Let’s simply agree — creating a brilliant app that does all of it isn’t a shiny new idea. In truth, the concept traces its roots again to 2011 when China’s WeChat bundled quite a few providers right into a single cell platform — messaging, funds, social media, ecommerce, information, ride-hailing, meals ordering, and extra.

And ever since, India has been on a wild chase for that dream. From fintechs to conventional banks, everybody desires to be in every single place, all the pieces, , with a ubiquitous tremendous app.

Whereas banks fancy calling it the ‘common financial institution’ mannequin, bundling bank cards, insurance coverage, loans and investments, fintechs don’t trouble with jargon.

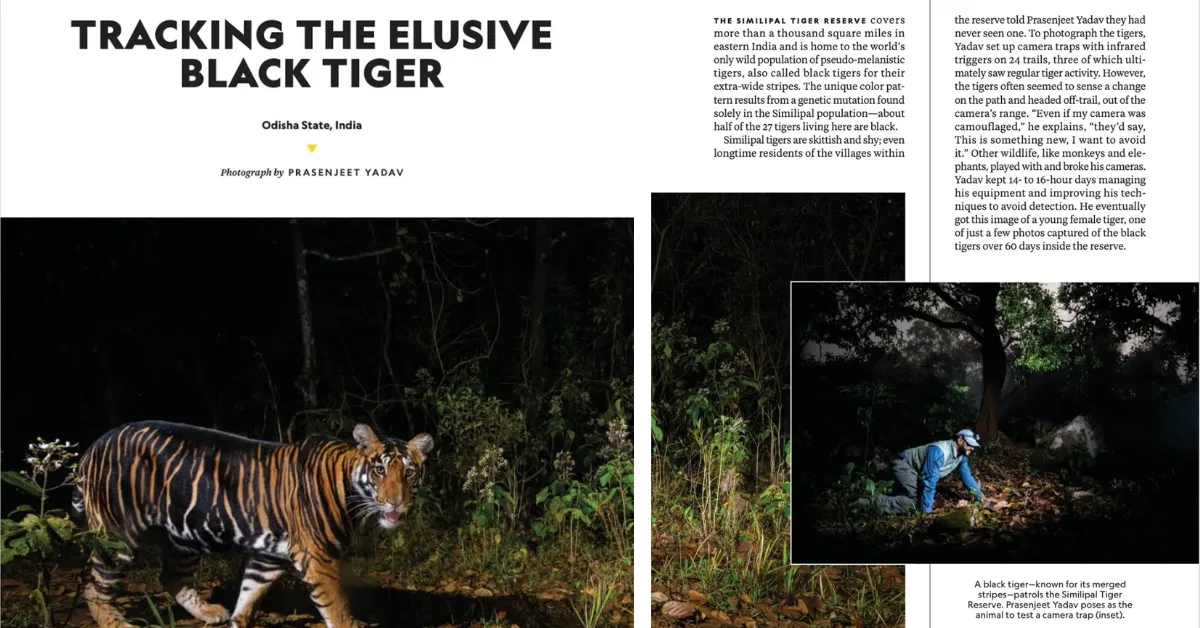

Nonetheless, beneath the tremendous app gloss, it’s largely the fundamentals — funds, lending, mutual funds, and ecommerce. That is precisely what Kunal Shah’s CRED is attempting to alter. Final week, the corporate appeared to lift the bar, but once more.

Focusing on its core base of creditworthy and aspirational people, CRED launched an all-in-one asset tracker that pulls collectively investments in shares and mutual funds, digital gold and even financial institution balances beneath one place. It additionally launched a co-branded bank card and an unique membership referred to as Sovereign for HNIs.

From afar, it’d appear to be CRED is stepping away from the herd, breaking the same old tremendous app mould. However, is it actually so? And is it going to be a worthwhile transition?

Earlier than we dive in, listed here are the highest tales from our newsroom this week:

Has The GPU Killer Arrived? As demand for AI shoots up, TPUs are moving into the highlight as a quicker, extra energy-efficient different to GPUs. However with NVIDIA nonetheless calling the pictures and India’s entry restricted, can TPUs actually change the sport for the nation’s AI future?

Groww’s Lopsided IPO: Groww’s DRHP throws up a story of explosive development. But, its problem construction displays the oft-repeated narrative in new-age firm listings, the place the OFS part is greater than 50-60% of the difficulty measurement. Will the heavy VC cashout erode belief?

CityMall’s Three Lefts And A Proper: CityMall’s path to INR 1,000 Cr income wasn’t straight—it took three pivots from social commerce to groceries, localisation, and personal labels. Now thriving in India’s small cities, it faces its hardest check but: fast commerce.

CRED’s Out-Of-The-Herd Strikes

The Kunal Shah-led startup’s intent to face out from the remaining stems from its retention battle early on in its journey, as its restricted choices weren’t sticky sufficient to drive engagement. Subsequently, it developed its playbook to draw solely the prosperous. And now the proposition appears to be evolving into one thing even sharper.

CRED’s Svalbard suite, for instance, launched earlier this 12 months, is all a few deeper push into credit score administration, with merchandise like Money+ for fast liquidity towards mutual funds and a consolidated credit score rating tracker.

Equally, CRED Storage goes into automobile administration, insurance coverage, car valuation and a member-run market. The corporate additionally piloted an e-Rupee pockets in collaboration with the RBI for the Central Financial institution Digital Forex (CBDC).

“Look intently, and the sample behind these launches turns into clear. Every new vertical just isn’t solely a standalone product but additionally a brick in a broader ecosystem CRED is constructing,” mentioned a associate at a enterprise capital agency focussed on fintech.

This readability on the premium expertise, he mentioned, provides CRED the flexibility to outshine firms like Paytm, PhonePe, Groww, Flipkart, Jio Monetary Providers and others which are additionally investing in consumer acquisition, constructing retention, and cross-selling.

Aspirations Take Off, However UPI Is Nonetheless Key

What makes CRED’s tremendous app technique totally different can also be the truth that it doesn’t have a stronghold on anybody specific vertical. PhonePe dominates UPI, Paytm has the model recall and scale, whereas Groww is clearly focussed on investments. However CRED doesn’t have a distinct segment, besides its premium positioning.

As one skilled we spoke to place it, in its need to be ubiquitous, CRED is shedding its grip on fundamental choices, which isn’t an excellent signal.

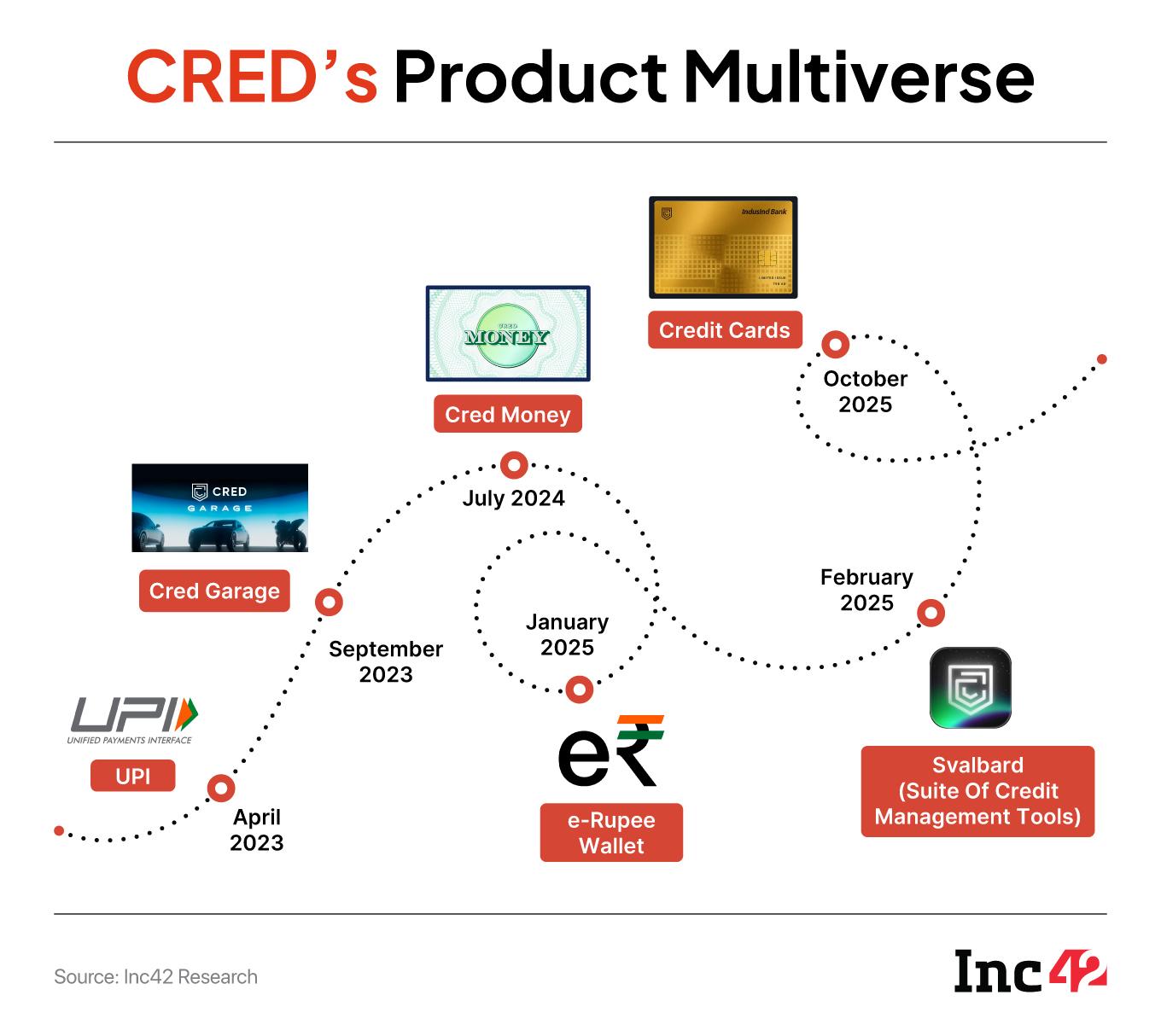

As an example, amid rising aspirations to decorate up in a different way, CRED is shedding grip on UPI, a crucial a part of the tremendous app funnel. CRED launched UPI funds in April 2023 and made it into the highest 4 in June 2024. It remained there till November 2024, when Navi dethroned it. Since then CRED has additionally been outmoded by Flipkart-owned tremendous.cash.

Whereas the UPI transaction quantity on CRED has remained flat within the final one 12 months, the whole worth has grown, implying a bigger common transaction measurement. Between August 2024 and August 2025, the month-to-month variety of transactions grew from 147.48 Mn to 150 Mn, up a mere 1.71%. The whole worth rose by 10% from INR 50,720.89 Cr to INR 55,756.24 Cr.

However as we have now explored right here, the distinction between CRED and the main UPI apps is important.

For context, at the same time as CRED’s share stays marginal within the broader context of India’s UPI ecosystem at simply 0.75% of transactions, its customers account for two.24% of complete transaction worth.

Regardless of its energy consumer play, the competitors is intensifying, and newer gamers are gaining floor — an space of concern for CRED. Plus the aspiration to be totally different has not translated into profitability.

“There are causes for this, too. First: they don’t seem to be class creators… large, established rivals are already on the market. Secondly, the highest 1-2% customers that CRED serves are dispersed, which poses a problem in producing money,” Sharat Chandra, founding father of consulting agency EmpowerEdge Ventures, mentioned.

Can CRED Flip Customers Into Income?

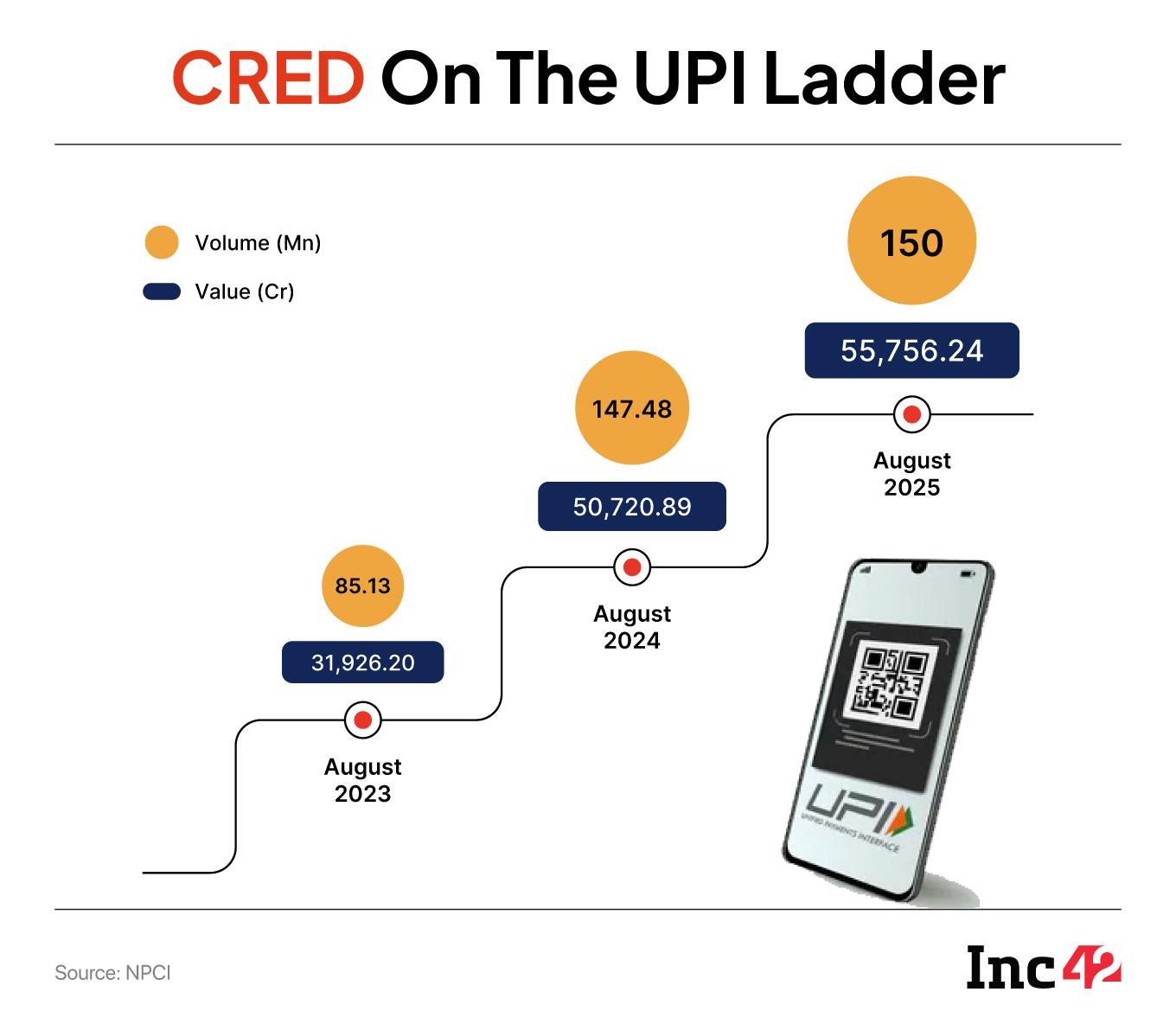

So let’s handle the elephant within the — profitability. Despite the fact that CRED has been profitable in constructing and milking a glorified userbase of lofty people, it was burning money as if it had been its second enterprise till FY24.

Regardless of garnering INR 2,397.3 Cr in FY24 revenues, its web loss widened 22% YoY to INR 1,645.6 Cr in FY24. CRED has but to launch its FY25 numbers.

“Regardless of having an excellent set of customers, they’re nonetheless not worthwhile. I’m unsure how they need to crack that piece of the puzzle,” mentioned Chandra.

He added that even with choices geared toward high-value customers — CRED Cash, Sovereign and Gold Playing cards, and CRED Storage — most stay strategic or experimental relatively than main income drivers.

One other key concern is that CRED has usually tried to bypass questions round profitability by describing itself as a younger firm that can develop into its full potential in the long term. Not everyone seems to be satisfied.

“For those who don’t focus first on profitability, it is going to be an elusive dream,” Chandra added.

As elusive a dream as it might look, there isn’t a denying that CRED is sitting on a gold mine of roughly 40 Mn prosperous shoppers, and if it has the proper product levers, this base is sufficient to change the market in a single day. However, for that to occur, CRED should play its playing cards excellent.

Sunday Roundup: Startup Funding, Offers & Extra

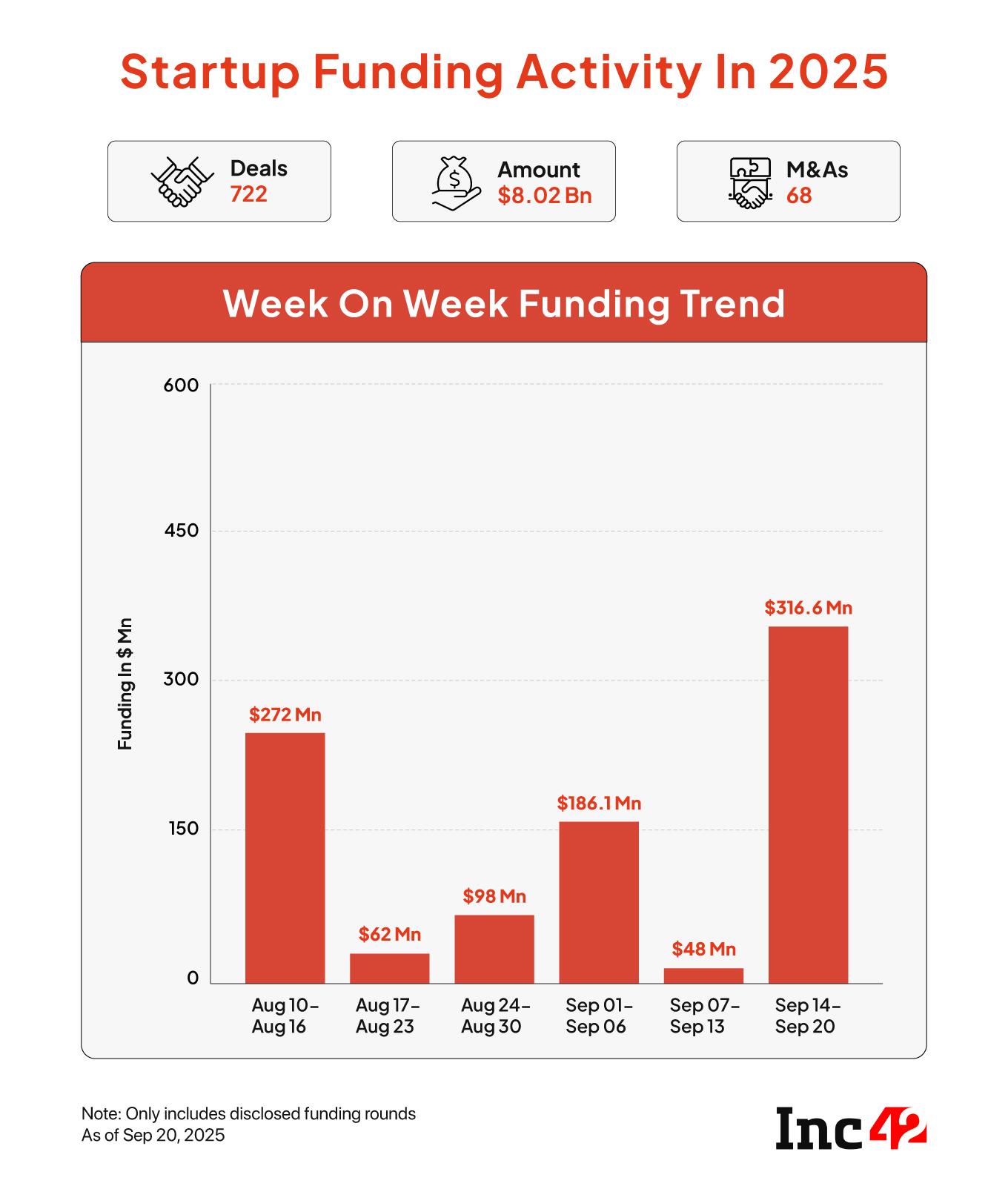

A Nice Funding Week: Indian startup funding surged previous $300 Mn final week, with 23 startups elevating a complete of $316.6 Mn between September 15 and 20. This marks practically a sevenfold soar from final week’s $47.8 Mn throughout 18 offers.

Pepperfry To Get Acquired: BSE-listed TCC Idea is eyeing a full takeover of Pepperfry. Whereas numbers aren’t out but, the deal goals to combine TCC’s tech know-how with Pepperfry’s market — hopefully turning the latter’s losses into couches of money.

Churn At Gameskraft: Rattled by the ban on actual cash gaming, Gameskraft has let go greater than 100 workers — identical to Games24x7, MPL, and Pokerbaazi. There are expectations of extra such layoffs within the brief time period as gaming startups reprioritise their enterprise wants.

BigBasket’s FY25 Loss Bloats: The fast commerce main’s FY25 outcomes present a worrying development. Its web loss rose 42% to INR 2,007 Cr, whereas working income slipped 2% YoY to INR 9,867 Cr. Whole expenditure, too, elevated to INR 11,893.6 Cr in FY25 from INR 11,515.1 Cr a 12 months in the past.

Paytm Brings Again BNPL: Paytm has relaunched its buy-now-pay-later service in partnership with Suryodaya Small Finance Financial institution. Presently rolling out selectively, the BNPL providing provides customers as much as 30 days of short-term credit score, with wider enlargement deliberate quickly.

[Edited by Shishir Parasher]

[ad_2]