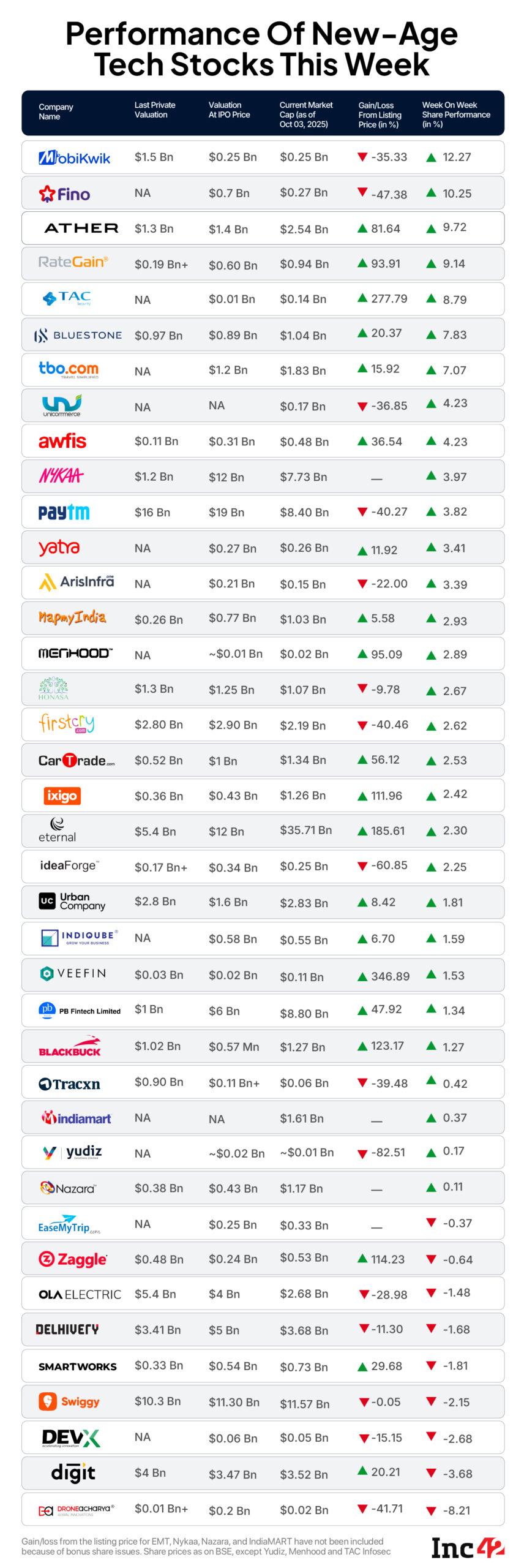

New-age tech shares gained this week because the Indian equities market rebounded amid volatility. Thirty of the 39 new-age tech shares below Inc42’s protection gained in a variety of 0.11% to over 12% between September 29 and October 3. With this, the cumulative market capitalisation of those firms rose to $106.59 Bn from $104.91 Bn on the finish of the final week.

After witnessing a protracted bearish investor sentiment, MobiKwik emerged as the most important winner this week. The inventory zoomed 12.27% to finish the week at INR 286. One other fintech firm Fino Funds Financial institution additionally maintained a bullish momentum all through the week, rising 10.25% to finish at INR 288.35.

In the meantime, EV main Ather Power continued its bull run, leaping 9.72% to finish the week at INR 592.25. The corporate’s shares touched an all-time excessive of INR 614.75 on September 22. Ather Power surpassed its rival Ola Electrical to achieve the third place in month-to-month electrical two-wheeler registrations in September.

Within the checklist of gainers, Deepinder Goyal-led Everlasting witnessed a major variety of block offers this week. Monetary companies main Goldman Sachs bought Everlasting shares price INR 622.2 Cr on Wednesday (October 1) and Friday (October 4) to Financial institution of America (BofA) Securities. The corporate’s shares ended the week 2.30% larger at INR 328.45.

Not too long ago listed City Firm gained 1.81% to shut at INR 174.55.

In the course of the week, the hyperlocal companies main was issued a present trigger discover by DGGI, Mumbai Zonal Unit for alleged non-payment of CGST price INR 51.3 Cr for the interval April 2021 to March 2025.

The corporate mentioned it is going to reply to the discover inside the prescribed timeline.

In the meantime, insurtech firm Go Digit additionally obtained a few demand notices within the final week of September. The corporate obtained the 2 present trigger notices from GST authorities in Delhi and Mumbai for a complete GST demand of INR 26.65 Cr. Its shares declined 3.68% this week to finish at INR 337.90.

Go Digit was the second largest loser among the many 9 shares which fell in a variety of 0.37% to over 8% this week.

Whereas dronetech firm DroneAcharya topped the checklist, shares of EaseMyTrip fell to a contemporary all-time low this week.

After falling to an all-time low of INR 7.99 on Monday (September 29), the net journey aggregator’s shares ended the week at INR 8.15. This marked a 0.37% decline from final week.

Now, let’s check out what occurred within the broader market.

RBI’s Dovish Stance Lifts Markets

The Indian equities market ended the holiday-shortened week on a constructive notice, rebounding from current losses amid broad-based shopping for and cautious optimism following the RBI’s coverage choice. The Nifty 50 gained 0.97% to shut at 24,894.25, whereas the Sensex rose 1% to settle at 81,207.17.

In keeping with Ajit Mishra, SVP of Analysis at Religare Broking Ltd, sentiment improved considerably after the RBI’s financial coverage committee (MPC) assembly end result on Wednesday (October 1), which supported home equities after final week’s sell-off.

The MPC saved the repo fee unchanged at 5.5% for the second consecutive assembly, whereas revising the FY26 GDP progress projection upward to six.8% and reducing its inflation forecast. The central financial institution additionally introduced plenty of measures geared toward boosting credit score circulate and strengthening capital markets.

In the meantime, home macro knowledge was combined – industrial output progress slowed to 4% in August, whereas the manufacturing PMI eased to 57.7 in September. GST collections, nevertheless, rose 9.1% year-on-year to INR 1.89 Lakh Cr in September.

With the rally this week, mid-cap and small-cap indices climbed round 2%, reflecting bettering danger urge for food regardless of persistent FII outflows. VK Vijayakumar, chief funding strategist at Geojit Investments, famous that sustained FII promoting continued in September, with web offloading of INR 27,163 Cr by way of exchanges.

“Nevertheless, FIIs purchased INR 3,278 Cr within the main market throughout the identical interval. Whole FII promoting in 2025 now stands at INR 1.98 Lakh Cr. Greater valuations in India and cheaper options overseas have pushed this technique, however with the valuation hole narrowing and Indian earnings probably to enhance in FY27, FII promoting is predicted to gradual going ahead,” he added.

Trying forward, the approaching week will probably be pivotal as Q2 FY26 earnings season begins, with IT bellwether TCS scheduled to announce outcomes on October 9. On the macroeconomic entrance, companies and composite PMI releases, together with banking sector mortgage and deposit knowledge, will probably be intently watched.

Globally, US macroeconomic updates, together with FOMC minutes, jobless claims, and shopper sentiment, will affect market sentiment, notably amid the continued authorities shutdown.

Main market exercise can also be set to stay robust, with massive IPOs from Tata Capital and LG Electronics lined up.

Nevertheless, the IPOs of new-age tech firms noticed muted response this week. Whereas Zappfesh needed to lengthen its IPO timeline and decrease its value band after undersubscription, WeWork India’s IPO was solely subscribed a mere 4% on day 1.

Now, let’s check out the efficiency of MobiKwik and DroneAcharya.

MobiKwik Regains Some Momentum

MobiKwik emerged as the highest gainer this week, however the inventory remains to be down 35.33% from its itemizing value.

About 5 months after venturing into the NBFC house, MobiKwik’s board accredited an funding of INR 9.99 Cr in its subsidiary, Mobikwik Monetary Companies Pvt Ltd (MFSPL), this week.

The funding, to be made by October 10, will assist MFSPL function as an NBFC and undertake leasing and hire-purchase offers for equipment, autos, ships, plane, factories, and actual property.

MobiKwik arrange MFSPL in April with INR 1 Lakh in paid-up capital. At the moment, the fintech companions with banks and NBFCs for offering loans. Bringing lending in-house may add a brand new income stream and broaden cross-selling alternatives.

On the monetary entrance, the corporate has been below stress over the previous few quarters. After reporting losses all through FY25, MobiKwik posted a web lack of INR 41.9 Cr in Q1 FY26, over 6X of INR 6.6 Cr in Q1 FY25. Income additionally fell 21% to INR 271.4 Cr.

CFO Upasana Taku attributed the decline to disruptions in credit score distribution and regulatory adjustments in P2P lending, which compelled the shutdown of merchandise like its BNPL platform Zip.

DroneAcharya Slips After H2 FY25 Loss

Dronetech firm DroneAcharya was the most important loser this week, with its shares dropping 8.21% to shut at INR 337.90 following the discharge of its H2 FY25 outcomes. The corporate reported a web lack of INR 15.1 Cr within the second half of FY25 as in opposition to a revenue of INR 2.2 Cr in H2 FY24. In H1 FY25, DroneAcharya had posted a web revenue of INR 1.6 Cr.

The loss was largely resulting from a pointy decline in working income in H2, which fell 47% YoY to INR 7.6 Cr. Sequentially, income crashed 72% from INR 26.9 Cr.

For the complete fiscal FY25, the corporate recorded a web lack of INR 13.5 Cr as in opposition to a revenue of INR 6.2 Cr in FY24. Working income for the 12 months stood at INR 34.5 Cr, down 1.9% from INR 35.2 Cr.

DroneAcharya attributed the delay in H2 disclosure to useful resource constraints and prolonged inner audits, which led to a BSE advantageous of INR 1.5 Lakh. The corporate additionally obtained a SEBI present trigger discover in Could. The matter is below examination and monetary implications, if any, are but to be decided.

In FY25, the corporate made a provision of INR 13 Cr for uncertain money owed and advances, whereas commerce receivables remained excessive at INR 25.3 Cr. Working money circulate turned damaging at INR 7.1 Cr, reflecting ongoing liquidity pressures.

[ad_2]