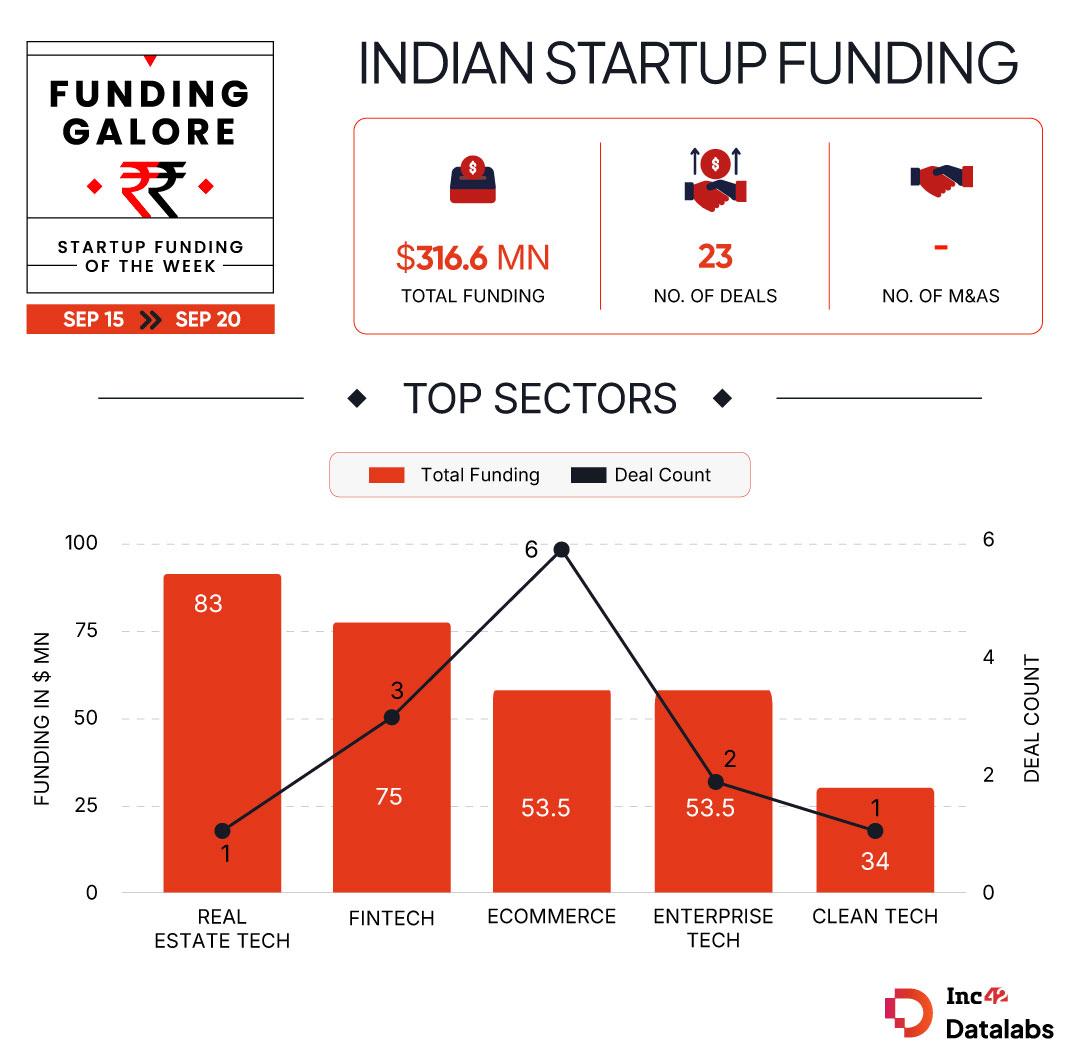

Twenty three startups cumulatively raised $316.6 Mn throughout September 15-20, a close to 7X bounce from the $47.8 Mn raised throughout 18 funding offers within the earlier week

Ecommerce topped the sectoral charts this week when it comes to the variety of offers. Six ecommerce startups raised $53.5 Mn this week

Accel, SIDBI, Blume Ventures and Kalaari Capital have been probably the most energetic traders this week, backing two startups apiece

After an prolonged interval of lull in investor curiosity, Indian startup funding zoomed previous the $300 Mn mark this week. Twenty three startups cumulatively raised $316.6 Mn throughout September 15-20, a close to 7X bounce from the $47.8 Mn raised throughout 18 funding offers within the earlier week.

Funding Galore: Indian Startup Funding Of The Week [ Sep 15 – 20 ]

| Date | Title | Sector | Subsector | Enterprise Mannequin | Funding Spherical Dimension | Funding Spherical Sort | Traders | Lead Investor |

| 18 Sep 2025 | Infra.Market | Actual Property Tech | Building | B2B | $83 Mn | Sequence G | Silverline Houses Pvt Ltd, NK Squared, Tiger International, Accel, Nexus | – |

| 17 Sep 2025 | EvoluteIQ | Enterprise Tech | Horizontal SaaS | B2B | $53 Mn | – | Baird Capital | Baird Capital |

| 17 Sep 2025 | FinBox | Fintech | Fintech SaaS | B2B | $40 Mn | Sequence B | WestBridge Capital, A91 Companions, Aditya Birla Ventures | WestBridge Capital |

| 19 Sep 2025 | Blue Power Motors | Clear Tech | Electrical Autos | B2B | $30 Mn | – | Nikhil Kamath (Cofounder, Zerodha), Omnitex Industries | Nikhil Kamath (Cofounder, Zerodha), Omnitex Industries |

| 16 Sep 2025 | InCred Cash | Fintech | Funding Tech | B2C | $30 Mn | – | Ranjan Pai (Chairman, Manipal Group), Ram Nayak (Ex-Funding Financial institution Head, Deutsche Financial institution), Mankind Household Workplace | – |

| 17 Sep 2025 | EcoSoul | Ecommerce | D2C | B2C | $20 Mn* | Sequence B | Accel, Bajaj Monetary Securities, StartupXseed Ventures, JSW Ventures, CK Birla Group, Singh Capital Accomplice, Alteria Capital, SIDBI | Accel, Bajaj Monetary Securities |

| 16 Sep 2025 | Indkal | Ecommerce | D2C | B2C | $20 Mn | – | Aries Alternatives Fund | – |

| 17 Sep 2025 | Scalekit | AI | Utility Layer | B2B | $5.5 Mn | Seed | Collectively Fund, Z47, Adam Frankl (US-based Angel Investor), Oliver Jay (MD, OpenAI), Jagadeesh Kunda (Cofounder, Oleria Safety) | Collectively Fund, Z47 |

| 17 Sep 2025 | Lucira | Ecommerce | D2C | B2C | $5.5 Mn | Seed | Blume Ventures, Spring Advertising Capital, SiriusOne Capital | Blume Ventures |

| 18 Sep 2025 | SpaceFields | Superior {Hardware} & Know-how | House Tech | B2B | $5 Mn | Pre-Sequence A | Globaz Applied sciences, Rockstud Capital, Enterprise Catalysts, Rainmatter, Burla Angel Community, Faad Capital, SIDBI, O2 Angels, MeitY Startup Hub | Globaz Applied sciences |

| 17 Sep 2025 | Pelocal | Fintech | Banking | B2B | $5 Mn | Sequence A | UNLEASH Capital Companions, Unicorn India Ventures | UNLEASH Capital Companions, Unicorn India Ventures |

| 16 Sep 2025 | iDO Gadgets | Ecommerce | D2C | B2C | $4 Mn | – | Blume Ventures, Merak Ventures | Blume Ventures, Merak Ventures |

| 15 Sep 2025 | Pascal AI Labs | AI | Utility Layer | B2B | $3.1 Mn | Seed | Kalaari Capital, Norwest Enterprise Companions, Information Edge Ventures, Antler | Kalaari Capital |

| 19 Sep 2025 | Equilibrium | Clear Tech | Local weather Tech | B2B | $3 Mn | Seed | Kalaari Capital, Peak XV Companions, Avaana Capital | – |

| 19 Sep 2025 | INCLUD | Ecommerce | D2C | B2C | $2.9 Mn | Pre-Sequence A | 3one4 Capital, Incubate Fund Asia | 3one4 Capital |

| 19 Sep 2025 | Blinkit-AI | AI | Utility Layer | B2B | $1.2 Mn | Seed | Foliflex Cables | Foliflex Cables |

| 17 Sep 2025 | Supply6 | Ecommerce | D2C | B2C | $1.1 Mn | Seed | Zeropearl VC, Kunal Shah (Founder, CRED), Ashutosh Valani (Cofounder, Beardo), Priyank Shah (Cofounder, Renee Cosmetics), Yogesh Kabra (Founder, XYXX) | Zeropearl VC |

| 11 Sep 2025 | UGX.ai** | AI | Utility Layer | B2B | $1 Mn | Seed | Blue Ocean Enterprise Companions, DeVC, iSeed, Atrium Ventures, Level One Capital, Ramakant Sharma (Founder & CEO, Livspace), Prateek Maheshwari (Cofounder, PhysicsWallah), Lovleen Bhatia (Cofounder, Edureka), Meghna Agarwal (Cofounder, IndiQube), Varun Pahwa (Pahwa Group), Asad Khan (Cofounder & CEO, LambdaTest), Dinesh Prasad (ex-India & SA Head, Qualcomm), Sai Yagnyamurthy (ex-Head of Partnerships, Ford Motor Firm), Gopi Prashant (ex-SVP – AI, Salesforce), Shekhar Vemuri (Founder, Emerge-In), Manish Agarwal (Co-Founder, KGeN) | Blue Ocean Enterprise Companions |

| 16 Sep 2025 | PlaySuper | Media & Leisure | Gaming | B2B | $1 Mn | Seed | Chimera, Audacity VC, India Angel Community, Dhruv Vohra (Managing Director – APAC Rising Markets, Meta) | Chimera |

| 19 Sep 2025 | Wankel Power Programs | Clear Tech | Local weather Tech | B2B | $1 Mn | Pre-Seed | Shastra VC | Shastra VC |

| 15 Sep 2025 | MyNaksh | Client Companies | Astrology Companies | B2C | $852K | Pre-Seed | Eximius Ventures, Gemba Capital | Eximius Ventures |

| 16 Sep 2025 | uKnowva | Enterprise Tech | Horizontal SaaS | B2B | $500K | Pre-Sequence A | Parv Community, Development 91, Aapna Infotech | – |

| 18 Sep 2025 | Raptee.HV | Clear Tech | Electrical Autos | B2C | – | – | Know-how Improvement Board (Ministry of Science & Know-how) | Know-how Improvement Board (Ministry of Science & Know-how) |

| Supply: Inc42 *Mixture of debt and fairness infusion ** Included this week because it was skipped final week. Observe: Solely disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- Ecommerce topped the sectoral charts this week when it comes to the variety of offers. Six ecommerce startups raised $53.5 Mn this week. Everything of those funds have been netted by D2C manufacturers.

- The week’s largest deal, Infra.Market’s $83 Mn Sequence G funding spherical, made actual property tech probably the most funded startup sector.

- Accel, SIDBI, Blume Ventures and Kalaari Capital have been probably the most energetic traders this week, backing two startups apiece.

- Ten startups on the seed stage raised $23.3 Mn this week.

Startup IPO Updates This Week

- Weeks after getting SEBI’s nod for its confidential submitting, Groww filed its up to date DRHP this week. The fintech main’s proposed public providing would comprise a contemporary challenge of shares value as much as INR 1,060 Cr and an offer-for-sale (OFS) element of as much as 57.4 Cr shares.

- Zappfresh filed the pink herring prospectus for its BSE SME IPO, which is able to solely include a contemporary challenge of as much as 59.06 Lakh shares. The corporate has set a worth band of INR 96 to INR 101, implying that it’s going to elevate as much as INR 59.65 Cr from the IPO and can be valued at round INR 225 Cr on the higher finish of the worth band.

- Pine Labs bought SEBI’s nod for its draft IPO papers this week. The corporate is predicted to file its RHP subsequent month and trim its challenge measurement to $700 Mn from $1 Bn earlier.

- InCred Holdings sought the approval of its shareholders to boost as much as INR 1,500 Cr through a contemporary challenge of shares in its proposed IPO.

- City Firm and DevX made their public market debut this week. Whereas City Firm listed at a premium of 56% and ended the week up 16%, DevX had a flat itemizing and its share costs ended the week down 6%.

Different Developments Of The Week

[ad_2]