Right here’s a curious thought for you this Sunday: At any time when a startup acquires a legacy agency or a much bigger participant, it has often not labored out.

Take the billion-dollar deal between BYJU’S and training big Aakash, which has kind of failed in mild of the troubles for BYJU’s. Or ride-hailing startup Ola, which splurged almost $200 Mn to amass FoodPanda and enter meals supply, earlier than realising it was not nearly buying an organization.

There are exceptions after all, however extra of than not, it has not turned out to be a very good match.

PharmEasy

Thyrocare was worthwhile all alongside and PharmEasy was flush with over $1 Bn funds raised. What PharmEasy didn’t have was earnings, and it was hoped that Thyrocare can be the magic bullet to vary this. Sadly for PharmEasy, 4 years later, earnings are nonetheless elusive.

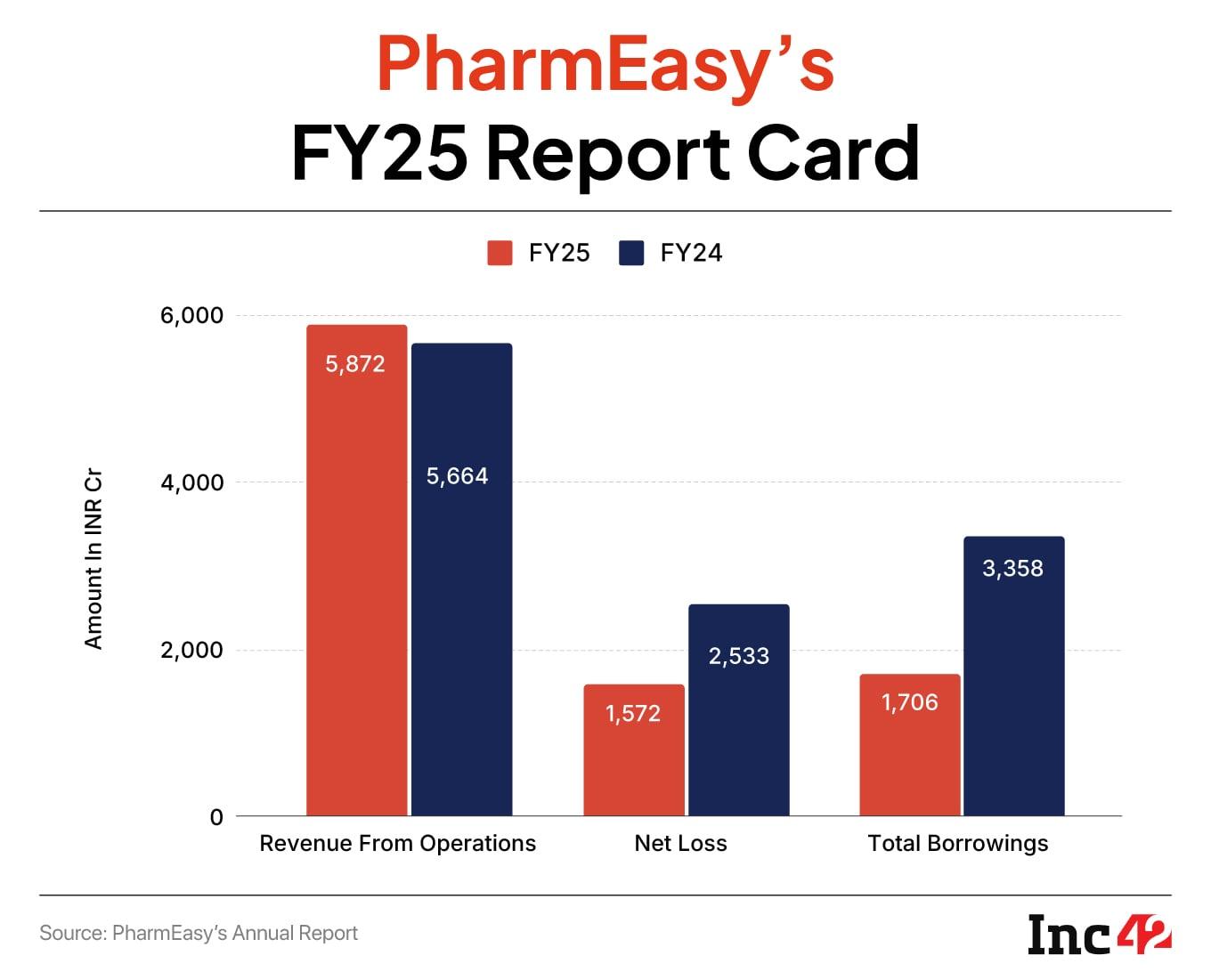

In truth, the corporate has reported a lack of INR 1,517 Cr in FY25, which is 40% decrease than FY24, however with its high line remaining virtually flat, this was not a significant needle-moving enchancment. Even so, that’s an enchancment on the 15% income decline in FY24.

So time to dive deeper into the B2B and B2C pharma firm’s woes, however after a take a look at the highest tales from our newsroom this week:

- PhysicsWallah’s IPO Litmus Take a look at: Earlier this week, the edtech main filed its up to date DRHP to boost INR 3,820 Cr through its IPO. Amid the dilapidated state of Indian edtech, the itemizing may very well be a breath of recent air. However is PW’s touted itemizing extra smoke than hearth?

- The Q-Commerce Advert Goldmine: The short commerce area has was a advertising battleground. What began as a comfort play has developed into India’s latest promoting goldmine that’s threatening Google and Meta.

- FirstClub’s Premium Q-Comm Sizzle: In contrast to different fast commerce gamers, the startup sells “high-quality” on a regular basis necessities and way of life merchandise at inexpensive costs. Can its premium-focussed mannequin compete with giants like Zepto, Blinkit and Instamart?

PharmEasy’s Ambition: Construct A Well being Empire

Siidharth Shah and his shut pals and cofounders Dharmil Sheth, Dhaval Shah, Harsh Parekh, and Hardik Dedhia needed to construct a holistic well being and wellness platform that would supply, prescribe and promote medicines, by means of on-line and offline touchpoints. The startup acquired its method to get midway there earlier than shedding steam.

It acquired Aknamed in 2018, Thyrocare and B2C pharmacy Medlife in 2021 to enter verticals reminiscent of pharma provide chain, well being consultations, diagnostics and testing.

Alongside the best way, the corporate additionally borrowed closely when the zero rate of interest fiscal coverage was in place throughout the pandemic. Whereas elevating these funds was straightforward, paying it again turned costlier and costlier for PharmEasy.

Any development at this stage was a results of cashburn, aside from Thyrocare. As soon as valued at $5 Bn, PharmEasy is struggling to show money stream optimistic 5 years after that high-profile acquisition.

Most of its struggles have come on account of the $300 Mn (INR 2,220 Cr) mortgage from Goldman Sachs which finally was charged an annual rate of interest of 17-18%.

Progress was exhausting at this level and different epharmacies pulled forward of PharmEasy. 1MG bought Tata’s backing, NetMeds bought the Reliance platform to develop, however PharmEasy merely couldn’t transfer on from the downturn after 2022.

New Management Amid The Chaos

One other connection to BYJU’S is Manipal Group’s chairman Ranjan Pai who stepped in as a white knight for BYJU’S and Aakash and did the identical with PharmEasy. He participated in PhamEasy’s rights subject as an exterior investor investing INR 1,300 Cr in 2023.

The Manipal Group Chairman by means of his household funding workplace has since put in INR 800 Cr in 2024 thus elevating his stake to double digit in API Holdings which noticed its valuation erode by 90%.

In August 2025, Siddharth Shah stepped down because the chief government officer in August 2025. The cofounder will stay the vice chairman at PharmEasy’s father or mother entity API Holdings, whereas Thyrocare managing director and chief government Rahul Guha took over on the helm at PharmEasy.

At this time, PharmEasy continues to be money stream damaging, has numerous belongings on its books whose values have been drastically impaired dragging its losses additional and bought off a few of its subsidiary corporations at lowered worth, in accordance with Inc42’s evaluation of API Holdings’ FY25 Annual Report.

With Shah’s exit from CEO position, API Holdings successfully is now managed by Ranjan Pai’s Household Workplace, Prosus, TPG, Temasek and different traders. Whereas the brand new management may steer PharmEasy’s sinking ship in direction of worthwhile shores, it first wants to return out of the outlet it has dug itself through the years.

The Debt Burden

On the coronary heart of PharmEasy’s troubles lies its mounting debt burden. In 2022, the corporate borrowed $300 million (INR 2,220 crore) from Goldman Sachs by means of non-convertible debentures (NCDs) at a steep 17-18% rate of interest.

This mortgage was meant to bridge liquidity gaps submit the failed IPO try in 2021, when PharmEasy aimed to boost INR 6,250 crore however finally withdrew because of market volatility.

A key covenant required PharmEasy to boost not less than INR 1,000 crore ($120 million) in recent fairness throughout the first 12 months after the quantity was disbursed i.e. August 2023.

There have been different stipulations together with the truth that PharmEasy needed to increase recent fairness capital as nicely and keep a wholesome debt to fairness ratio. However PharmEasy failed to satisfy these phrases.

In keeping with API Holding’s FY25 report, the corporate had paid a number of tranches to Goldman Sachs and medical provides agency Evox to service this mortgage — totalling INR 1,772 Cr and INR 250 Cr respectively.

PharmEasy’s internet money stream stays damaging and complete publicity to borrowings as of FY25 was INR 1,700 Cr. At its peak, this quantity was INR 3,358 Cr, the report reveals.

The corporate has additional incurred losses on its investments by promoting off just a few of its subsidiary corporations at a loss which has been recorded as “distinctive loss” on books in FY25 to the tune of INR 44.5 Cr, as per its annual report.

Amidst the monetary woes, PharmEasy’s 90% valuation erosion from its $5.6 Bn peak to $456 Mn throughout its rights subject and subsequent fundraises in 2024, may be an overhang on its IPO pricing and valuation prospects.

Income Focus: The B2B Dependency

What’s going to save PharmEasy? Will it’s the B2B enterprise or the buyer model itself?

Whereas PharmEasy’s journey could have begun as a B2C on-line pharma market, its income mannequin has more and more tilted towards B2B operations. However according to the unique imaginative and prescient, each components of the enterprise are essential.

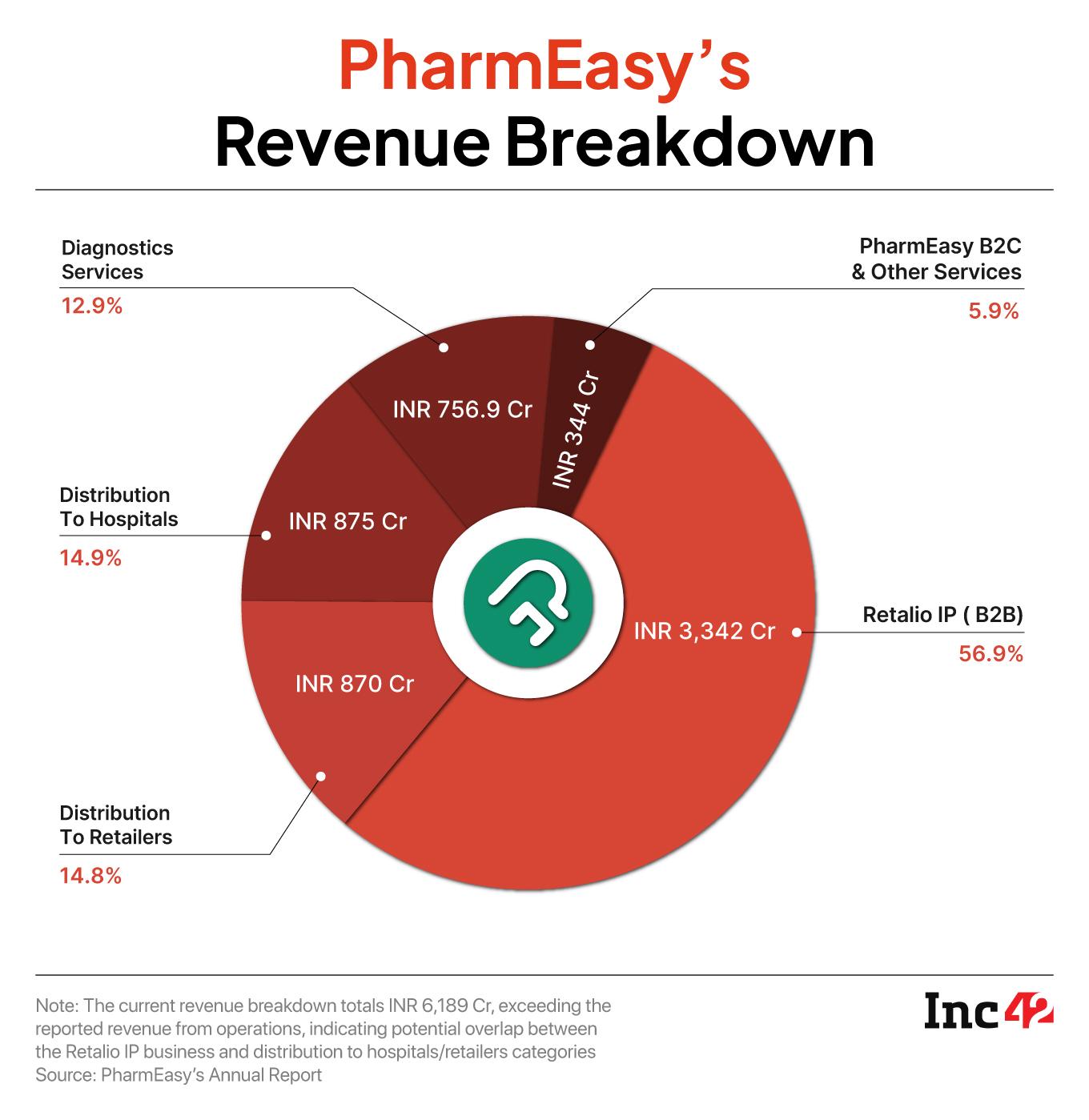

In FY25, a significant chunk or 87% of PharmEasy’s working income of INR 5,097.5 Cr got here from pharmaceutical and beauty gross sales. B2B gross sales — procurement of pharmaceutical, OTC, surgical, consumables from pharmaceutical corporations and promoting to native chemists and well being establishments — by means of Retailio generated INR 3,343 Cr in income in FY25, accounting for 56.9% of complete income.

On the brighter aspect, common income per retailer rose from INR 48,000 in March 2024 to INR 53,000 in March 2025, signaling improved effectivity.

Diagnostics, through Thyrocare, contributed INR 757 Cr (12.9%) however notably, PharmEasy’s as soon as core B2C market and “different companies” added simply INR 344 Cr (5.9% of general income) to the corporate coffers.

So whereas the B2B mannequin is sustaining PharmEasy, the model behind the B2C platform has did not shine.

IPO On The Horizon?

As PharmEasy eyes a possible IPO in FY26 in accordance with media studies, its path stays fraught with the identical perils which have continued to canine Indian startups.

Any try and relaunch the IPO ambitions after giving them up in 2021 would should be accompanied by measurable enhancements within the backside line and a predictable development path.

As soon as once more, Thyrocare might be seen as a saviour for PharmEasy from the viewpoint of earnings, given the comparatively skinny margins in B2B pharma and lengthy receivables cycles. In some way PharmEasy’s dependency on Thyrocare’s cashflow has not modified previously 4 years.

If something, PharmEasy’s loss is the acquire of latest gamers like Swiggy-owned Instamart, Zepto and Blinkit, as we coated just a few weeks in the past.

PharmEasy’s saga as soon as once more underscores the perils of aggressive acquisitions with out severe long-term planning.

Presently, PharmEasy’s unlisted shares are being traded at INR 7-12 per share, which reveals the state of the corporate within the gray market. Its valuation has plummeted considerably to $500-600 Mn. With most marquee traders seeking to shift off the corporate, and the exit of all of the cofounders, the $600 Mn query is will the corporate script a turnaround, or be a part of different cautionary tales from the Indian startup ecosystem?

Sunday Roundup: Startup Funding, Offers & Extra

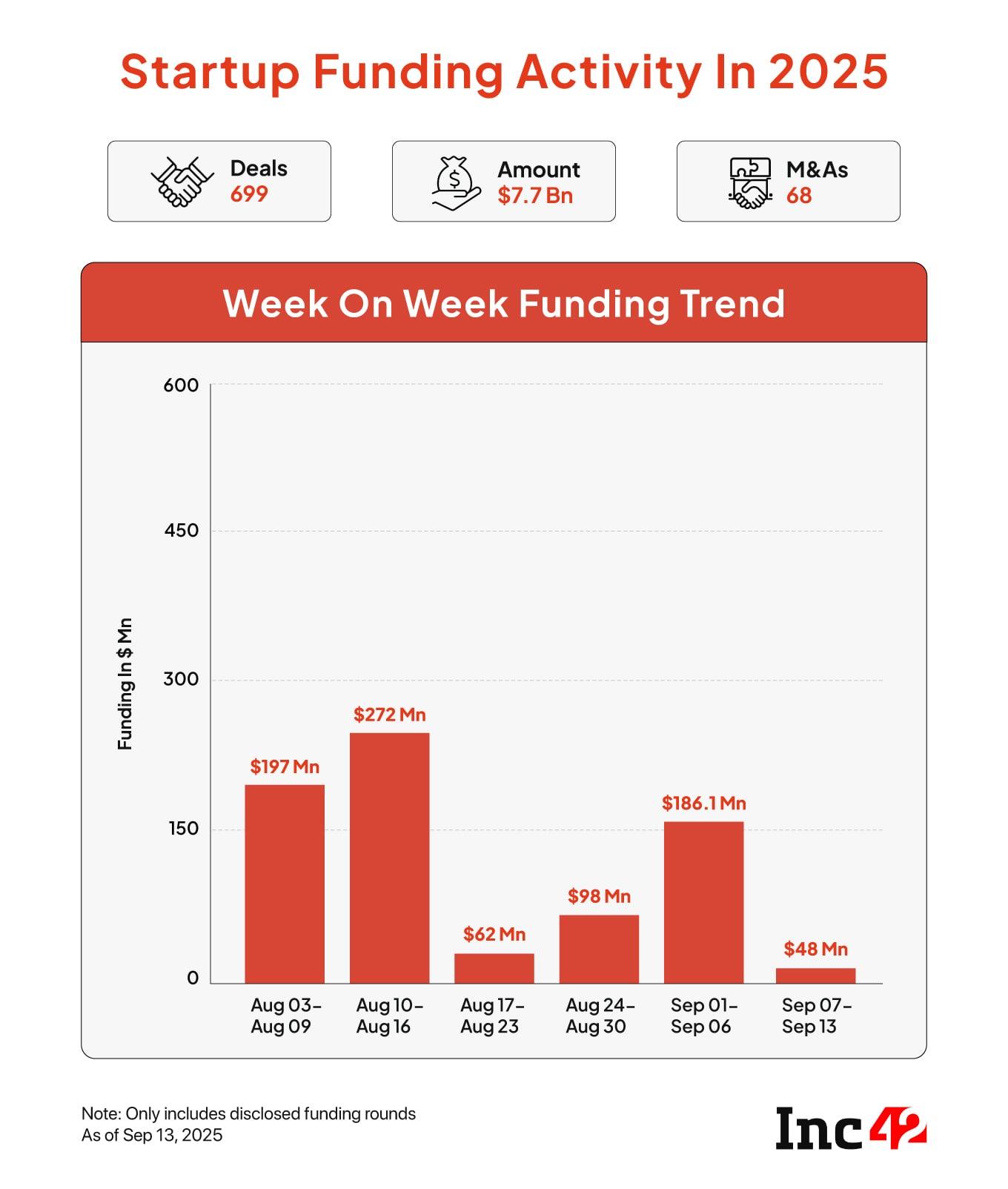

- Funding Drops: Indian startups raised a mere $47.8 Mn throughout 18 funding offers between September 8-13. This marked a 74% drop from the earlier week

- Early Diwali At PhonePe: The fintech big has initiated an ESOP buyback scheme price as much as INR 800 Cr. The transfer is anticipated to profit 1,000 out of the corporate’s 12,000 staff. This comes as PhonePe is seeking to increase as much as $1.5 Bn through its IPO

- Tata 1mg’s Consumer Retention Mannequin: The epharmacy’s advertising stack is constructed on buying new customers, retaining them engaged and making certain they return. Going ahead, 1mg is now reshaping its advertising engine by integrating AI and focussing on privateness.

- Games24x7 Axes 500 Jobs: Following the Centre’s ban on on-line actual cash gaming, the unicorn now plans to put off almost 70% of its workforce. This comes months after the gaming big fired 180 staff in Might, fearing a income hit from a GST clarification

- Flipkart’s Income Landmark: Flipkart’s market enterprise crossed the INR 20,000 Cr income mark in FY25, reaching a brand new excessive as earnings from operations rose 14.4% from INR 17,907 Cr in FY24

[ad_2]