This text has been contributed by Neeraj Gupta, GM-PeX Head World (India/Africa), Bharti Airtel Ltd

Reflecting on my 17 years within the Indian telecom finance area, the transformation has been nothing wanting breath-taking. I started my profession in an period of paper ledgers/Tally and guide reconciliations, the place the sheer scale of our operations was a continuing, looming problem. Right now, I lead finance groups in a world pushed by knowledge, automation, and intelligence the place expertise is not only an enabler however the basis of our operate.

The monetary complexity of the telecom sector is exclusive. It’s a high-volume, capital-intensive {industry} the place billions of {dollars} circulate by way of our techniques day by day. We course of hundreds of thousands of buyer recharge transactions, handle advanced settlements with an unlimited community of channel companions, and account for an enormous base of mounted belongings. In India, with a cell tower wanted each 300 meters or much less in dense city areas post-5G, our mounted asset register incorporates over 150 million particular person belongings.

On this surroundings of utmost quantity and velocity, leveraging expertise shouldn’t be an possibility; it is the one manner to make sure effectivity, accuracy, and compliance. The catalysts for the present revolution are Synthetic Intelligence (AI) and Robotic Course of Automation (RPA) and different rising applied sciences , that are reshaping finance from a reactive, back-office price middle right into a proactive, strategic accomplice to the enterprise.

Nevertheless, the journey isn’t a easy plug-and-play affair. It started with fundamental RPA dealing with repetitive, rule-based duties, which delivered fast wins. However many organizations hit a plateau, discovering it tough to establish new high-ROI alternatives. The important thing to unlocking sustained worth lies not within the expertise itself, however within the strategic determination to embed AI inside a broader agenda of elementary course of transformation.

Redefining Income: From Reconciliation to Intelligence

One in every of our best historic challenges was reconciling hundreds of thousands of day by day buyer recharges throughout our ERP, billing, and banking techniques—a course of fraught with the chance of income leakage and fraud. To sort out this, we pioneered an industry-first AI-based reconciliation engine. The outcomes have been unbelievable: we achieved huge manpower effectivity and established real-time fraud alerts that prevented vital monetary losses.

That was just the start. The following wave of expertise is shifting us from reconciling the previous to actively predicting the longer term.

- Predictive Income Assurance: Fashionable AI and machine studying (ML) frameworks, reminiscent of these provided by AWS, Subex, and Neural Applied sciences, now use unsupervised studying to research huge knowledge streams in real-time, detecting refined anomalies and new fraud patterns that rule-based techniques would miss.

- Smarter Money Move: ML platforms can scrutinize historic fee knowledge and buyer conduct to foretell which prospects are prone to pay late, forecast Days Gross sales Excellent (DSO) with excessive accuracy, and suggest efficient assortment methods from reactive assortment to predictive forecasting. This transforms the AR workforce right into a strategic driver of working capital.

- GenAI for Communications & Dispute Decision: Generative AI is revolutionizing buyer interactions. For example, Billtrust’s GenAI-powered e-mail assistant for collectors has reduce the typical e-mail response time from eight minutes to only two and a half.

The AR division is not simply closing the books; it’s turning into a strategic intelligence hub, offering forward-looking insights into money circulate, buyer monetary well being, and danger.

How Synthetic Intelligence Is Remodeling Enterprise

Synthetic Intelligence is a essential issue within the technique of those that need to broaden their enterprise affect on this digital period to make a win.

Taming the Beast of Clever Asset Administration

The size of our mounted belongings is tough to understand—our register exceeds 150 million belongings and 30 GB of knowledge. Managing this portfolio with out superior expertise could be not possible. The muse for contemporary asset administration is a strong, cloud-based ERP system. A landmark instance is Vodafone’s migration of its colossal SAP system to Google Cloud, a transfer that yielded multi-million Euro financial savings and vital efficiency boosts.

- The Rise of the Digital Twin and IoT: The following frontier is connecting the bodily asset to its digital document within the ERP in real-time. IoT (Web of Issues ) sensors deployed on essential belongings like cell towers can monitor every part from vitality consumption to structural integrity, streaming stay knowledge to the cloud. This knowledge, mixed with drone imagery, permits for the creation of a “digital twin” a dynamic digital duplicate of a bodily tower. Utilizing this twin, engineers can remotely monitor an asset’s well being and simulate the affect of including new tools with out a bodily web site go to.

- AI-Powered Predictive Upkeep: This convergence of knowledge permits essentially the most vital leap ahead: predictive upkeep. As a substitute of reacting to failures, main worldwide operators are already utilizing AI to forecast community failures, cut back downtime, and decrease operational prices. The finance workforce should now work hand-in-glove with community operations, breaking down historic silos and making the CFO’s position extra operationally built-in than ever earlier than.

Automating the Engine Room: The Evolution of Accounts Payable

In my very own expertise, one among our most impactful early automation initiatives was in Accounts Payable.zWe confronted a relentless inflow of invoices. By implementing RPA with OCR and ML, we achieved quicker processing, lowered errors, and boosted vendor satisfaction. Right now, the market has advanced to complete, that handle your complete bill lifecycle—from clever knowledge seize and automatic validation to good approvals and embedded fraud detection, slashing course of time by as much as 70%.

The following frontier is Agentic AI, which might independently question a vendor a few mismatched bill and suggest a decision, liberating up finance professionals for really strategic work.

The worth of AP automation creates a constructive impact throughout the enterprise. It extends far past the finance division’s P&L. Environment friendly, error-free bill processing results in dependable, on-time funds. This strengthens vendor relationships, giving the procurement workforce higher leverage to barter higher phrases and safe early fee reductions.

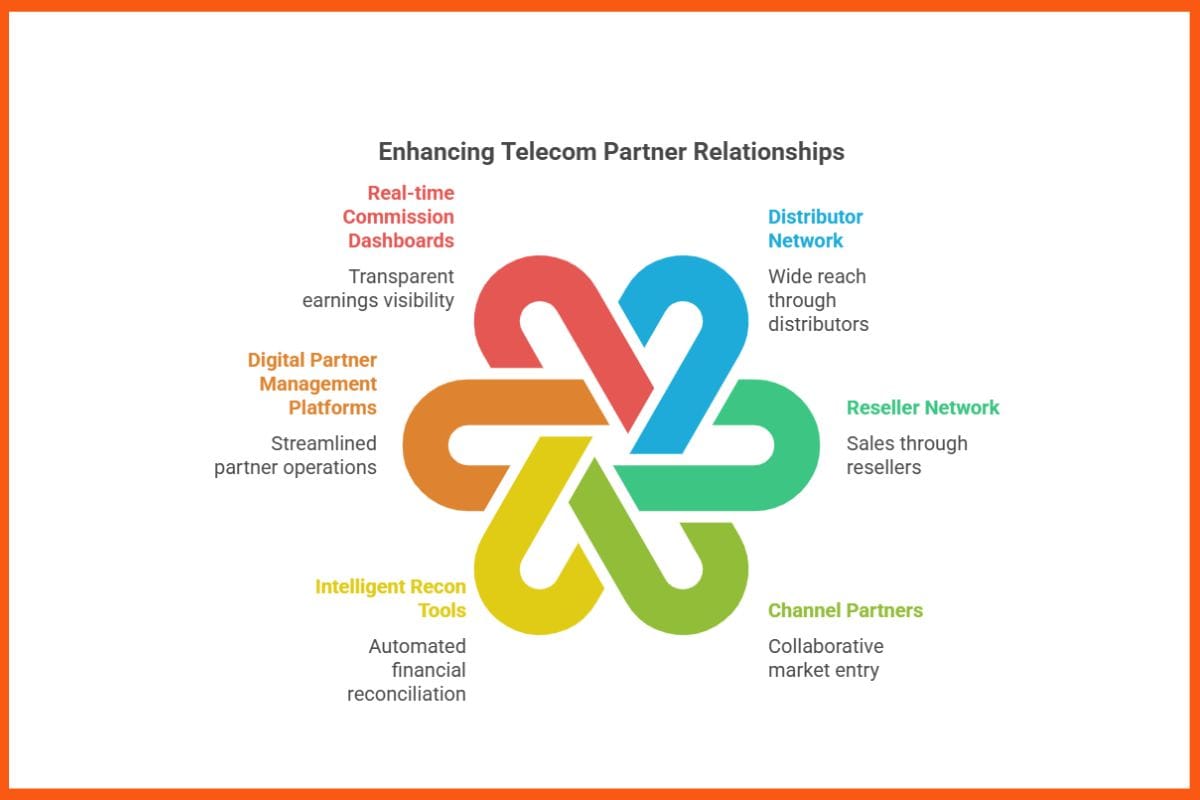

Streamlining the Associate Ecosystem: Buyer & Channel Accounting

For a telecom operator, our huge community of distributors, resellers, and channel companions is a essential path to market. This effectivity extends to the advanced world of channel accomplice finance. Clever Recon instruments, Fashionable Digital Associate Administration platforms automate every part from accomplice onboarding to the settlement of intricate revenue-sharing fashions. A persistent ache level for companions is a scarcity of visibility into their earnings; new techniques now present real-time fee calculations by way of devoted dashboards. In a aggressive market, a monetary relationship constructed on velocity and transparency turns into a key differentiator to draw and retain the very best companions.

Navigating the Maze: Know-how in Taxation, Compliance, and Reporting

The regulatory panorama is a fancy maze. Our preliminary steps in automating GST compliance and related-party disclosures have paved the best way for a extra built-in method to tax, compliance, and reporting.

- TaxTech: Our journey started with a cloud-based instrument to handle GST compliance. For an organization of our scale, manually dealing with the intricacies of the GST regime, reconciling GSTR-1A and 2B, managing enter tax credit, and inserting vendor fee holds primarily based on submitting standing, is solely not possible. These obtainable cloud obtainable who provide direct API integration with authorities portals and ERP techniques, automating tax calculations and filings.

- Governance, Compliance, and the Rise of RegTech: Legacy GRC techniques, born from rules like SOX, buried finance groups in a flood of “false constructive” alerts. Right now, AI-powered RegTech is flipping the mannequin from reactive to proactive. As a substitute of reactive, Steady Management Monitoring (CCM) analyzes 100% of transactions in real-time. System-Primarily based Monetary Delegation of Authority (FDoA) strikes past static coverage paperwork, embedding and actively imposing approval guidelines immediately inside core monetary techniques. In the meantime, clever doc evaluation combines AI and OCR to identify refined bill fraud that rule-based checks would miss. This shift transforms compliance from a loud, reactive price middle into an clever, proactive defend, permitting human consultants to concentrate on strategic danger as an alternative of chasing ghosts within the machine.

- AI-Pushed FP&A: The following evolution in reporting is AI-driven Monetary Planning & Evaluation (FP&A). Fashionable platforms like Anaplan and Oracle Cloud EPM permit groups to mannequin a whole lot of potential enterprise situations in seconds and generate extra correct, rolling forecasts that constantly be taught from new knowledge. A revolutionary characteristic is pure language interplay; a CFO can now ask a dashboard in plain English, “What was our gross margin development final quarter?” and obtain an prompt reply, democratizing knowledge entry and accelerating decision-making.

Total Abstract

The next desk gives a roadmap of this transformation throughout the important thing verticals of telecom finance, which we mentioned and outlining the journey from conventional challenges to the worth unlocked by next-generation expertise

The Unstated Prerequisite: Course of Earlier than Know-how

Essentially the most essential lesson from my 17 years is that this: expertise utilized to an inefficient course of will solely enlarge the inefficiency. The successes I’ve witnessed weren’t simply expertise initiatives; they have been enterprise transformation initiatives. We did not simply purchase an AI engine; we essentially redesigned your complete workflow from the bottom up.

This process-first philosophy is the unstated prerequisite for achievement. Analysis by BCG discovered that embedding AI initiatives right into a broader transformation agenda will increase the likelihood of success considerably. The best returns come from eliminating redundant steps, not simply making present ones quicker.

Conclusion: The Daybreak of the Autonomous Finance Operate

Throughout telecom finance, a profound transformation is underway. AR is now a predictive income hub, asset administration is an clever, real-time operate, and reporting is a dynamic, forward-looking dialogue. The convergence of AI, RPA, and specialised cloud functions is dissolving conventional silos, paving the best way for the last word aim: the Autonomous Finance Operate.

Sooner or later, Agentic AI will deal with advanced exceptions, digital twins will autonomously set off monetary forecasts, and FP&A fashions will self-correct in real-time. We’re shifting past merely recording monetary historical past to an period the place we will actively predict and form our financial future. The finance skilled of tomorrow shouldn’t be an accountant, however a strategist, analyst, and knowledge scientist, empowered by clever expertise to drive worth at each flip. The revolution is right here, and it’s autonomous.

How Synthetic Intelligence has Revolutionized Advertising and marketing

Synthetic intelligence has proved in lots of ways in which its higher than conventional advertising. So, Lets have a look The way it has Revolutionized Advertising and marketing?

WIDGET: questionnaire | CAMPAIGN: Easy Questionnaire