Brokerages and analysts declare Zepto has slowed down, however is that this only a non permanent section in preparation for profitability?

Reddit could make or break a startup. Many such startups within the US have confronted the wrath of Redditors. However the final time this occurred to an Indian startup, it was in 2019, when BYJU’S and WhiteHat Jr received flak for deceptive adverts. That began a interval of intense scrutiny for the edtech big and in some methods, it dented the BYJU’S model badly.

Six years later, the main focus is on Zepto

The subreddit r/F***Zepto is floor zero in terms of the anti-Zepto sentiment. Customers right here outrage about and dunk on the corporate’s complicated and opaque charge construction. Uninterested in the so-called darkish patterns, near 30K lively customers have joined up. And it’s not a well mannered crowd.

Does this subreddit have something to do with a supposed slowdown in Zepto’s progress and adoption — as per latest experiences — or is that this only a non permanent sluggish section in preparation for profitability as the corporate has claimed?

Let’s attempt to reply this, however first a take a look at the important thing tales from our newsroom this week.

- The Wakefit IPO Query: Specialists consider that Wakefit stands out on the again of its mattress enterprise and never the wood furnishings enterprise, which is susceptible to main headwinds, however it’s the latter that has set the benchmark for income progress. So which means will the IPO pendulum swing?

- ClassPlus Caught In Conundrum: As soon as a pureplay SaaS enabler of lecturers, faculties, schools, edtech soonicorn Classplus finds itself at a crossroads as core enterprise progress plateaus. Right here’s how the edtech startup flipped its script

- VerSe Hits Reset: After elevating greater than a billion {dollars}, digital content material aggregator VerSe Innovation fights for relevance as its core companies face AI disruption at a time when the advert income mannequin is shaken. However can AI additionally save this unicorn?

Blinkit, Instamart Acquire As Zepto Slips?

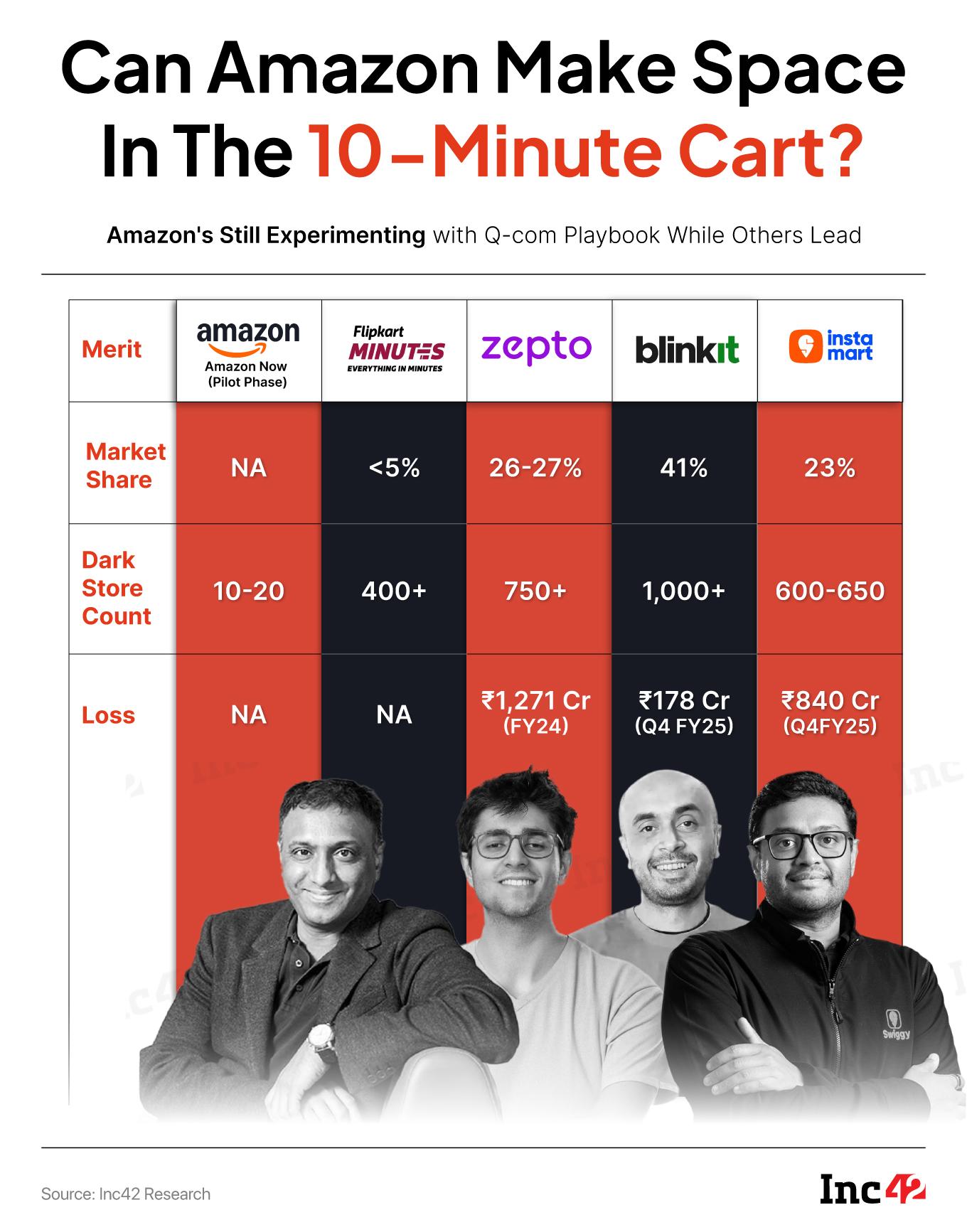

Brokerage and analyst experiences previously two weeks have pointed to Blinkit and Instamart grabbing market share whilst investments in darkish retailer enlargement and different operational capability have decreased.

Everlasting-owned Blinkit and Instamart gained market share as per a report by ICICI Securities, with the previous stated to have seen a 25% progress in gross order worth, in comparison with Instamart’s 22% QoQ progress in Q1 FY26. That is in opposition to a sector-wide 20% enhance in GOV, indicating that the 2 listed gamers have managed to capitalise previously quarter.

The numbers additionally possible imply that Zepto misplaced some market share or didn’t see as a lot progress because it had loved beforehand. Notably, Zepto was stated to be trying to scale back its money burn and switch worthwhile because it gears up for its IPO. This additionally resulted within the firm deferring its public itemizing plans to 2026 from 2025 earlier.

That’s to not say that issues are dangerous at Zepto. Cofounder and CEO Aadit Palicha stated final month that the choice to defer the submitting of draft papers was taken as the corporate desires to extend home possession. He additionally claimed that Zepto was near reaching EBITDA breakeven.

Is Zepto Slowing Down?

A separate JP Morgan report from April additionally claimed that Zepto had moderated its progress tempo by way of darkish retailer additions as of March 2025.

Whereas Blinkit and Swiggy’s Instamart added roughly 250-300 darkish shops every, Zepto was at lower than half of that capability enlargement at 105 shops. The brokerage steered that progress depth was waning.

On the optimistic facet, Zepto has extra shops which have been operational for longer and due to this fact this might lead to improved margins. With Blinkit and Instamart including new darkish shops, these shops can be a pull on their respective profitability.

Certainly, the aggressive enlargement spree undertaken by the three main gamers within the fast commerce sector noticed their profitability taking successful over the previous few quarters. Whereas the monetary numbers for Zepto should not out, Everlasting and Swiggy noticed their bills surge over the previous few quarters.

Whereas Everlasting noticed its consolidated web revenue crash almost 78% YoY to INR 39 Cr in This autumn FY25, Swiggy’s web loss surged 95% to INR 1,081.2 Cr. That is maybe why retailer enlargement slowed down within the June quarter in comparison with the March interval.

Or Is It About Income?

Within the interim, the businesses at the moment are turning their focus in the direction of profitability following the enlargement push. ICICI Securities stated its channel checks point out that value discounting steadily decreased throughout platforms in Q1 and efficiency advertising and marketing spends additionally remained comparatively muted.

The brokerage expects Blinkit’s GOV to develop 140.3% YoY in Q1, whereas Instamart is estimated to see a 110.1% enhance in GOV. It sees Blinkit posting an adjusted EBITDA lack of INR 150 Cr through the quarter as in opposition to an adjusted EBITDA lack of INR 178 Cr in This autumn FY25.

In the meantime, Instamart is projected to publish an adjusted EBITDA lack of INR 910 Cr in Q1 FY26 as in opposition to a lack of INR 840 Cr in This autumn 2025.

If certainly Zepto can present all of that is to succeed in higher unit economics in its FY25 numbers, that will add a ton of stress on Blinkit guardian Everlasting and Instamart proprietor Swiggy within the quick time period.

Each are listed and would due to this fact must ship the worth that shareholders are promised. Whereas this is perhaps excused over one or two quarters, there might be extra requires worthwhile progress if Zepto exhibits that it might do it.

Particularly once we take a look at the slowdown in meals supply, Zepto has the chance to show what are being seen as cracks into strengths.

Most experiences initially of the 12 months indicated that no fast commerce firm can be backing off from investing in progress and enlargement. Zepto’s plan was to do the identical, however as phrase received round a couple of public itemizing, there have been doubts about whether or not Zepto ought to rein in a number of the prices.

Legacy ecommerce gamers like Amazon, Flipkart, Myntra, and Nykaa are dashing to enter fast commerce, however face challenges like excessive supply prices, logistical complexity, and slower execution in comparison with new-age gamers. Whereas many don’t instantly compete with Zepto, Instamart or Blinkit, there was some concern of a market share battle.

This might have prompted a rethink from progress to income. Certainly, that was the widely accepted notion when Zepto stated it’s shifting its IPO timeline.

The general public itemizing, initially deliberate for 2025, has now been moved to subsequent 12 months, and whereas Palicha says that is to streamline the cap desk and turn into extra domestically-owned, there might be some fact to the story that Zepto has slowed down as these latest experiences have indicated.

The following huge factor for Zepto can be to launch its FY25 monetary image as quickly as doable to place to relaxation any rumours of a slowdown. Blinkit and Instamart’s numbers for the primary quarter of FY26 can be out quickly, and that might be Zepto’s cue for its personal numbers.

Sunday Roundup: Startup Funding, Shutdowns & Extra

- Funding Slips This Week: Between July 7 and 12, startups raised $132.9 Mn throughout 17 offers, down 58% from the $314.6 Mn secured by 21 startups within the previous week

- Blip Shuts Down: Simply over a 12 months after starting operations, trend fast commerce startup Blip has shut store on account of working capital and GTM technique constraints

- Tesla’s Official Launch: Elon Musk-led Tesla will formally open its first India expertise centre in Mumbai on July 15, with deliveries starting late August

- OYO Will get Aid: In a serious reprieve for OYO, the Delhi HC has stayed the restoration of tax demand price almost INR 1,140 Cr beneath the now-revoked angel tax regime

- VSS On AI: Reflecting on India’s place within the world AI race, Paytm founder Vijay Shekhar Sharma has stated that the nation ought to place itself because the “AI use case capital” of the world

[ad_2]