The Nice Indian Meals Supply Reset

India’s $55 Bn meals supply market is witnessing its largest disruption. A multi-front conflict is brewing – ignited by a state-backed revival technique for ONDC and the emergence of Rapido as a brand new rival – to interrupt the duopoly of Zomato and Swiggy. So, what’s cooking in India’s foodtech kitchen?

ONDC 2.0: To fire up ONDC’s stagnant orders, the federal government is lining up a devoted INR 200 Cr to INR 250 Cr fund to dole out incentives to new eating places becoming a member of the platform. As a part of the technique, the Centre has additionally directed eateries to supply reductions from the associated fee financial savings, ensuing from little-to-no commissions on ONDC.

Rapido, The Darkish Horse: Amid this ONDC-led disruption, Rapido is quietly constructing its meals supply platform, Ownly. What makes it a severe contender is its in-house logistics capabilities, give attention to low-cost meals and its disruptive zero-commission mannequin. Rapido additionally eliminates ONDC’s historic ache level of coordinating a number of operators per transaction.

Laborious Time For Zomato-Swiggy? The developments come at a time when the broader meals supply market is witnessing a slowdown. Consequently, the margins of each Swiggy and Zomato are thinning, person bases are shrinking, and any makes an attempt to spice up profitability by way of elevated platform and supply charges have been alienating customers.

All mentioned and carried out, business insiders don’t see the dominance of Swiggy or Zomato ending any time quickly. They anticipate the 2 giants splurge extra on retaining their market share. However, because the tide turns in direction of subscription-led fashions, are the times of the Zomato-Swiggy duopoly over?

From The Editor’s Desk

Ather’s Q1 Present: The EV main narrowed its web loss by 3% to INR 178.2 Cr in Q1 FY26 from INR 182.9 Cr a yr in the past. Its working income jumped over 79% to INR 644.6 Cr within the quarter beneath overview from INR 360.5 Cr in Q1 FY25.

Antfin To Exit Paytm: The Chinese language tech big is planning to dump its remaining 5.84% stake in One 97 Communications in an INR 3,800 Cr block deal. The corporate has liquidated a few 10% stake within the fintech main within the final three years.

Mitigata Raises $5.9 Mn: The cyber insurance coverage startup has raised the funds in its Sequence A spherical led by Nexus Enterprise Companions. The startup leverages AI to supply cybersecurity and cyber insurance coverage options to companies in addition to people.

TBO Tek’s Lukewarm Q1: The B2B journey tech firm’s web revenue rose a meagre 3% to INR 63 Cr in Q1 FY26 from INR 60.9 Cr within the year-ago interval. Its working income jumped 22% YoY to INR 511.3 Cr within the quarter beneath overview.

Swiggy Floats DeskEats: The foodtech main has launched the brand new providing to cater to working professionals throughout India. DeskEats provides 7 Lakh menu objects throughout a curated assortment of worth combos, stress munchies and one-handed grabies.

Centre’s EV Push: The federal government is more likely to exempt electrical automobiles from the 15-year ‘finish of life’ regulation to spur the adoption of unpolluted automobiles within the nation. The EV penetration in India stands at 7.8%, a lot beneath the federal government’s goal of 30% by 2030.

Kaynes’s INR 5K Cr TN Unit: The electronics producer is planning to arrange a manufacturing facility in Tamil Nadu’s Thoothukudi, with an funding of INR 4,995 Cr. The unit will produce 74-layer PCBs, versatile PCBs, HDI PCBs, and high-performance laminates, amongst others.

Airtel’s Desi Cloud: The telecom main has rolled out its personal sovereign cloud platform, which can supply regionally managed, AI-powered cloud infrastructure to Indian companies. This follows Microsoft’s current suspension of IT providers to homegrown Nayara Vitality.

Inc42 Startup Highlight

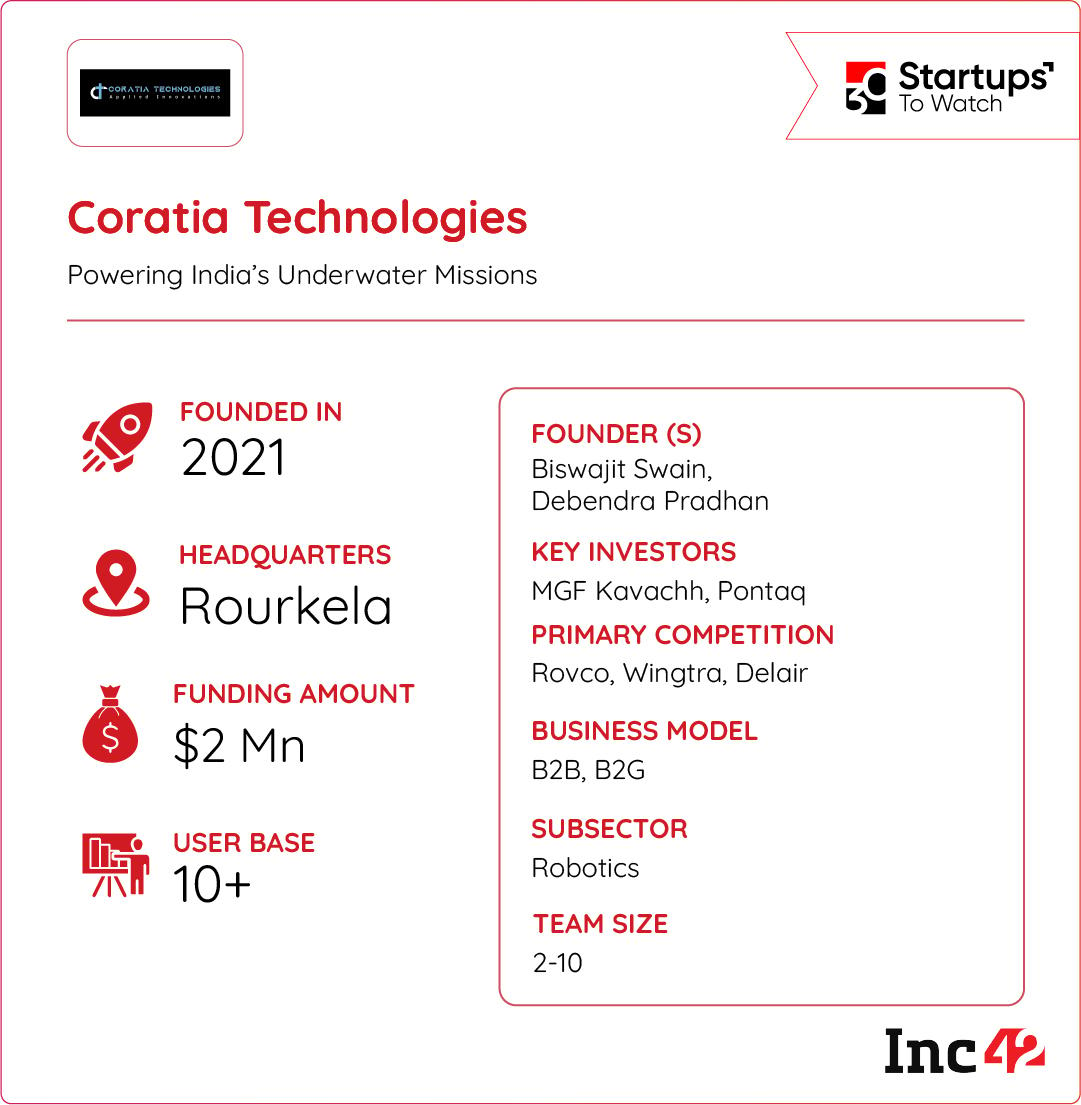

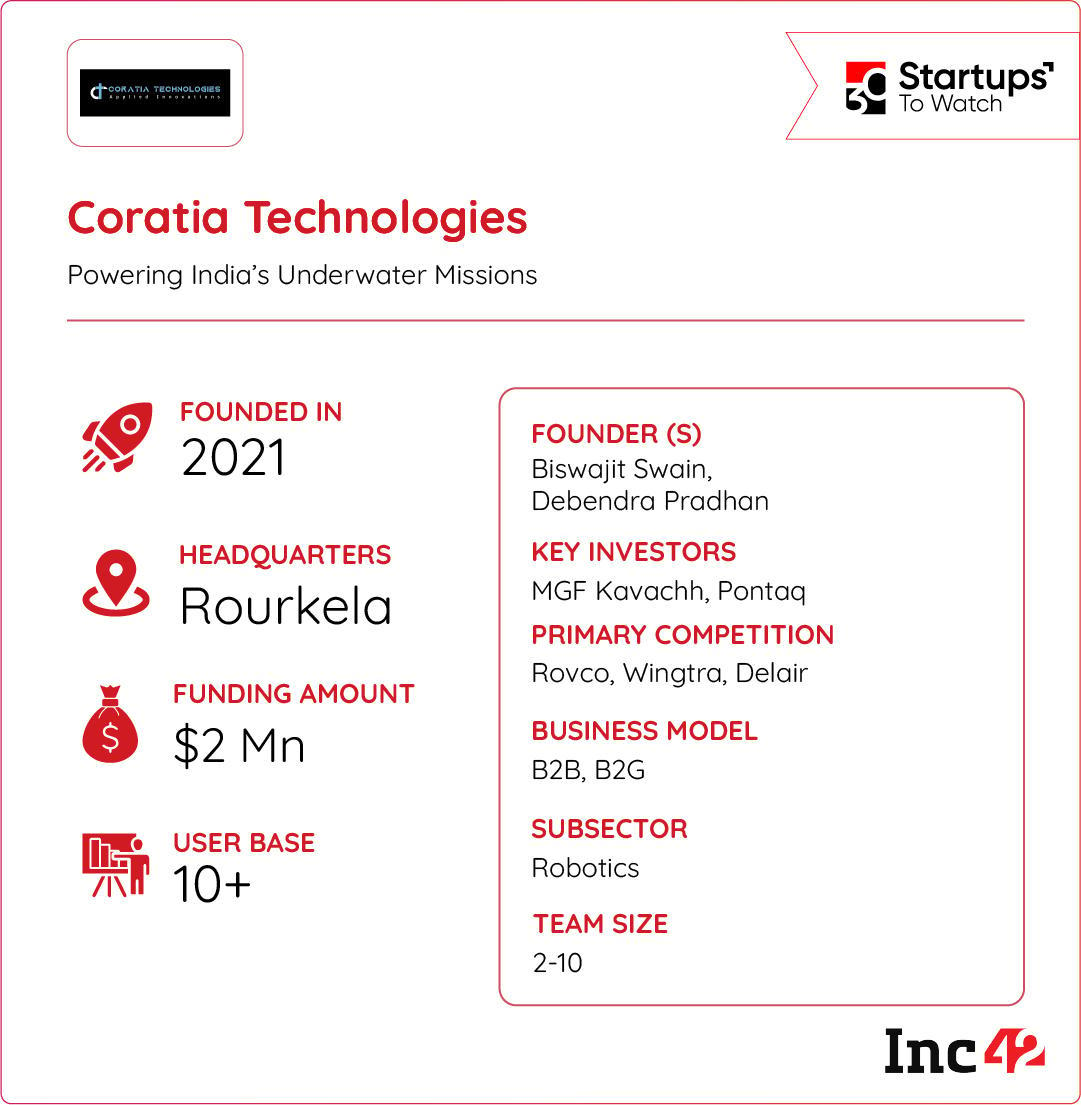

Can Coratia Supercharge India’s Underwater Missions?

Underwater exploration stays a problem in India as a consequence of a lack of information in underwater engineering capabilities and applied sciences. Based in 2021, Coratia Applied sciences is fixing these points with its high-tech robots.

Powering Deep-Sea Expeditions: The Rourkela-based startup designs and manufactures remotely operated automobiles and autonomous underwater automobiles. Constructed for numerous underwater missions, these machines are able to inspecting submerged infrastructure similar to ship hulls, bridges, pipelines and dams.

Beneath The Floor: The startup caters to make use of instances throughout crucial sectors like oil and gasoline, maritime logistics and civil infrastructure. Coratia additionally aids environmental analysis, underwater mapping, and search and rescue operations in hard-to-reach or hazardous zones.

Eye On The Market Pie: Working in India’s underwater robotics market, which is projected to breach the $20 Bn mark by 2032, Coratia has already gained contracts from the Indian Navy, and in addition counts Tata Metal, SAIL, Indian Oil and Indian Railways as its shoppers.

As India rolls out the purple carpet for homegrown deeptech applied sciences, can Coratia Applied sciences supercharge underwater exploration missions within the nation?

[ad_2]