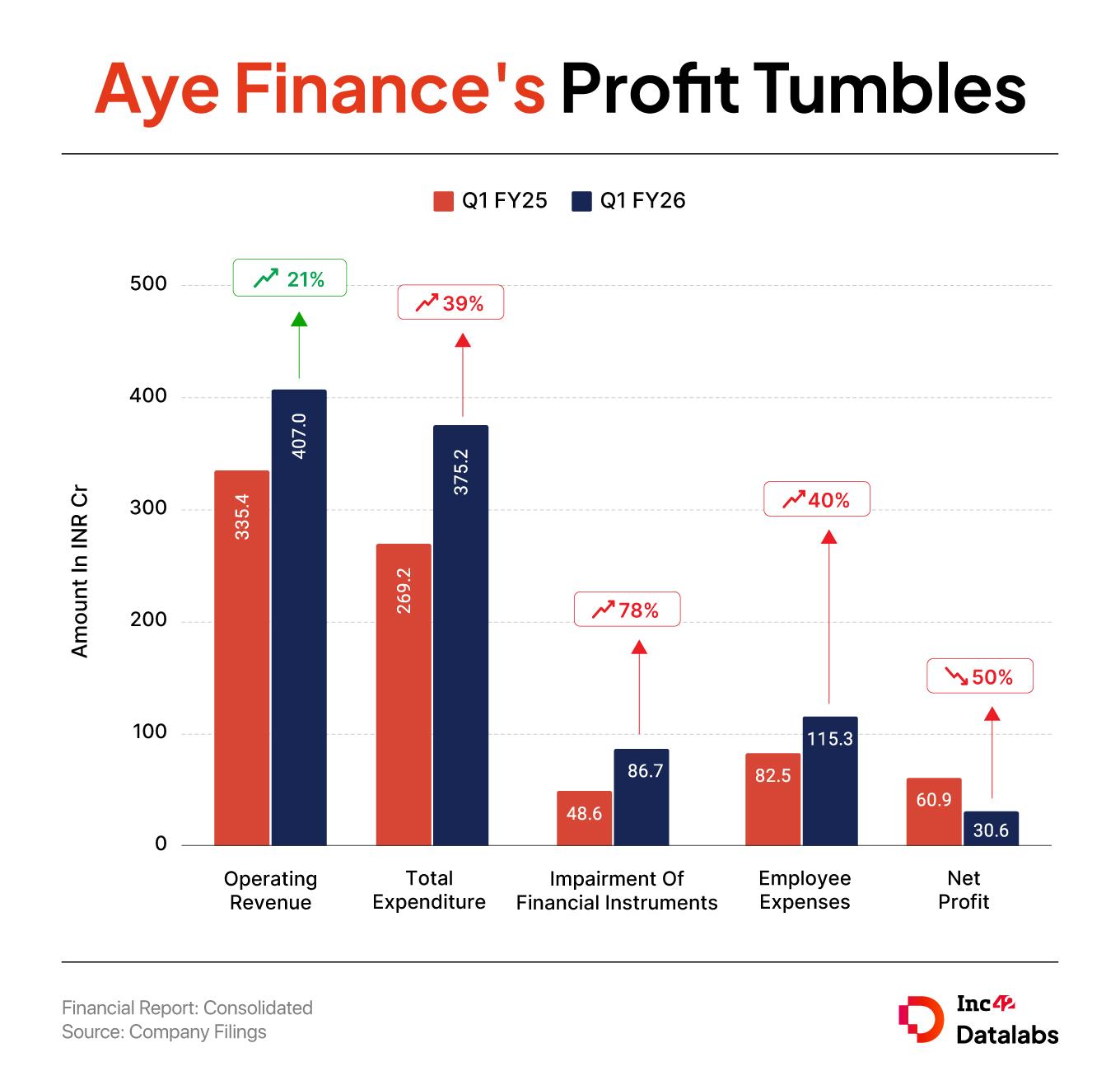

The NBFC’s prime line grew 21% to INR 407 Cr throughout the quarter below evaluate from INR 335.4 Cr in Q1 FY25

Aye Finance’s impairment loss surged 78% to INR 86.7 Cr throughout the quarter below evaluate from INR 48.6 Cr in Q1 FY25

For the total fiscal yr FY25, the corporate’s web revenue grew 6% YoY to INR INR 171.3 Cr whereas working income jumped 40% YoY to INR 1,459.7 Cr

IPO-bound NBFC Aye Finance’s web revenue declined about 50% to INR 30.6 Cr in Q1 FY26 from INR 60.9 Cr within the year-ago quarter as its impairment loss rose sharply. On a sequential foundation, Aye Finance’s revenue fell 25% from INR 40.7 Cr.

The NBFC’s prime line grew 21% to INR 407 Cr throughout the quarter below evaluate from INR 335.4 Cr in Q1 FY25. Working income diminished barely from INR 409.1 Cr within the earlier quarter.

Curiosity earnings was the largest contributor to working income in Q1, rising 16% YoY to INR 360.8 Cr. Charges and fee, web achieve on derecognition of economic devices and web achieve on truthful worth costs have been the opposite contributors to the highest line. The earnings from these sources stood at INR 46.2 Cr in Q1 FY26, up 95% from INR 23.7 Cr within the year-ago quarter.

Together with different earnings of INR 9.2 Cr, Aye Finance’s complete income stood at INR 416.1 Cr within the June quarter.

Notably, the corporate’s web revenue rose 6% to INR 171.3 Cr in FY25 from INR 161.1 Cr in FY24. Working income for the total fiscal yr stood at INR 1,459.7 Cr, up over 40% from INR 1,040.2 Cr within the earlier yr.

In April this yr, Aye Finance

As per the DRHP, the general public subject would comprise a contemporary subject of fairness shares price as much as INR 885 Cr and a suggestion on the market (OFS) of as much as INR 565 Cr. Traders like LGT Capital, CapitalG, A91 Fund, MAJ Make investments, Alpha Wave, amongst others, will offload their shares by way of the OFS.

The corporate plans to deploy the contemporary subject proceeds from the IPO to fulfill its future capital necessities, arising out of the enterprise and belongings progress.

Over the previous few months, Aye Finance has been on a spree to lift funds by way of personal placements of debentures and bonds. It allotted debentures price INR 215 Cr throughout March-June and raised $15 Mn by way of issuance of bonds to BlueOrchard Microfinance Fund in Could 2025.

Moreover, it raised a debt funding of INR 110 Cr from Northern Arc, ASK Monetary Holdings, MAS Monetary Providers and CredAvenue in January this yr.

Now, let’s check out the corporate’s expenditure for the primary quarter of the continuing fiscal yr.

Breaking Down Aye Finance’s Bills

The corporate’s complete expenditure for the quarter grew 39% to INR 375.2 Cr in Q1 FY26 from INR 269.2 Cr spent within the year-ago quarter.

Finance Value: This was the largest expense for the NBFC, rising 17% YoY to INR 126.3 Cr.

Worker Bills: The corporate’s spending on its workforce grew 40% YoY to INR 115.3 Cr.

Impairment Of Monetary Devices: Aye Finance’s impairment loss surged 78% to INR 86.7 Cr throughout the quarter below evaluate from INR 48.6 Cr in Q1 FY25.

[ad_2]