Generics distribution and telemedicine startup Truemeds goals to bridge the accessibility hole in a market identified for low-cost generics, however dominated by costly branded medication

By slicing out advertising and medical consultant prices, it retains 50-60% margin earlier than discounting, and 20-30% after reductions, whereas nonetheless providing medicines at a lower cost

The startup banks on medicines for persistent sicknesses and plans to foray into the diagnostic area to broaden the enterprise

India, a $66.66 Bn-strong pharma big, is within the throes of a persistent sickness. Medical bills are consuming into the family price range, pushing the common Indian to shell out INR 135 in rural areas and INR 250 in cities each month, exhibits the federal government’s month-to-month consumption expenditure survey.

Why can’t India heal itself regardless of fostering the 14th largest pharma business when it comes to worth and third in volumes? It is usually the biggest provider of generic medicines, making up 20% of the worldwide provide, and persevering with to be a key participant in inexpensive vaccines.

But, greater than 1.6 Mn lives are crushed yearly within the nation due to insufficient healthcare.

A mix of excessive air pollution ranges, poor healthcare infrastructure, and restricted entry to high quality docs has closely accentuated the drug dependency in India, whereas the price of prescribed branded medication saved constructing strain on the family price range.

In India’s bustling startup economic system, this drug dependence has paved the best way for on-line medication supply platforms and what started as dwelling supply providers, has developed into the 10-minute doorstep supply of medicines.

“That’s the place we noticed the chance,” mentioned Akshat Nayyar. He arrange Truemeds

Truemeds positioned itself on the paradox of rising price of branded medicines in a market reputed for low-cost generics.

An Irony Evolves Into An Concept

Truemeds is the story of an irony fostering an concept. The founders have been colleagues in international pharma main Abbott. Collectively, they facilitated the very brand-driven ecosystem that their brainchild sought to disrupt, just a few years later.

The seeds of the concept had probably germinated when the Medical Council of India (MCI) mandated that docs ought to prescribe medication by their salt (generic) names, and never model names. The transfer was supposed to make medicines extra inexpensive and accessible.

When Nayyar was tasked to evaluate the affect of this regulatory shift on India’s retail drug market, he observed that no organised participant was focussed on bridging the affordability hole by serving to sufferers entry high quality generic options.

Though the MCI’s mandate confronted resistance from docs, the federal government doubled down on it in 2018, asking pharma corporations to print the generic names of medicine in a font as giant because the model identify. Even authorities hospitals have been directed to prescribe the salt and never the model. This regulatory nudge was squarely geared toward weakening the unholy nexus between drugmakers and docs.

Truemeds was rolled out in 2019 to bridge this hole. The platform started as a list service, permitting sufferers to match different medicines – considerably akin to Zomato’s early mannequin of restaurant discovery. However rising client curiosity rapidly pushed the founders to evolve into medication supply, immediately linking affordability with accessibility.

Sitting on the intersection of regulatory intent and client want, the startup has thus far raised over $100 Mn, together with a current $85 Mn spherical, led by Accel and Peak XV Companions. “We’re not providing the most cost effective choices on the market. What Truemeds does is it provides the fitting worth for cash whereas guaranteeing high quality,” Nayyar mentioned.

Making Cash From The Market Hole

Recognizing the market hole wasn’t sufficient, the true take a look at was execution at scale. Figuring out a less expensive substitute to a branded drug is straightforward – a Google search rapidly lists the options. The true bottleneck is in guaranteeing that lesser-known generic manufacturers really attain the patron’s doorstep.

For branded medicines, the system is well-oiled. Pharma corporations know which docs are prescribing their merchandise, distributors inventory accordingly, and pharmacies carry predictable inventories, typically with 45 days of provide readily available. This not solely ensures robust visibility for the branded medication, nevertheless it additionally establishes their dominance.

Generics, in contrast, function in a fragmented and unsure setting. Smaller producers hardly ever have visibility into demand traits, making distribution patchy and inconsistent. Because of this, even right this moment, large manufacturers management almost 88% of India’s pharmaceutical market, regardless of the supply of low-cost options, mentioned the founder.

“We instructed these smaller producers that we are going to generate demand for you, primarily based on our rising buyer base. In flip, this permits us to work with higher margins and cross worth to clients,” Nayyar mentioned.

In a typical pharma provide chain, out of an INR 100 medication, a branded drug firm retains a 60-70% margin. This accounts for heavy spending on promoting, packaging, branding, and creates room for medical representatives to push their merchandise. What trickles down is a meagre 10-15% margin that pharmacies and on-line platforms like Tata 1mg or PharmEasy make.

Truemeds flips this construction. By slicing out model advertising and medical consultant prices, the startup captures 50-60% margins earlier than discounting, and 20-30% after reductions, whereas nonetheless providing medicines at a lower cost to sufferers. This twin benefit – larger margins for Truemeds and decrease prices for shoppers – lies on the core of its working mannequin.

The truth is, Truemeds has begun displaying the size in income phrases. A greater margin profile helped it attain a topline of INR 510 Cr in FY25, making a 57% on-year surge, with a mean order worth of INR 1,000 to INR 1,500. To additional broaden the AOV and seize extra of the healthcare pockets, the startup has begun diversifying its product assortment, including nutritional vitamins, oral care merchandise like toothpaste and mouthwash, and different necessities sometimes bought from pharmacies.

“Truemeds isn’t just a fulfilment accomplice, but in addition a requirement generator and educator,” Nayyar famous.

Prescribing Blueprint For Future

For Truemeds, the most important price load is buyer schooling and acquisition. “Educating the person is our largest ache level,” Nayaar mentioned. Not like pharmacies, which depend on prescriptions to drive demand, Truemeds must persuade shoppers to shift from branded medication to generic substitutes. This required sustained advertising within the type of campaigns and consciousness constructing.

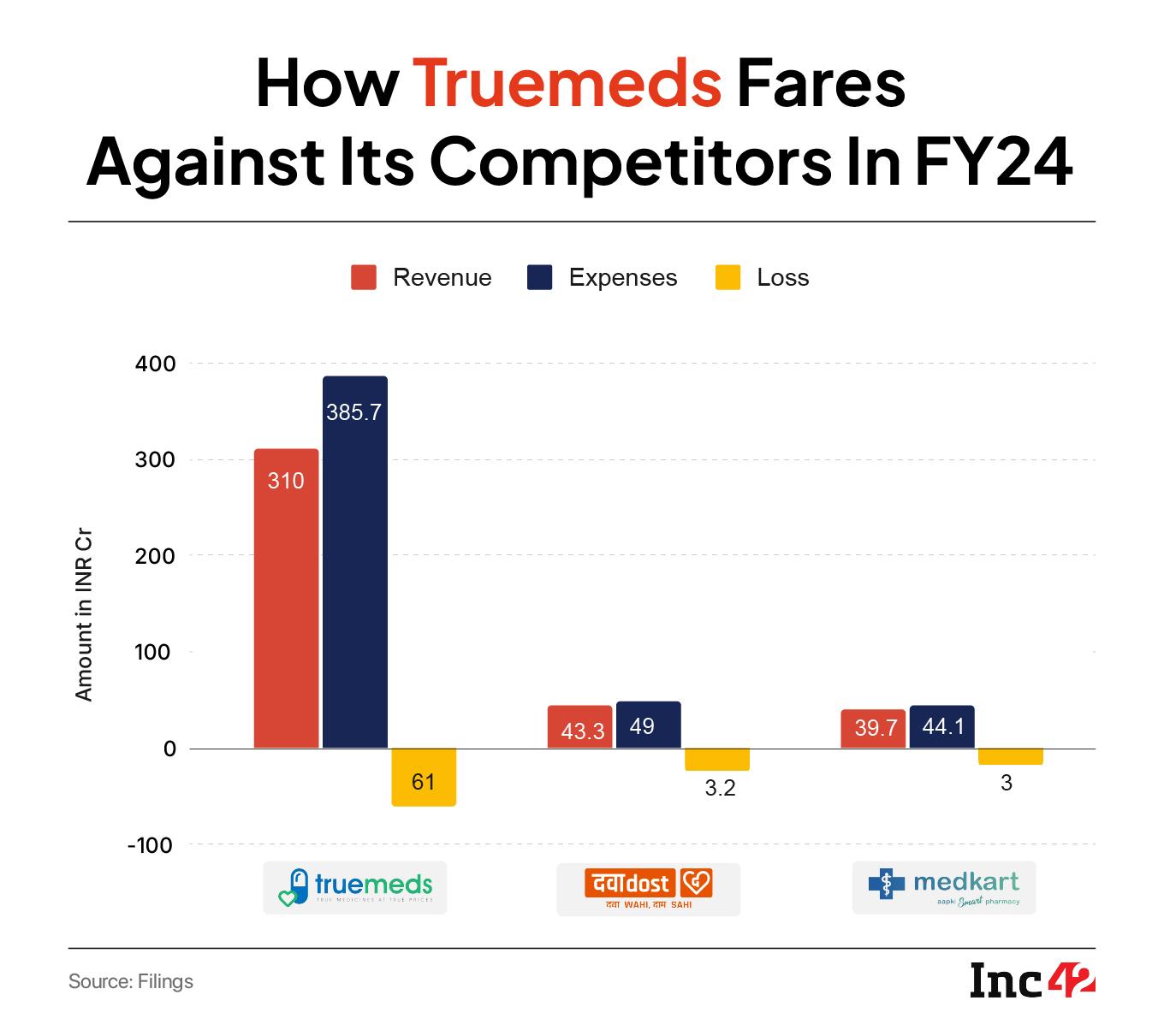

Regardless of a great margin, that is the very cause why there are only a few generic medication platforms and people which are there, similar to MedKart and Dawa Dost, haven’t been in a position to scale a lot.

As soon as acquired, although, retention is much less of a priority. “If you happen to begin saving 40-50% in your persistent sickness medicines, you’d need that to proceed,” he defined.

Power or non-communicable ailments are on the rise internationally, making up 73% of all deaths. In India, non-communicable ailments trigger 53% of deaths and 44% of disability-adjusted life-years misplaced. The truth is, income in pharmacy enterprise varies immediately with rising persistent ailments and age.

The startup can be exploring adjoining healthcare providers. “We noticed that almost all persistent sufferers have to endure blood exams, and there’s a real demand. We’re planning to launch this within the subsequent couple of quarters in choose places,” Nayyar shared.

The startup can be exploring adjoining healthcare providers. “We noticed that almost all persistent sufferers have to endure blood exams, and there’s a real demand. We’re planning to launch this within the subsequent couple of quarters in choose places,” Nayyar shared.

The startup plans pilot diagnostic providers by partnerships with labs in Tier II and Tier III cities.

Whereas its friends like Tata 1mg and Apollo have jumped on the short commerce bandwagon, Truemeds has no such plans, however Nayyar talked about that it’s going to ship medicines in at some point. In fast commerce, he mentioned, the AOV is as little as INR 400, which makes fulfilment prices disproportionately excessive and erodes any reductions handed on to sufferers. “For us, the economics should work in a means that financial savings are sustainable for the person.”

For Truemeds to make true progress within the enterprise, there’s a want for extra belief in generics amongst shoppers in India, the place pricey, branded medicines take pleasure in an edge available in the market over low-cost generic medication.

Edited By Kumar Chatterjee

[ad_2]