Revolutionizing debt assortment in enterprise corporations has been introduced down into new horizons by varied AI instruments that make it simpler for enterprise corporations to raise overdue accounts. They present forthcoming behaviors in fee by machine studying with automated reminders whereas customizing strains for respective purchasers, ensuing to be decrease guide work and engagement with brokers for extra sophisticated instances. Pure language processing would additionally assist the methods perceive the nuances of how issues are stated-the tone and intent-thus making these efforts seemingly extra human and esteemed. These instruments may even deal with compliance, so that each outreach may even adjust to the authorized requirements.

| Device | Distinctive Differentiator | Key Integrations | Particular Functionality |

|---|---|---|---|

| Conduit | Conversational AI throughout all channels (SMS, WhatsApp, e-mail, voice, chat) | Main CRMs & Mortgage Mgmt Programs | Unified inbox + clever workflows for compliance |

| TrueAccord | HeartBeat engine personalizing timing, channel & message | Shopper self-serve portal | 96% funds occur with out human interplay |

| HighRadius | 15+ AI brokers optimizing order-to-cash | CRM & ERP methods | Cuts overdue accounts by 20% with real-time dashboards |

| Debtrak | 1,500+ configurable options for full automation | Core finance, CRM & dialer methods | ISO 27001 compliance + dynamic dashboards |

| Tesorio | Predictive AI for money circulate forecasting | ERP methods | Self-serve hyperlinks + proactive dangerous debt prevention |

| CollectAI | AI-optimized dunning & reminders | ERP & CRM | Cloud-based ML evaluation of buyer response patterns |

| InDebted | Empathy-first multilingual AI collections | Cloud-native, international attain | Versatile compensation choices with strict compliance |

| Accountgram | B2B restoration + authorized escalation/public debt itemizing | Finance platforms | Predictive fashions for fee habits |

| Esker | Combines credit score administration + collections | ERPs & credit score bureaus | Actual-time threat evaluation + credit score monitoring |

| Gaviti | AR automation with dispute administration | A number of ERPs | Cuts DSO by 30%, reduces late invoices by 50% |

Conduit

| Web site | conduit.software program |

|---|---|

| Score | 4.7 |

| Free Trial | Free plan out there |

| Finest For | Warehouse operations: dock scheduling, driver check-in, gate administration, YMS/WMS workflows. |

Conduit is an AI instrument for debt collections in 2025, integrating conversational AI throughout channels-SMS, WhatsApp, e-mail, chat, and voice- with an end-to-end automated workflow that makes every part associated to collections painless. The platform affords native integration to main CRMs and mortgage administration methods, thus offering deep buyer perception and customized engagement. It delivers a unified inbox and clever agentic workflows that facilitate communication, improve regulatory compliance, and enhance restoration charges by offering fast and customized compensation options to prospects. This strategy leads to extremely productive and low cost operations for the companies whereas fostering a respectful and caring buyer expertise, thus revolutionizing debt restoration within the digital age.

Execs

- Deep workflow automations for complicated enterprise processes

- Seamless integration with CRM and mortgage administration

- Regulatory compliance and automatic reminders

Cons

- The model remains to be rising in recognition

- Might take time to onboard because of complicated legacy system integration.

Pricing

Conduit affords customized pricing; contact them for a quote.

TrueAccord

| Web site | trueaccord.com |

|---|---|

| Score | 4.6 |

| Free Trial | No |

| Finest For | Companies searching for digital-first, AI-powered debt restoration & collections options with self-serve choices. |

TrueAccord boasts of getting an AI-driven HeartBeat engine, which personalizes the timing, channel, and message for each account. This makes it stand out amongst digital debt assortment platforms. The answer is self-learning from shopper response and makes it straightforward for the general public to handle money owed through self-serve portals, whereby 96% of payoffs happen with out being initiated by a human. TrueAccord has its always-on bots designed to deal with large accounts without delay whereas making every part compliant to the regulation and throughout channels like e-mail, SMS, and cellular. It is a platform that has a respectful and hassle-free method of debt assortment, thus enhancing buyer expertise and enterprise outputs with out compromising all authorized requirements.

Execs

- Distinctive AI is offering customized engagement for each debtor.

- 24/7 robotic course of automation ensures well timed motion.

- Self-service debtor portal for quick and clean funds.

Cons

- Requires a degree of digital literacy,

- AI could not incorporate some sophisticated monetary points.

Pricing

TrueAccord affords customized pricing; contact them for a quote.

Prime AI Apps to Save Cash | Sensible Budgeting & Finance Instruments

Uncover the most effective AI apps that provide help to lower your expenses. From budgeting and expense monitoring to sensible procuring and funding insights—discover the highest instruments to handle your funds higher.

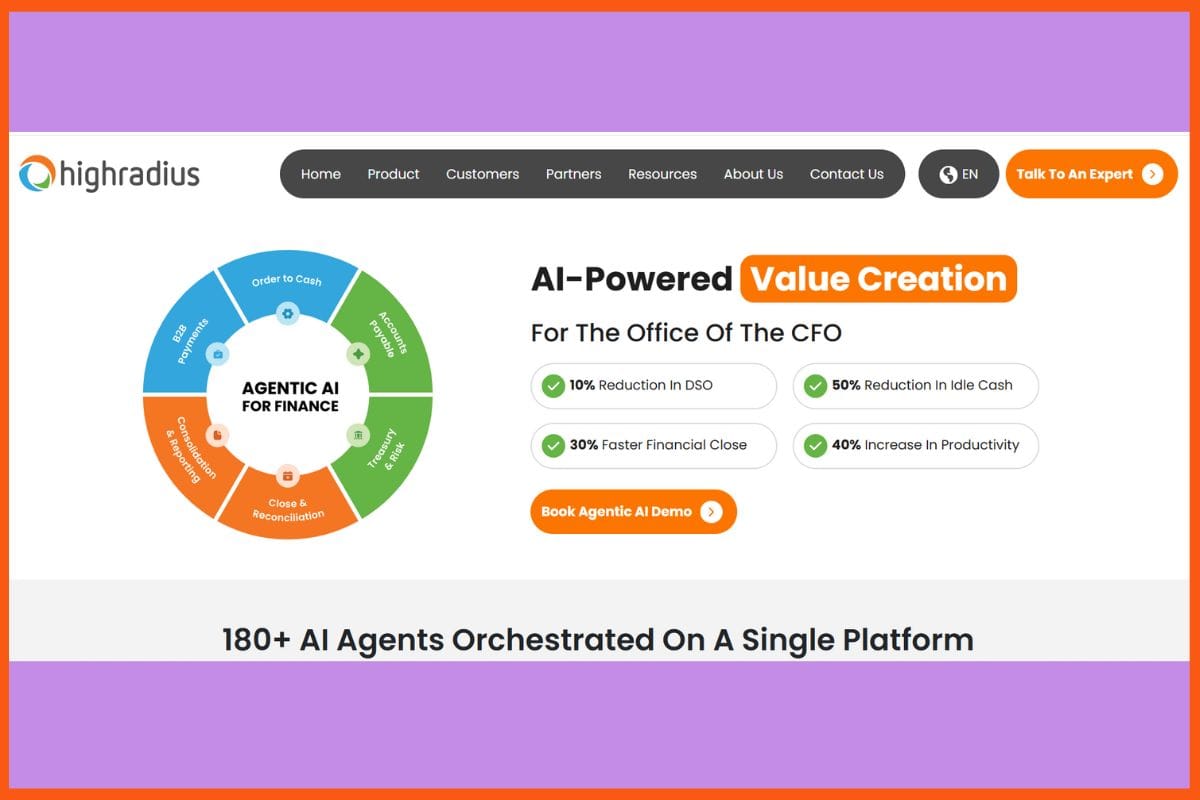

HighRadius

| Web site | highradius.com |

|---|---|

| Score | 4 |

| Free Trial | No |

| Finest For | Enterprises and finance groups needing AI-powered automation for order-to-cash, treasury, receivables, and record-to-report processes. |

HighRadius has geared up over 15 AI brokers for debt assortment, whereas it minimizes previous dues by 20% and empowers collectors with doubled output. Its platform totally automates the group of calls, emails, reminders, account precedence, and real-time fee information in order that brokers could be freed to deal with complicated instances. With built-in dashboards, deep analytics, and self-service fee choices, groups all the time have a transparent view of money circulate and what it is up towards. HighRadius connects with CRM and ERP methods for a frictionless course of, creating at-a-glance decision-making with prompt information. It’s trusted by international manufacturers. Its system sharpens focus, automates, and engages smarter in each step of the gathering journey.

Execs

- Actual-time dashboard and analytics to optimize the workflow.

- Interoperates with key enterprise methods.

- 20% discount in overdue accounts.

Cons

- Difficult customization could improve onboarding time

- Entry to full options typically requires superior coaching and integration.

Pricing

HighRadius affords customized pricing; contact them for a quote.

Debtrak

| Web site | debtrak.com |

|---|---|

| Score | 3.9 |

| Free Trial | Sure |

| Finest For | Organisations needing automated debt-collection workflows, compliance, dashboards & communication instruments. |

Along with offering enterprise debt assortment software program with greater than 1,500 configurable options, Debtrak automates each facet, together with invoicing and fee, reminders, and reporting. Debtrak is designed for scalability and blends into core finance, CRM, and dialer methods for 360-degree account visibility, and so forth., to create dynamic dashboards for real-time decision-making. As well as, Debtrak permits multi-channel communication, entry to customized engagement, and compliance with the ISO 27001 and all international guidelines. With near-zero implementation time and excessive customization, organizations can provide wealthy analytical options, enhancing money flows, growing recoveries, and taking the load off their groups, successfully rendering debt assortment processes smarter, sooner, and much more clear for employees and purchasers alike.

Execs

- 1,500+ customizable options out there for complicated automation.

- Scalable for organizations of any dimension.

- Straight integrates with dialers, fee, and reporting methods.

Cons

- The feature-rich platform could require extra onboarding or customization.

- Could also be extreme for a small crew

Pricing

Debtrak affords customized pricing; contact them for a quote.

Tesorio

| Web site | tesorio.com |

|---|---|

| Score | 4.9 |

| Free Trial | No |

| Finest For | Finance groups & CFOs who need AI-driven money circulate forecasting, AR/AP automation, and decreasing Days Gross sales Excellent (DSO). |

Tesorio makes use of AI to automate collections with foresight, permitting groups to foretell money flows, establish dangers, and ship focused, across-channel reminders. The system integrates with ERPs and consolidates workflows, so late funds are changed into visibility and motion. Customers can configure campaigns with self-serve fee hyperlinks that present real-time analytics to lower DSO and dangerous debt. Thus, finance professionals could train better management and focus for collections to be maximally productive whereas nurturing good relationships. By automating routine duties and surfacing accounts that can trigger issues earlier than they do, Tesorio helps prospects understand money, placing working capital again into play whereas avoiding disagreeable monetary surprises-clear and quick.

Execs

- Predictive analytics spotlight at-risk accounts earlier than there is a vital situation.

- Seamless money circulate administration by way of built-in ERP.

- Self-service fee hyperlinks for a optimistic buyer expertise.

Cons

- Closely enterprise-focused

- Studying curve for superior options

Pricing

Tesorio affords customized pricing; contact them for a quote.

Finest AI Instruments for Portfolio Administration | Smarter Investing

Uncover the most effective AI instruments for portfolio administration. Discover how AI helps buyers monitor property, optimize returns, scale back dangers, and make smarter funding choices.

CollectAI

| Web site | accumulate.ai |

|---|---|

| Score | 4.3 |

| Free Trial | Sure |

| Finest For | Companies needing AI-powered accounts receivables automation, digital collections & dunning with cost-reduction and buyer retention focus. |

CollectAI turns into a first-of-its-kind digital communication world that transforms debt assortment through the use of synthetic intelligence. It impacts personalization of fee reminders, automates dunning flows, and gives a seamless excessive engagement by way of e-mail, SMS, and past. It is anticipating the best power stimulation of machine studying in its cloud-based platform, analyzing buyer response patterns and, on that foundation, optimizing when and learn how to get in touch with individuals. Different options embody self-service fee hyperlinks and interactive dashboards to enhance consumer expertise and restoration charges, in addition to authorized compliance in all outreach actions. CollectAI’s seamless integration with any sort of ERP or CRM reduces guide work and permits groups to have full management of their total debt portfolio.

Execs

- Dynamic and AI-powered multi-channel engagement

- Dashboards and notifications on time for continuous enchancment

- Flawless integration with any well-established monetary system

Cons

- Not appropriate for these corporations that search on-premises

- No trial provide for implementation

Pricing

CollectAI affords customized pricing; contact them for a quote.

InDebted

| Web site | indebted.co |

|---|---|

| Score | 4 |

| Free Trial | — |

| Finest For | Companies searching for tech-enabled, honest debt-collection processes with emphasis on compliance, transparency, and buyer respect. |

InDebted is all about altering the debt assortment panorama with an AI-automated, cloud-native platform constructed for international attain and empathizing with debtors. It examines billions of knowledge factors to find out how finest to achieve out to customers with multichannel and multilingual messaging at simply the fitting time and in simply the fitting tone for that particular person. Their workflows permit for versatile compensation choices and self-service with strict compliance controls in order that the corporate will get paid quickly whereas sustaining excessive buyer satisfaction. That system thereby automates the mundane duties, predicts fee chance, and presents actionable analytics, thereby empowering groups to create an environment friendly assortment course of whereas nonetheless engendering buyer goodwill.

Execs

- An empathy-first strategy and versatile fee plan improve satisfaction

- Person-friendly portals allow self-service for hassle-free fee

- Wonderful in compliance, privateness, and enterprise scale

Cons

- Enterprise pricing could also be greater than primary localized options

- Full advantages can be found solely to giant or fast-growing portfolios

Pricing

InDebted affords customized pricing; contact them for a quote.

Finest AI Finance Instruments for Professionals

Uncover prime AI finance instruments , enhancing effectivity, evaluation, and decision-making for monetary professionals.

Accountgram

| Web site | accountgram.com |

|---|---|

| Score | 4 |

| Free Trial | No |

| Finest For | Companies needing B2B debt restoration with authorized escalation, public debt itemizing, and contract enforcement. |

Accountgram comes with options powered by synthetic intelligence to allow the automation of monetary workflows, reminders, and analytics that help companies in recovering accounts extra shortly. Combining straightforward integration with finance methods, customized follow-ups, and predictive fashions that forecast fee habits permits its platform to maximise assortment productiveness. A digital dashboard gives productiveness help by way of the monitoring of all assortment steps and outcomes, whereas sensible messaging adjusts to every debtor’s response for optimum engagement. The sturdy safety and compliance instruments empower companies to scale with confidence, decrease operational prices, and attain out to debtors respectfully primarily based on strong information for enhanced relationship administration.

Execs

- Predictive fee forecasting with customized reminders

- Safe integrations with main finance platforms

- Intuitive dashboards for fast and knowledgeable choices

Cons

- Restricted public documentation concerning superior AI capabilities

- Customized setup could also be required for some verticals

Pricing

Accountgram affords customized pricing; contact them for a quote.

Esker

| Web site | esker.com |

|---|---|

| Score | 4.6 |

| Free Trial | Sure |

| Finest For | Automating order-to-cash, procure-to-pay, doc administration, bill & buy requisition workflows. |

Esker is the enterprise-grade AI-powered platform that’s revolutionizing debt assortment and order-to-cash processes. Its central process is consolidating buyer and credit score information, automating the intricacies of invoicing, reminders, and blocked order administration, and including predictive analytics to the combination to prioritize at-risk accounts and velocity money restoration. Actual-time dashboards and alerts, integration with ERPs and credit score bureaus, and omnichannel engagement for custom-made buyer outreach are all facilitated by Esker Synergy AIs. By integrating credit score administration with collections, Esker optimizes the effectivity and satisfaction of each processes whereas bringing advantages like diminished DSO, fewer write-offs, and compliance to organizations—making the entire monetary course of very seamless and clear.

Execs

- Threat evaluation and credit score monitoring on a real-time foundation

- Centralized dashboards and full ERP integrations

- Gives a novel mixture of credit score administration and collections

Cons

- Not appropriate for small companies

- Relying on the improved AI and customization may require onboarding and coaching

Pricing

Esker affords customized pricing; contact them for a quote.

Gaviti

| Web site | gaviti.com |

|---|---|

| Score | 4.5 |

| Free Trial | Sure |

| Finest For | B2B corporations needing AI-powered invoice-to-cash automation, credit score threat administration, automated reminders, and decreasing DSO. |

Gaviti is pushing the boundaries of AI know-how to alter the way in which companies conduct debt collections by creating an accounts receivable platform that automates sending reminders, forecasts delayed funds, and customizes engagement for each buyer. Its real-time analytics dashboard integrates with a number of ERPs, pointing to high-risk accounts, diminished days gross sales excellent (DSO), and improved money circulate. By Gaviti’s buyer portal, self-service fee choices, dispute administration, and prompt entry to invoices are provided. The automated actions alleviate guide work for finance groups, scale back labor prices, and facilitate proactive data-driven decision-making. Concentrating on mid-market and enterprise corporations, Gaviti enhances speedy funds and reduces dangerous debt, enabling a speedy return on funding inside a single cloud answer

Execs

- Reduces days gross sales excellent by 30% and reduces late invoices by 50%

- Portal for buyer self-service and dispute administration

- Enterprise needs- adaptable and customizable workflows

Cons

- Annual customized pricing goes by way of the Vendor solely

- Superior options have to be arrange and skilled earlier than seeing the optimum outcomes.

Pricing

Gaviti affords customized pricing; contact them for a quote.

Conclusion

AI has reworked each aspect of recovering overdue funds: debt assortment has turn into “smarter,” sooner, and extra humane. AI instruments now translate complicated information into simple actions, resembling automating reminders for tailoring outreach on accounts and prompt insights that assist enhance resolution high quality by groups. The result’s a leap in effectivity, improved restoration charges, in addition to prospects receive customized, respectful, and dignified communication at each level of the journey. Prices lower as guide effort steadily dwindles, and compliance turns into simpler to handle by way of built-in authorized safeguards. Corporations stash monumental quantities of money by using these mechanisms, develop belief, and maintain their focus in-house on what actually issues.

Finest Cash Saving Apps in India: Each day Digital Piggy Financial institution Apps to Develop Your Financial savings

Uncover the most effective cash saving apps ike Jar and Gullak in India. Discover each day financial savings apps, digital piggy financial institution instruments, and sensible methods to develop your financial savings effortlessly.

FAQs

What are some Prime AI Instruments for Debt Assortment?

Some Prime AI Instruments for Debt Assortment are:

- Conduit

- TrueAccord

- HighRadius

- Debtrak

- Tesorio

- CollectAI

- InDebted

- Accountgram

- Esker

- Gaviti

How do AI debt assortment instruments enhance restoration charges for companies?

By analyzing fee habits and predicting dangers, AI platforms ship reminders on the proper time, on the fitting channel, and with customized messaging.

WIDGET: questionnaire | CAMPAIGN: Easy Questionnaire