuster IPO. With over 1.5 Cr customers, INR 1,819 Cr in revenue for FY25 and a recent $200 Mn within the conflict chest, Groww appears to be like set for a bumper public itemizing.

However curiously, now there’s a change in Groww’s tune. It’s focussing on professional merchants and HNIs with new merchandise which might be distinctly totally different from what made Groww such a giant model identify in India. What does this imply for the funding tech large?

Let’s attempt to reply this however first a have a look at the highest tales from our newsroom this week:

- The Inventory Broking Gold Rush: With income from digital lending beneath stress on account of stringent norms, fintech startups are inventory broking to spice up engagement and high line. From JFS to MobiKwik and CRED, competitors is lining as much as tackle Zerodha and Groww

- India’s Deeptech Quandary: The Centre’s Analysis Growth and Innovation (RDI) scheme earlier this month gave the deeptech ecosystem a sigh of reduction, however behind closed doorways, VCs and startups are famished for readability

- Lenskart’s XR Imaginative and prescient: Lenskart is about to foray into the good glasses and XR units house and is altering its DNA for the subsequent section of its journey because it nears an IPO, however that is an altogether totally different ballgame than making spectacles and sun shades. Will Lenskart be capable of see this by way of?

Trying Past Retail Traders

So far, Groww’s story has been outlined by profitability and fast development; the subsequent chapter, notably the diversification push by way of the wealth administration and professional buying and selling platforms, would possibly throw up a problem or two.

For Groww, the sport is now not nearly democratising investing for the lots; it’s about chasing greater fish within the funding pool.

The IPO-bound fintech large is orchestrating a calculated transfer, designed to enhance its income past the fiercely aggressive, and infrequently fickle, retail section.

This isn’t nearly including just a few new options. In some ways, it’s a elementary shift in the direction of courting area of interest, high-value prospects: the skilled, high-volume merchants and the ultra-rich high-net-worth people (HNIs).

This diversification is the secret, a direct response to the pressures of a maturing, highly-competitive market and the ever-present want to indicate development.

The massacre on the inventory exchanges in early 2025, which noticed each Groww and Zerodha witness a major erosion of their lively consumer base, served as a stark reminder of the vulnerabilities of relying too closely on fair-weather retail buyers.

When the market corrects, the exercise from this section drops. This phenomenon, as Zerodha’s Nithin Kamath admitted, led to a 30% lower in exercise throughout brokers and prompted the primary enterprise degrowth for his firm in 15 years. For an IPO-bound firm like Groww, such volatility is a legal responsibility.

Groww’s Want For Diversification

The reply, it appears, is to construct new verticals. First, there’s the launch of ‘915’, a standalone, web-based platform constructed in-house particularly for skilled and high-volume merchants.

Providing superior instruments like historic straddle charts and customisable dashboards, ‘915’ is a transparent sign that Groww is shifting past its easy, user-friendly mantra to cater to a extra refined, demanding clientele. It is a transfer to shore up revenues, particularly as SEBI tightens the screws on F&O buying and selling for retail buyers, a key income supply for a lot of brokerages.

The second, and maybe extra vital, prong of this technique is a full-fledged leap into wealth administration. Groww has additionally launched ‘W’ to supply Portfolio Administration Companies (PMS) and Various Funding Funds (AIF) to its prosperous customers. This isn’t a tentative step; it’s a strategic invasion of a territory historically dominated by banks and specialised corporations.

To bolster this ambition, Groww has made a major transfer by buying wealthtech startup Fisdom in an all-cash deal valued at round $150 Mn. Fisdom brings not solely its experience but additionally established partnerships with 15 nationwide and regional banks, offering a ready-made launchpad for Groww’s HNI ambitions.

The corporate plans to construct an omnichannel, bodily presence, recognising that high-value transactions require a human contact—a degree of belief {that a} purely digital interface won’t command.

How will Groww’s course be formed by this omnichannel technique?

Competitors Bearing Down

Groww’s core id will not be in danger, however these new verticals do push Groww right into a dichotomy. For years, Groww has been generally known as the pleasant funding app, simplifying the jargon-filled world of investing, educating buyers on making the proper selections.

Now, it’s additionally constructing unique, high-end suites for the monetary elite or rich people. The problem is immense: how do you create a bridge on your prospects to maneuver from a easy SIP to a posh AIF, or from an informal inventory buy to a high-frequency buying and selling setup, with out being seen as pushing them?

That is the place the shadow of Zerodha looms massive. Zerodha has constructed its model on a really public philosophy of not nudging customers to commerce extra.

For brand spanking new-age fintech startups, the true threat to larger digital gamers like Zerodha and Groww isn’t only a large consumer decline, however shrinking engagement as new gamers fragment consumer consideration. The problem is to adapt to a post-derivatives world—the place long-term investing, advisory providers, and experience-led loyalty will matter greater than uncooked buying and selling quantity.

Groww’s new technique places it on a direct collision course with this ethos. By constructing these refined new verticals, Groww is creating highly effective inner pathways to upsell and cross-sell. There’s immense strain to information its 1.5 Cr-strong consumer base in the direction of these new, extra profitable choices.

How does an organization that educated the lots in regards to the dangers of the market now entice them into the higher-stakes sport {of professional} buying and selling and wealth administration with out overexposing them to threat? This tightrope stroll will take a look at the corporate’s moral compass and its product design philosophy.

There’s additionally the matter of the general public itemizing. The confidential route for IPO submitting has created some intrigue. It permits Groww to manage the narrative, to current its financials at a most popular time, and to protect its strategic shifts from the prying eyes of opponents who’re additionally gunning for a bit of the wealthtech pie. However this secrecy solely delays the inevitable public scrutiny.

Ultimately, the market will demand solutions. Like whether or not Groww can seamlessly combine its previous — focusing on Indians in cities and hinterlands — with its new wealth administration {and professional} buying and selling ambitions and monetising the consumer base.

There’s no motive to panic, after all. Corporations undergo this trajectory on a regular basis and generally, it’s a needed evolution. Groww has not proven any indicators of dealing with such modifications badly up to now.

It’s positively an fascinating problem to unravel and a vital time from a contest viewpoint within the funding tech ecosystem.

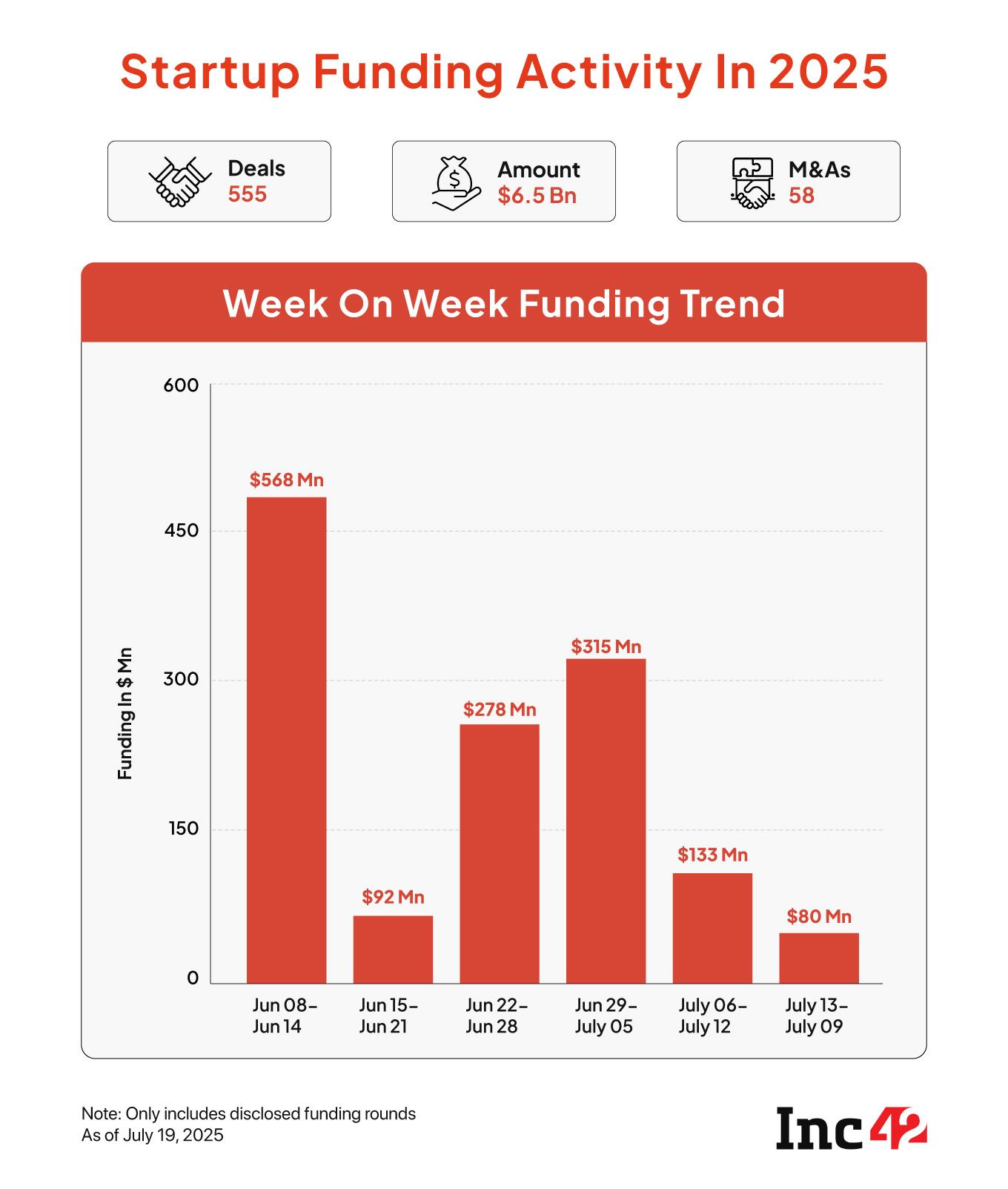

Sunday Roundup: Startup Funding, Pivots And Extra

- Weekly Funding Down: Between July 14 and 19, startups raised $79.7 Mn throughout 21 offers, down 40% from the $132.9 Mn secured by 17 startups within the previous week

- Insurgent Shake-Up: In a serious top-level reshuffle, IPO-bound cloud kitchen unicorn Insurgent Meals has elevated cofounder and India CEO Ankush Grover to the publish of world CEO

- Zepto Cafe Takes A Backseat: The fast commerce main is cutting down its 10-minute meals supply service on account of provide chain points and employees scarcity, after already shutting down 44 cafes final month

- Will MDR Tide Carry All UPI Apps? Fintech stakeholders have been lobbying the Centre to cost MDR on massive retailers for transactions above INR 2,000. However, who amongst high fintech gamers will profit probably the most from the potential regime?

- Blinkit’s Stock-Led Pivot: The Everlasting-owned fast commerce main will change to the brand new mannequin, however what does this imply for Blinkit and the 1000’s of sellers on its platform?

[ad_2]