Oversubscribed 3.5X, the fund indicators confidence in India’s startup ecosystem at a time of worldwide enterprise slowdown, with robust founder-LP backing, world institutional participation, and a quick, conviction-led funding mannequin.

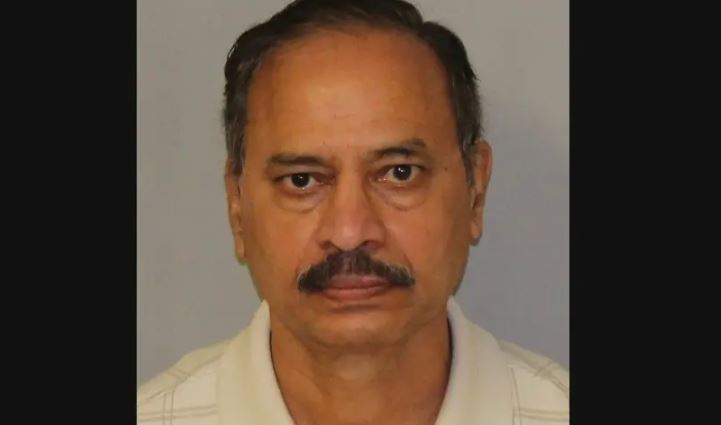

Zeropearl VC, India’s main solo GP-led pre-seed and seed enterprise fund, immediately introduced the ultimate shut of its maiden corpus at ₹159 crore (approx. USD 18 million). The fund, based by veteran investor and IIT Bombay alumnus Bipin Shah, was oversubscribed greater than 3.5 instances its authentic ₹80 crore goal, with commitments exceeding ₹280 crore earlier than Shah selected to shut at a disciplined degree. Staying true to his conviction-led philosophy, he intentionally capped the fund at ₹159 crore, preferring to stay extremely selective, backing solely about 0.5% of firms he evaluates every year, and focusing on efficiency constant together with his realised IRR of over 50% from the previous decade.

The launch comes at a pivotal second. Whereas world enterprise capital exercise has slowed, India continues to consolidate its place because the world’s third-largest startup ecosystem, with entrepreneurs in Tier-2 and Tier-3 cities in addition to in frontier sectors equivalent to AI, local weather tech and healthtech driving a brand new wave of innovation. Zeropearl VC’s launch underlines that the earliest stage of funding, the place conviction issues greater than metrics, is attracting significant capital and credibility in India.

Shah, previously a Companion at Titan Capital, is amongst India’s most prolific early-stage buyers, with over 14 years of expertise and a report of evaluating greater than 50,000 startups, personally assembly 5,000 founders, and investing in over 250 firms on the seed and pre-seed levels. His portfolio contains early bets on standout successes equivalent to Mamaearth, Credgenics, InVideo, Giva, and CityMall, together with notable outcomes like Beardo (acquired by Marico), Oziva (acquired by HUL), and SuprDaily (acquired by Swiggy).

An alumnus of IIT Bombay, Shah credit his training with shaping his ardour for startups, saying, “My 5 years on the Entrepreneurship Cell, together with main Eureka!, Asia’s largest marketing strategy competitors, gave me publicity to a number of founder journeys, serving to me develop empathy and perception of their potential. Again in 2012, I noticed an enormous hole in pre-seed funding in India, and since then, I’ve devoted my life to supporting founders at this stage.”

His choice to take solely ₹159 crore of the ₹280 crore dedicated displays this self-discipline, conserving the fund tight, extremely selective, and geared towards replicating the superior outcomes which have outlined his profession.

The fund has drawn unprecedented help from the startup ecosystem, with greater than half its capital, 52%, coming from 31 profitable founders, together with 18 unicorn leaders and 21 entrepreneurs from IPO-listed or IPO-bound firms. These founder-LPs, lots of whom had been a part of Shah’s earlier portfolio, deliver extra than simply capital. They supply operational steering, mentorship, and the collective knowledge of entrepreneurs who’ve scaled their firms from inception to IPO. The remaining commitments got here from world funds-of-funds and choose household workplaces, additional validating the credibility of Zeropearl VC’s mannequin.

Positioning itself as one of many first large-scale solo GP funds in India, Zeropearl VC is designed round pace, readability, and conviction. In contrast to bigger enterprise corporations the place founders might face layers of gatekeeping, the fund provides direct entry to decision-makers and a dedication to ship readability inside seven days of an utility. By prioritising selectivity and disciplined deployment, Shah goals to take care of the power to generate the type of superior returns, north of fifty% IRR, which have outlined his final decade of investing. Shah has already begun placing the mannequin into motion. Fund I has backed twenty firms so far, with seven publicly introduced: Gully Labs, Cura Care, Zanskar, Catalogus, Akinna, Supply6, and Tryo, whereas evaluating greater than 800 pre-seed alternatives every month.

Reflecting on the journey, Shah mentioned, “Beginning over once more wasn’t simple, however this fund is each a recent starting and a tribute to the founders who dared to take early dangers on themselves. Zeropearl VC is constructed to again the following wave of leaders shaping India’s future.”

Founders who’ve dedicated capital to the fund echoed that confidence. Amongst them is unicorn LP Aman Gupta, Co-founder & CMO of boAt, who shared: “I’ve recognized Bipin for 7 years, and what has all the time stood out is how deeply founder-friendly he’s. On the pre-seed stage, when nobody is selecting up your name and it’s simply you in opposition to the world, Bipin is that man who exhibits up. Now, as he takes the solo GP plunge, I’m excited to again him and see him construct a real pre-seed establishment.”

With Fund I, Zeropearl VC plans to spend money on 45 startups throughout sectors, with the ambition of seeing the bulk elevate vital follow-on rounds inside 12 to fifteen months, a aim supported by Shah’s monitor report of enabling two-thirds of his previous portfolio firms to safe follow-on capital in an analogous timeframe. Trying forward, the agency intends to deepen collaborations with world enterprise funds, household workplaces, and establishments, whereas additionally increasing founder-LP engagement by means of structured workshops, peer studying circles, and networking classes. The imaginative and prescient is to create not only a fund however a platform, one which identifies India’s most promising startups at their earliest stage and helps them by means of their early life with each capital and counsel.

About Zeropearl VC

Zeropearl VC is India’s main pre-seed solo GP fund with a corpus of ₹159 crore (USD 19 million). Based by Bipin Shah, IIT Bombay alumnus and veteran investor, the Gurugram-headquartered agency companions with formidable founders from Day Zero by means of a conviction-led, fast-decision mannequin. Supported by 31 profitable founder-LPs, unicorn entrepreneurs, IPO-linked leaders, and world funds-of-funds, Zeropearl VC combines capital with mentorship, making it one among India’s most founder-friendly early-stage enterprise corporations.

WIDGET: questionnaire | CAMPAIGN: Easy Questionnaire